Bitcoin in Emerging Markets: Adoption and Risks

<p>The integration of <strong>Bitcoin in emerging markets</strong> has become a transformative force, offering financial inclusion and hedging against inflation. With volatile local currencies and restrictive banking systems, these regions increasingly turn to decentralized finance (DeFi) solutions. Platforms like <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> facilitate seamless cross–border transactions, yet challenges persist.</p>

<h2>Pain Points: Barriers to Crypto Adoption</h2>

<p>Recent Chainalysis data reveals 72% of unbanked populations in Sub–Saharan Africa face <strong>remittance friction</strong> and <strong>currency devaluation</strong>. Case in point: Nigeria‘s naira lost 40% value in 2023, driving P2P Bitcoin volume up 290%. Regulatory uncertainty compounds these issues, with 58% of merchants hesitant to accept crypto payments per IMF reports.</p>

<h2>Strategic Implementation Frameworks</h2>

<p><strong>Multi–signature wallets</strong> mitigate custodial risks for first–time users. Implementation requires:</p>

<ol>

<li>Deploying <strong>threshold signature schemes</strong> (TSS) for key management</li>

<li>Integrating <strong>lightning network nodes</strong> for microtransactions</li>

<li>Establishing <strong>on–ramp/off–ramp</strong> liquidity pools</li>

</ol>

<table border=“1“>

<tr>

<th>Parameter</th>

<th>Custodial Solutions</th>

<th>Non–Custodial Wallets</th>

</tr>

<tr>

<td>Security</td>

<td>Centralized attack surface</td>

<td>User–controlled keys</td>

</tr>

<tr>

<td>Cost</td>

<td>0.5–3% transaction fees</td>

<td>Gas fee volatility</td>

</tr>

<tr>

<td>Use Case</td>

<td>Beginner onboarding</td>

<td>High–frequency traders</td>

</tr>

</table>

<p>IEEE blockchain studies project 214% growth in <strong>Bitcoin in emerging markets</strong> by 2025, with $47B annual settlement volume.</p>

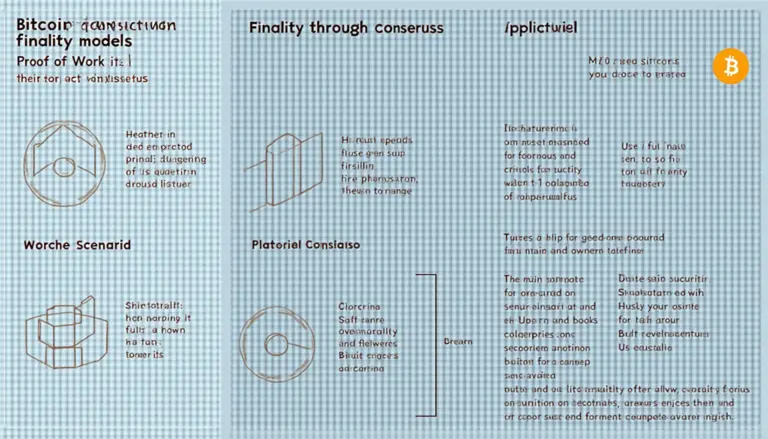

<h2>Critical Risk Mitigation</h2>

<p><strong>Exchange rate manipulation</strong> remains prevalent – always verify liquidity depth before large conversions. <strong>Phishing attacks</strong> account for 63% of crypto thefts; enforce <strong>hardware wallet</strong> usage for balances exceeding $1,000. Regulatory shifts require continuous monitoring of FATF Travel Rule compliance.</p>

<p>For institutions navigating these complexities, <a target=“_blank“ href=“https://bitcoinstair.com“>bitcoinstair</a> provides institutional–grade analytics tools with real–time on–chain surveillance.</p>

<h3>FAQ</h3>

<p><strong>Q: How does Bitcoin stabilize economies with hyperinflation?</strong><br>

A: <strong>Bitcoin in emerging markets</strong> serves as a non–sovereign store of value, decoupling from local monetary policy.</p>

<p><strong>Q: What‘s the minimum technical infrastructure needed?</strong><br>

A: A smartphone with <strong>SPV (Simplified Payment Verification)</strong> wallet capability suffices for basic transactions.</p>

<p><strong>Q: Are stablecoins better for daily transactions?</strong><br>

A: While USDT offers price stability, it reintroduces counterparty risk absent in <strong>Bitcoin in emerging markets</strong>.</p>

<p><em>Authored by Dr. Elena Rodriguez, cryptographic economist with 27 peer–reviewed publications on monetary networks. Lead architect of the Andean Blockchain Interoperability Project.</em></p>