Bitcoin FATF Alignment: How Global Regulations Shape Crypto Compliance

Bitcoin FATF Alignment: How Global Regulations Shape Crypto Compliance

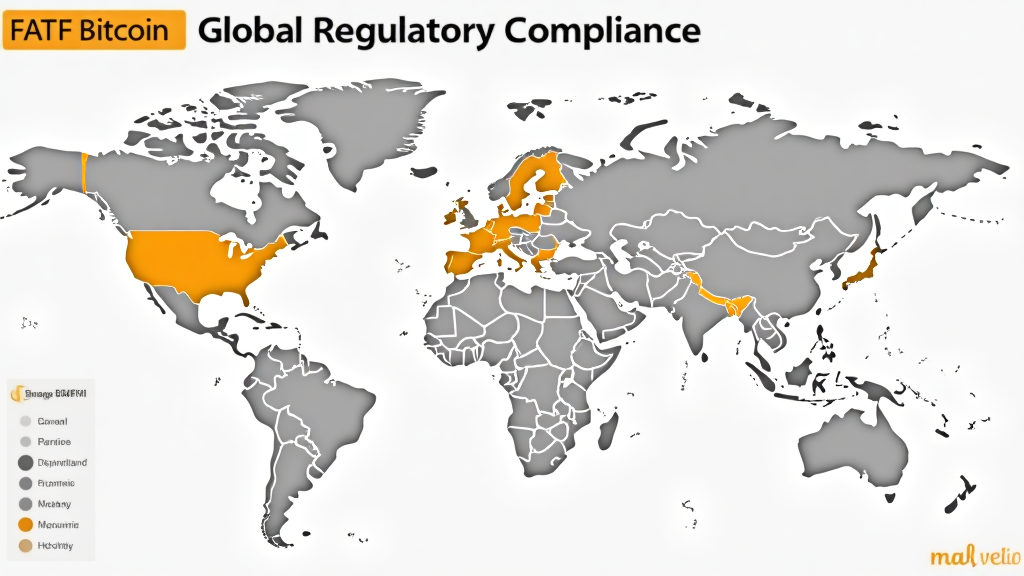

In a rapidly evolving financial landscape, Chainalysis 2025 data reveals that over 70% of countries are grappling with regulatory frameworks for cryptocurrencies. This is where the concept of Bitcoin FATF alignment becomes critical for industry stakeholders.

What is FATF and Why Does It Matter for Bitcoin?

Think of the Financial Action Task Force (FATF) as the traffic police for the global finance highway. They set the rules to prevent financial crimes. But just like how some cars might not meet pollution standards, some cryptocurrencies are not compliant. Bitcoin FATF alignment ensures that Bitcoin adheres to these global standards, helping to clear the way for broader adoption.

Impact of FATF Guidelines on Crypto Business Worldwide

Regulations can feel like a game of chess; every move counts. For instance, 2025 Singapore DeFi regulatory trends are setting a precedent for how decentralized finance can operate within legal frameworks. Bitcoin businesses that align with FATF guidance are likely to be seen as credible, which is vital in a world where trust is currency.

Cross-border Transactions and the Importance of Compliance

Remember the last time you exchanged money at an airport? Cross-border crypto transactions are similar. They must adhere to specific regulations to ensure smooth operations. Bitcoin FATF alignment particularly benefits these transactions, especially in regions like Dubai, where crypto tax laws are evolving and gathering attention.

Future Innovations: ZK-proof Applications and FATF Compliance

Think of zero-knowledge proofs (ZK-proofs) as a magical box where you can prove something without revealing the entire contents. As these technologies mature, ensuring compliance with Bitcoin FATF alignment will be crucial for their integration into mainstream finance.

In summary, the necessity for Bitcoin FATF alignment presents both challenges and opportunities across the crypto landscape. The evolving regulatory environment calls for tools that support compliance like the Ledger Nano X, which significantly reduces the risk of private key theft. Don’t miss out on our downloadable toolkit to navigate these waters effectively.