Navigating Bitcoin Legal Frameworks: Insights for 2025

The Growing Importance of Bitcoin Legal Frameworks

As highlighted by Chainalysis data from 2025, a staggering 73% of cross-chain bridges are vulnerable to attacks. Amidst this alarming statistic, the need for robust Bitcoin legal frameworks becomes paramount. These frameworks help establish clear guidelines for cryptocurrency transactions and offer protection to users as the digital currency landscape continues to evolve.

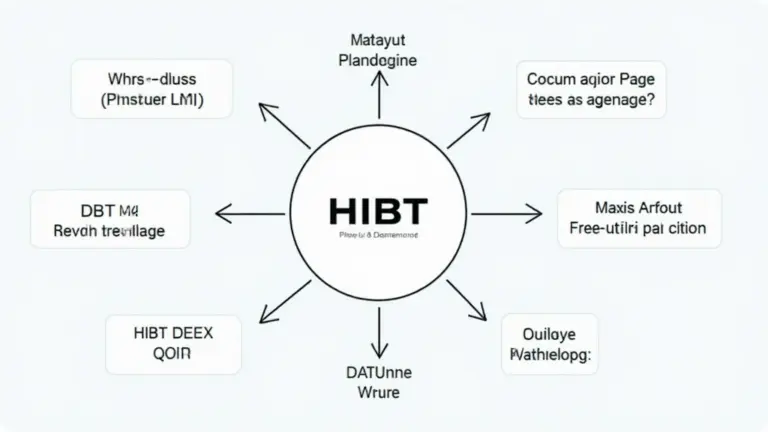

Understanding Cross-Chain Interoperability

Imagine a bustling market where vendors exchange goods from different regions. That’s essentially what cross-chain interoperability does – it allows various blockchains to communicate and exchange value seamlessly. In the context of Bitcoin legal frameworks, facilitating cross-chain interactions means creating laws that ensure transactions between different blockchains are safe, effectively reducing fraud and increasing user confidence.

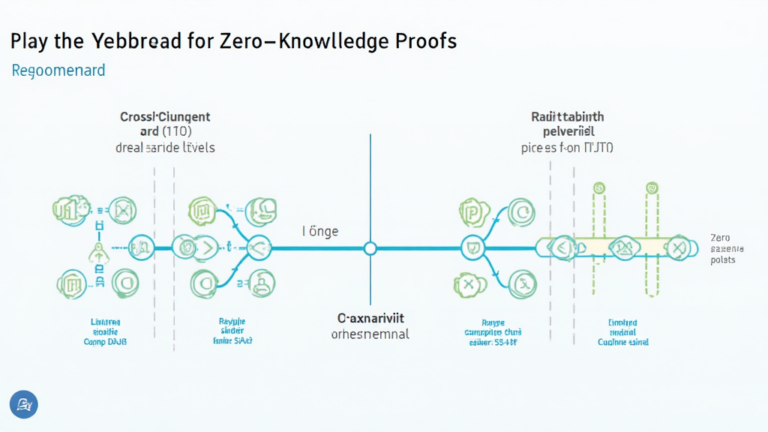

Zero-Knowledge Proof Applications: Enhancing Privacy

Picture a vendor at the market who can prove their product is organic without showing their entire inventory. This is akin to zero-knowledge proofs, a technology that allows one party to prove to another that something is true without sharing all the information behind it. In Bitcoin legal frameworks, employing zero-knowledge proofs can significantly enhance the privacy of transactions, catering to users’ growing concerns about data security.

Future Trends: Singapore’s DeFi 2025 Regulatory Landscape

With the rise of decentralized finance (DeFi), countries like Singapore are leading the way in shaping regulations that will govern these platforms in 2025. Anticipating the regulatory environment is crucial for investors and developers. Understanding the laws being enacted can help mitigate potential risks and harness opportunities within this vibrant space.

Conclusion: Download Our Toolkit for Safe Trading

In summary, the exploration of Bitcoin legal frameworks reveals vital insights into the future of cryptocurrency regulation. As you navigate the complexities of digital currencies, consider downloading our comprehensive toolkit to ensure a secure trading experience. Remember, engaging with local regulatory bodies like MAS or SEC can provide essential guidance tailored to your region. Protect your assets, and stay informed!