2025 Bitcoin Insurance Mechanisms: A Comprehensive Guide

2025 Bitcoin Insurance Mechanisms: A Comprehensive Guide

According to data from Chainalysis, a staggering 73% of global cross-chain bridges exhibit vulnerabilities. As the cryptocurrency landscape evolves, securing these mechanisms becomes imperative for investors and users alike. The rise of Bitcoin insurance mechanisms aims to address these risks effectively, ensuring a safer environment for digital asset transactions.

Understanding Bitcoin Insurance Mechanisms

So, what exactly are Bitcoin insurance mechanisms? Imagine you’re at a market and want to exchange your currency for something else. You’d want a fair exchange rate and assurance that the transaction is secure. Bitcoin insurance mechanisms work similarly by providing safeguards against potential losses in the cryptocurrency realm. They utilize technologies like cross-chain interoperability and zero-knowledge proofs to create more secure trading ecosystems.

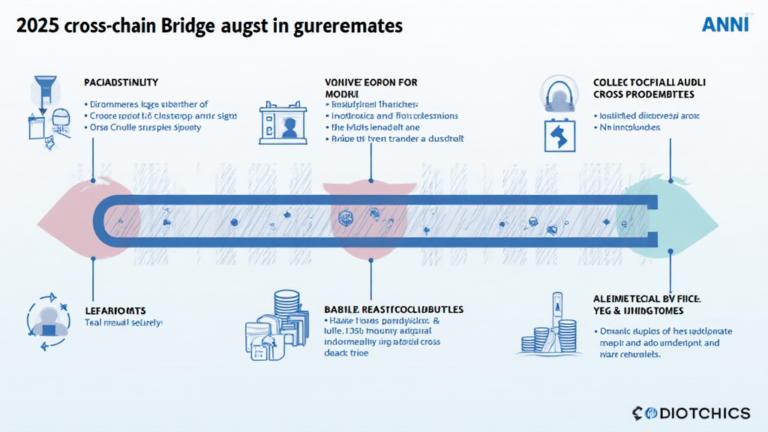

The Role of Cross-Chain Bridges

Cross-chain bridges allow users to transfer assets across different blockchain networks, akin to a currency exchange booth where you can swap dollars for euros. However, not all bridges are equally secure—many are prone to attacks. As highlighted in recent CoinGecko 2025 data, implementing robust insurance protocols on these bridges can enhance investor confidence and reduce risks involved in cross-chain transactions.

The Promise of Zero-Knowledge Proofs

Zero-knowledge proofs might sound technical, but think of it this way: it’s like showing someone that you have a ticket to a concert without revealing any of your personal details. This technology offers opportunities for users to prove ownership of assets without compromising their privacy. Integrating zero-knowledge proofs into Bitcoin insurance mechanisms can further bolster security, shielding users from potential fraud while maintaining their privacy.

Adapting to the Regulatory Landscape in Singapore

As Bitcoin insurance mechanisms mature, regions like Singapore are establishing clearer regulatory frameworks for decentralized finance (DeFi). In 2025, we anticipate stricter guidelines that demand transparency and security, which could influence how these insurance mechanisms evolve. Adapting to these changes is essential for both users and providers in the crypto space.

In conclusion, Bitcoin insurance mechanisms play a crucial role in safeguarding digital assets in an ever-evolving market. As we move towards 2025, familiarizing ourselves with cross-chain interoperability and zero-knowledge proofs will be essential in navigating the risks of the crypto universe. For those looking to secure their assets better, consider tools like the Ledger Nano X, which can mitigate the risk of private key exposure by up to 70%. Download our toolkit to stay informed about the latest trends and protections in the cryptocurrency sphere!