Understanding Bitcoin Lightning Network Fees in 2025

Introduction

According to Chainalysis 2025 data, a staggering 73% of cryptocurrency transactions face challenges due to high Bitcoin Lightning Network fees. The soaring costs are pushing traders to rethink their transaction strategies. Understanding how to navigate these fees is essential for anyone involved in crypto.

What Are Bitcoin Lightning Network Fees?

Imagine you’re at a local market and want to exchange currency with a vendor. Just like them, Bitcoin Lightning Network fees are the costs you incur when making transactions over the network. These fees can vary, affecting how much your transaction ultimately costs. Factors like network congestion and demand influence these service fees, similar to how busy times at your local exchange might raise the fees you pay.

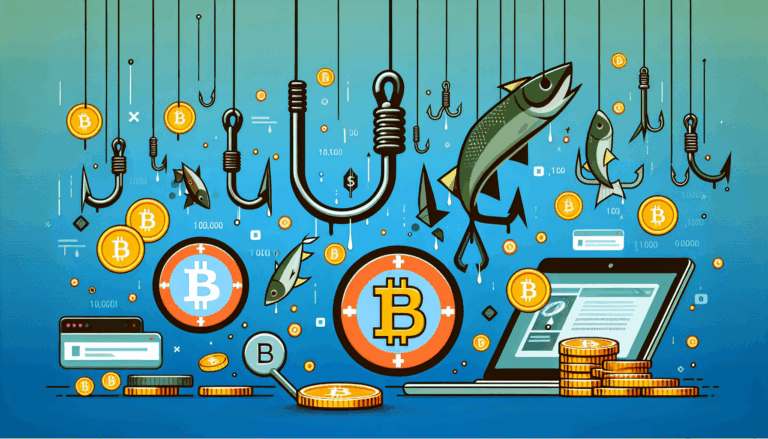

How to Minimize Fees?

You might wonder how to avoid hidden charges. Think of it as shopping during a sale. Optimize your transaction timings! Fees tend to drop during off-peak hours. Additionally, using channels with a higher capacity can make transactions cheaper. Furthermore, using wallets that automatically adjust according to network conditions can be similar to finding a bargain on everyday essentials.

The Role of Cross-Chain Interoperability

With increasing interest in DeFi, cross-chain interoperability is becoming crucial. Picture it as a friendly neighbor offering you a variety of pots for cooking. Interoperability allows seamless transaction exchanges between different blockchains, reducing your reliance on any single network and optimizing fee costs. As the landscape of decentralized finance evolves, more solutions will emerge, increasing efficiency and lowering those pesky fees.

Future Predictions for Bitcoin Lightning Fees

Using CoinGecko’s 2025 data, experts predict that more sophisticated algorithms will help to manage and predict Bitcoin Lightning Network fees effectively. It’s like learning to use a discount app that helps you find the best deals before making a purchase. Stay ahead of the curve by adapting to these technological advances!

Conclusion

Understanding and managing Bitcoin Lightning Network fees is vital for maintaining cost-effective trading strategies. The world of cryptocurrencies is fast-paced; staying informed about these fees will save you money in the long run. For additional insights, download our comprehensive toolkit to guide you through reducing fees effectively.