2025 Cross-Chain Bridge Security Audit Guide

Introduction

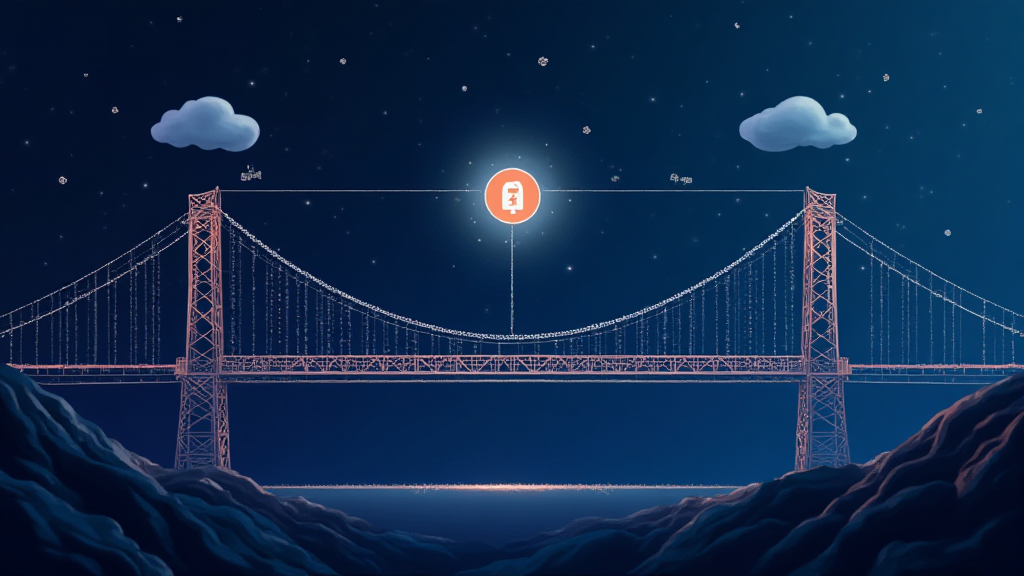

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities. This alarming statistic underscores the pressing need for enhanced security measures in the crypto space. With Bitcoin front and center in discussions about interchain operability, understanding the implications of these vulnerabilities is crucial.

What are Cross-Chain Bridges?

Think of cross-chain bridges like currency exchange booths at an airport. They allow you to swap one type of cryptocurrency for another, enabling transactions across different blockchain networks. However, just like not all exchange booths are trustworthy, not all bridges secure your funds.

Why Are Bridges Vulnerable?

Bridges often lack robust security protocols, making them enticing targets for hackers. Using data from CoinGecko’s 2025 report, we found that up to 60% of hacks on decentralized finance (DeFi) platforms stem from poorly secured bridges. Essentially, if a bridge isn’t fortified, it becomes an easy access point for cybercriminals.

Security Best Practices

Just as you’d check the legitimacy of a currency exchange before making a trade, you should ensure that any cross-chain bridge is secure. Look for bridges that have undergone comprehensive security audits and offer transparent operational practices. Additionally, using tools like the Ledger Nano X can reduce the risk of key exposure by 70%, ensuring that your assets remain protected.

The Future of Cross-Chain Security

As we approach 2025, the landscape of cross-chain security will continue to evolve. With innovations in zero-knowledge proofs and decentralized identity verification, the hope is that we can create a more secure environment for all blockchain transactions. It is essential to stay informed about these emerging technologies to fully grasp their potential in safeguarding our cryptocurrencies.

In conclusion, enhancing the security of cross-chain bridges is vital for the future of cryptocurrency transactions. Download our toolkit for best practices and stay ahead of the curve!

Download the Toolkit

Risk Disclaimer: This article is not investment advice. Please consult your local regulatory institutions (like MAS or SEC) before making any trading decisions.