Understanding Bitcoin Market Cap to Volume Ratio

Introduction

The landscape of cryptocurrency investing is filled with statistics that can be both overwhelming and enlightening. One critical metric that has been garnering attention is the Bitcoin market cap to volume ratio. As of August 2023, this ratio gives insight into market trends, liquidity, and potential growth areas. Understanding this ratio is essential for Vietnamese investors, especially as the user growth rate in the Vietnam cryptocurrency market is projected to rise by 20% over the next year.

What is Bitcoin Market Cap to Volume Ratio?

The market cap to volume ratio can be seen as a measure of the relationship between the value of all Bitcoins in circulation and how much of those Bitcoins are being traded within a given period. A higher ratio may indicate a market that is either experiencing less trading activity or that it is at a more stable phase, which can be likened to a bank vault that holds valuable assets securely.

Why is this Ratio Important?

- Liquidity Insight: A lower ratio generally indicates a market with higher liquidity. This suggests that investors can buy and sell without significantly impacting the price.

- Market Sentiment: Monitoring this ratio helps gauge investor sentiment. Sudden spikes may indicate speculative trading, whereas stable ratios can reflect long-term holding.

Current Trends in Vietnam’s Cryptomarket

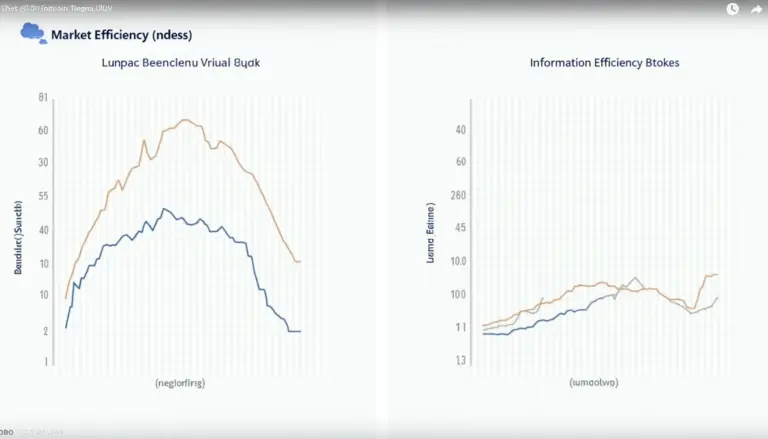

According to a recent report, the Vietnamese cryptocurrency market is rapidly expanding. As per Statista, the Vietnamese user base for cryptocurrencies has grown by 15% in the last year. This growth is partly driven by younger demographics who are looking for alternative investments. Additionally, the Bitcoin market cap to volume ratio in Vietnam has mirrored global trends, underscoring the worldwide influence of cryptocurrency.

Comparative Analysis of Other Cryptocurrencies

It’s essential not only to follow Bitcoin but also to monitor other altcoins. For instance, while Bitcoin has had a market cap to volume ratio of 5 in recent months, Ethereum’s ratio fluctuates around 3. Understanding these differences can assist investors in spotting potential opportunities in the market.

How Can Investors Use This Data?

Investors can use the Bitcoin market cap to volume ratio to make informed decisions. For instance, when predicting the 2025 most promising altcoins, recognizing patterns in Bitcoin’s trading behavior can lead to better choices.

Practical Tools for Investors

There are many resources available to track market metrics, including websites like CoinMarketCap and CoinGecko. Utilizing these platforms can provide valuable insights for analyzing how to audit smart contracts and understanding the broader market behavior.

Conclusion

In conclusion, the Bitcoin market cap to volume ratio serves as an essential indicator in the cryptocurrency sphere. As the market continues to evolve, particularly in Vietnam, keeping an eye on this metric can benefit both seasoned investors and novices alike. Remember, investing in cryptocurrency carries inherent risks; always consult with local regulators before making investment decisions.

For more information, visit hibt.com and explore our in-depth resources.