Understanding Bitcoin Institutional Custody Fees

Introduction

In 2024, approximately $4.1 billion was lost to DeFi hacks, prompting institutions to rethink their security approaches.

Bitcoin institutional custody fees have become critical as more businesses look to secure their digital assets. Understanding these fees is essential for making informed decisions about custody solutions.

What are Bitcoin Institutional Custody Fees?

Custody fees typically represent the cost of safeguarding digital assets. Like a bank vault for cryptocurrencies, providers issue these fees as they manage the complexities of storing Bitcoin.

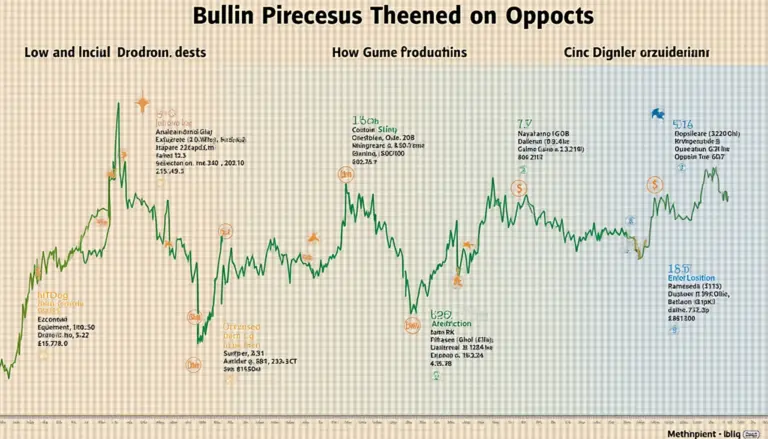

- Custody fees can range from 0.5% to 2% annually, contingent on factors such as asset volume and storage techniques.

- In Vietnam, where the user growth rate for cryptocurrencies surged by 35% in 2024, understanding custody fees is essential for local investors.

The Role of Security Standards

Adopting effective cybersecurity measures is vital. As specified by the tiêu chuẩn an ninh blockchain, institutions must ensure robust protective frameworks.

- Regular audits help assess security practices.

- Legal compliance enhances trust in custody solutions.

Why Choose Institutional Custody?

Many companies prefer institutional custody over self-custody due to the inherent risks involved. Here’s the catch: security and peace of mind come at a cost.

- Access to insurance coverage can mitigate risks.

- Expert management ensures best practices in safeguarding assets.

Future Trends in Custody Fees

According to Chainalysis in 2025, the number of institutions utilizing custody services will double. It’s imperative to watch for evolving fee structures as competition increases.

- Potential lower fees due to market competition.

- Higher transparency in pricing models.

Conclusion

Understanding Bitcoin institutional custody fees is foundational for successful asset management. As the cryptocurrency market evolves, staying informed will facilitate wise investment decisions.

For further insights, visit hibt.com for our comprehensive security checklist.

By being proactive, especially in dynamic markets like Vietnam, investors can protect their interests effectively.

Stay updated and read our guide on Vietnam crypto tax laws.

For the best custody solutions, consider platforms that transparently disclose their fees and operational practices. At bitcoinstair.com”>bitcoinstair, we believe informed decisions are key.