Forecasting Bitcoin Market Cycles: Insights for Investors

Understanding Bitcoin Market Cycles

Bitcoin’s price dynamics can often feel like riding a roller coaster, but through careful analysis, we can forecast market cycles. In 2024 alone, over $4.1 billion was reportedly lost to DeFi hacks, emphasizing the importance of understanding market movements and investment safety. By examining historical data and market indicators, investors can build strategies that align with the cyclical patterns of Bitcoin.

Key Indicators for Market Cycle Prediction

- Market Sentiment: Tools like the Fear & Greed Index help gauge emotional market responses, indicating potential turning points.

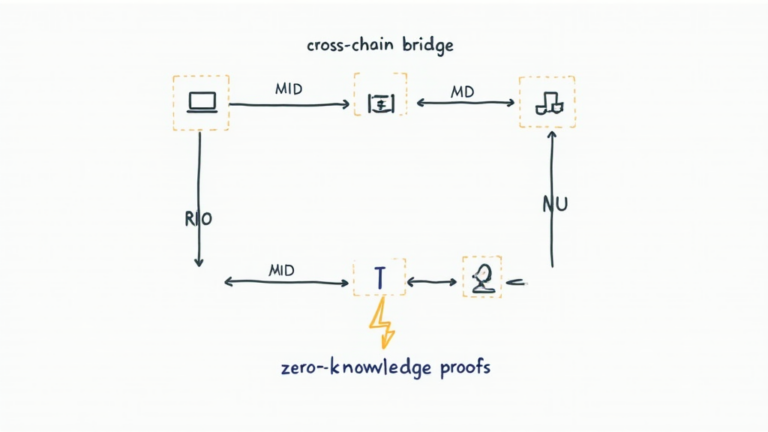

- On-Chain Metrics: Analyzing blockchain data, such as transaction volumes and wallet activity, provides insights into market health.

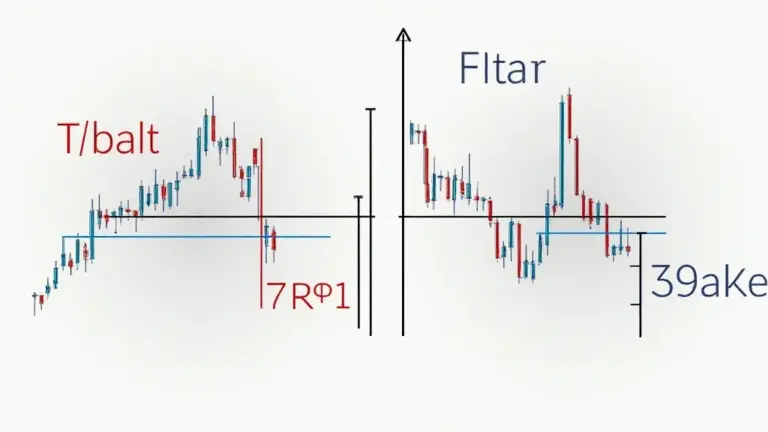

- Technical Analysis: Using past price movements and technical indicators like moving averages can highlight trends.

The Importance of Historical Data

Historical data serves as a roadmap for predicting future trends. For example, previous cycles have shown that after a significant peak, a correction commonly follows. According to recent studies, Bitcoin’s price tends to experience major fluctuations every four years, aligning with the Bitcoin halving events.

Applying This Knowledge to the Vietnamese Market

In Vietnam, crypto adoption is on the rise, with user growth rates reported at a staggering 15% annually. This booming market showcases the need for localized forecasting strategies. Tailoring Bitcoin market cycle predictions to Vietnamese investors can enhance understanding and safer investment practices.

Common Mistakes to Avoid

- FOMO: Jumping into the market during highs due to fear of missing out often leads to losses.

- Ignoring Fundamentals: Overlooking the underlying technology and market fundamentals can blind investors to potential downturns.

Utilizing Expert Resources

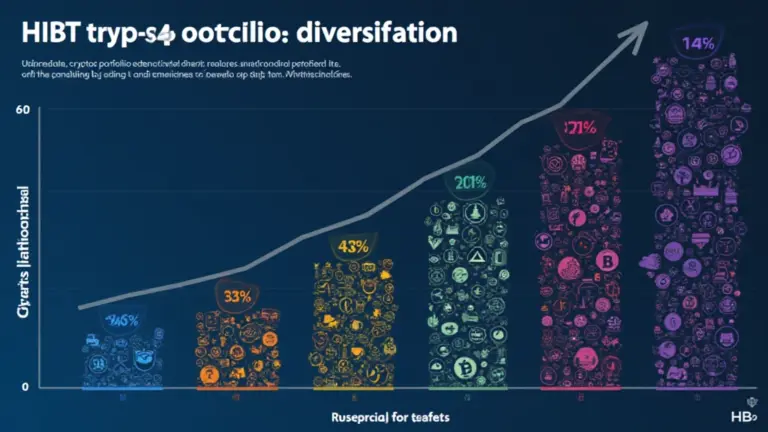

For those serious about investing, consider expert resources like Hibt.com’s detailed market analysis. They provide critical insights that can help polish your investment strategy. Always ensure to consult local regulators, especially considering the growing focus on compliance in Vietnam.

Conclusion: Smart Forecasting for Bitcoin Investors

In conclusion, forecasting Bitcoin market cycles requires a mix of historical analysis, understanding market indicators, and localization strategies for specific markets like Vietnam. By staying informed and using the right tools, you can significantly improve your investment decisions. Remember, this is not financial advice—always consult with a professional.

For further insights, visit bitcoinstair for more resources.