Understanding Bitcoin Futures Liquidation Thresholds

Introduction

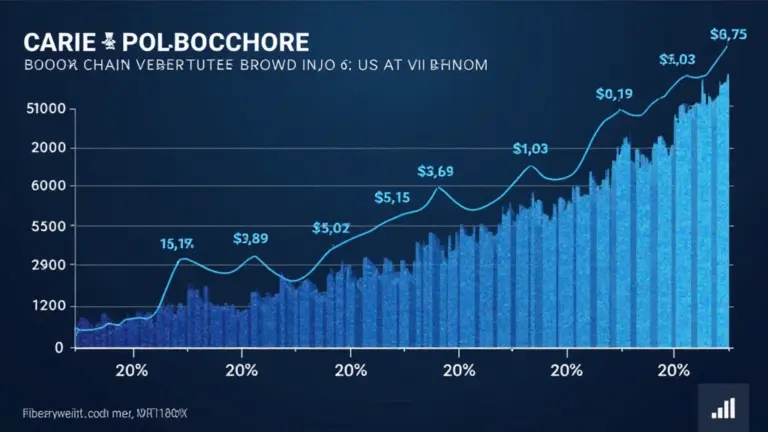

In the world of cryptocurrency trading, Bitcoin futures liquidation thresholds are crucial concepts that can greatly influence traders’ strategies. Did you know that in 2024 alone, a staggering $4.1 billion was lost due to forced liquidations? This significant loss underscores the importance of understanding how liquidation thresholds function in trading.

What Are Bitcoin Futures Liquidation Thresholds?

Liquidation thresholds refer to specific prices at which a trader’s position is automatically sold off to cover losses when the margin requirement falls below a certain level. In simpler terms, it’s like a safety net designed to protect both the trader and the exchange. When trading Bitcoin futures, knowing how these thresholds work can prevent unexpected losses.

The Mechanics of Liquidation

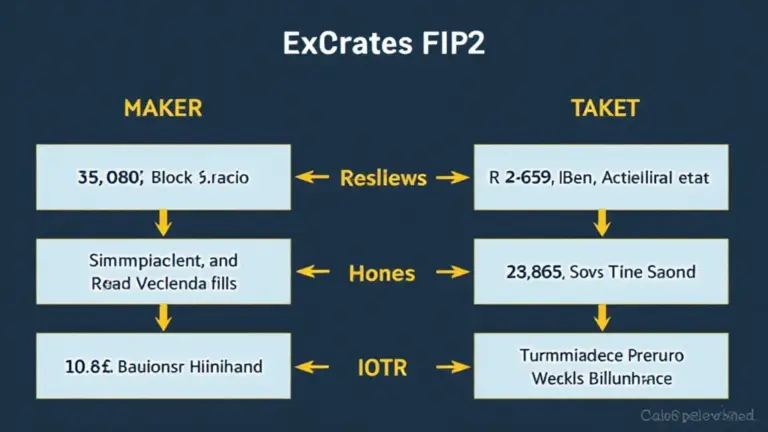

Let’s break it down: when a trader’s account balance dips below a defined level, the exchange automatically closes their positions. This is similar to a bank recalling funds if your balance dips below the minimum required. The liquidation price can be affected by:

- Market volatility

- Margin balance

- Trade size

For instance, if Bitcoin experiences a sudden drop, your liquidation threshold might be triggered, closing your position unexpectedly.

Factors Influencing Liquidation Thresholds

Several elements play a role in determining these thresholds. Here are some major factors:

- Leverage: Utilizing leverage can amplify both gains and losses, thus affecting your liquidation point.

- Margin Calls: Keep in mind, a margin call can happen before liquidation, giving traders a chance to add funds.

- Market Conditions: Sudden market movements can quickly lead to liquidations, hence always staying informed is key.

As of 2025, it’s estimated that around 60% of traders do not properly manage their margins, leading them to significant losses during downturns.

The Impact on Trading Strategies

Understanding liquidation thresholds aids traders in developing effective strategies. Consider the following:

- Setting lower leverage can reduce the risk of hitting your liquidation point.

- Modify your stop-loss orders wisely to prevent a spike in liquidation during volatile markets.

- Regularly monitor Bitcoin market trends and act promptly.

For example, Vietnamese crypto users have seen a growth rate of over 50% in 2024, indicating a rising interest in better risk management strategies among local traders.

Conclusion

Understanding Bitcoin futures liquidation thresholds is essential for every trader aiming to navigate the volatile waters of cryptocurrency. By comprehending these thresholds and employing sound trading strategies, you can mitigate risks and enhance your overall trading performance. Remember, always consult the right resources, such as hibt.com, to stay updated on best practices.

As the trading landscape evolves, diligent traders will continue to prioritize understanding liquidation thresholds to protect their investments. For further localized insights into cryptocurrency, feel free to check out our