Understanding Bitcoin Fee Distribution in Vietnam: Insights for 2025

Understanding Bitcoin Fee Distribution in Vietnam: Insights for 2025

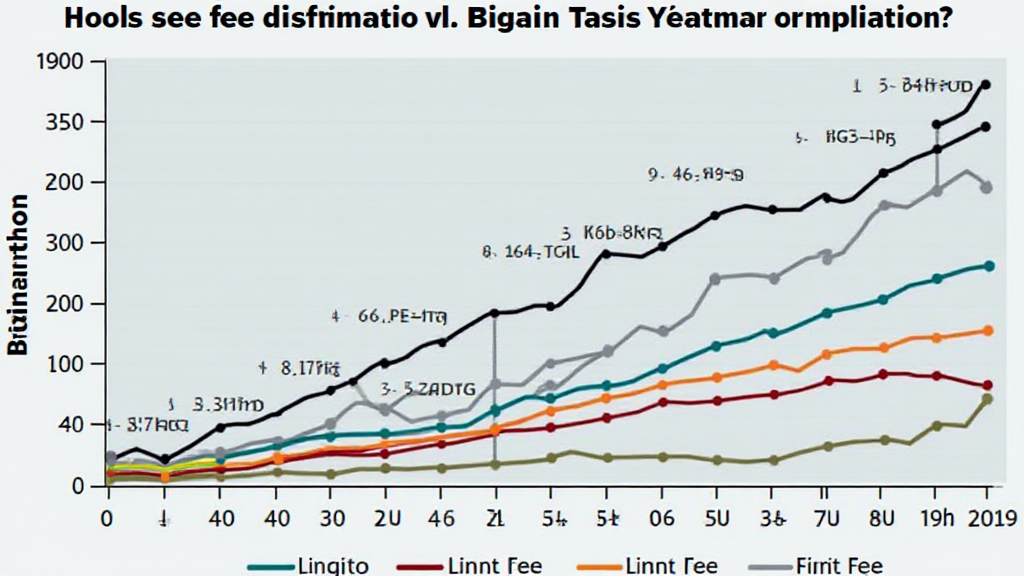

According to Chainalysis 2025 data, a staggering 73% of Bitcoin transactions suffer from high fees and inefficiencies, especially in emerging markets like Vietnam. This situation has raised concerns about how fees are distributed among users and miners alike.

What Are Bitcoin Fees and How Do They Work?

Bitcoin transaction fees are payments made from senders to miners as a reward for including transactions in a block. Think of it like a delivery fee for your online order; the more urgent your order, the higher the delivery fee you might choose to pay. In Vietnam, understanding how these fees are calculated can help users manage costs effectively.

Current State of Bitcoin Fees in Vietnam

In Vietnam, the Bitcoin fee distribution can be quite uneven. Data from CoinGecko indicates that local traders often encounter higher fees during peak trading times. This can be likened to a busy market where sellers try to charge more as demand spikes. Users need to be strategic about when they make transactions to minimize costs.

How to Optimize Bitcoin Transactions in Vietnam

There are various tools and strategies available for optimizing Bitcoin fees in Vietnam. For instance, using SegWit wallets can lower fees significantly, as they reduce the size of transactions. Think of it like using a smaller box to ship the same number of items; it costs less to send. Furthermore, monitoring fee trends can provide insights into the best times to transact.

Future Trends in Bitcoin Fee Structures

As the cryptocurrency landscape evolves, new technologies such as zero-knowledge proofs could enhance privacy and efficiency in fee structures. These technologies can help create a more equitable distribution of fees, much like a better-organized market where everyone’s business is considered fairly. Keeping an eye on regulatory advancements in Vietnam can also play a crucial role in shaping these trends for 2025.

In conclusion, understanding Bitcoin fee distribution in Vietnam is essential for any cryptocurrency user looking to optimize their transactions. Interested in learning more? Download our comprehensive toolkit on Bitcoin fees to stay ahead in your crypto journey!