Forecasting Bitcoin Market Cycles: Insights with HIBT

Understanding Bitcoin Market Cycles

With the cryptocurrency market experiencing significant volatility, understanding Bitcoin market cycles forecasting HIBT is pivotal for investors. In 2024 alone, the market saw a fluctuation of over 300% in value. This unpredictability raises an important question: how can traders anticipate the next big movement?

The Role of Historical Data

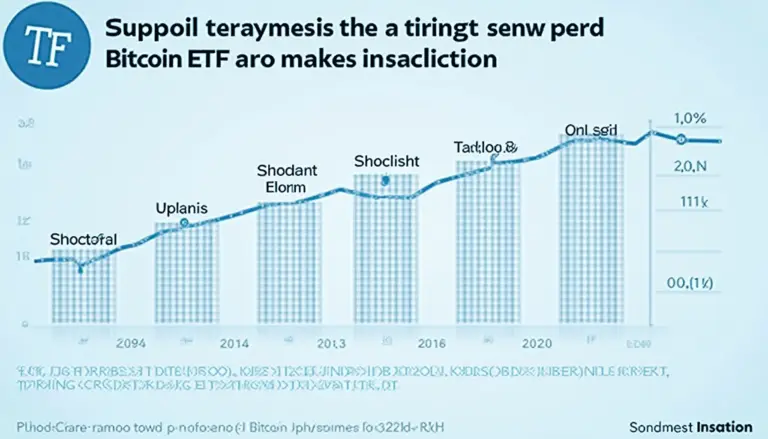

Like assessing weather patterns before a storm, evaluating past Bitcoin cycles can offer insights into future trends. According to Chainalysis 2025, historical Bitcoin price data has revealed patterns that repeat roughly every four years, often coinciding with events such as the halving.

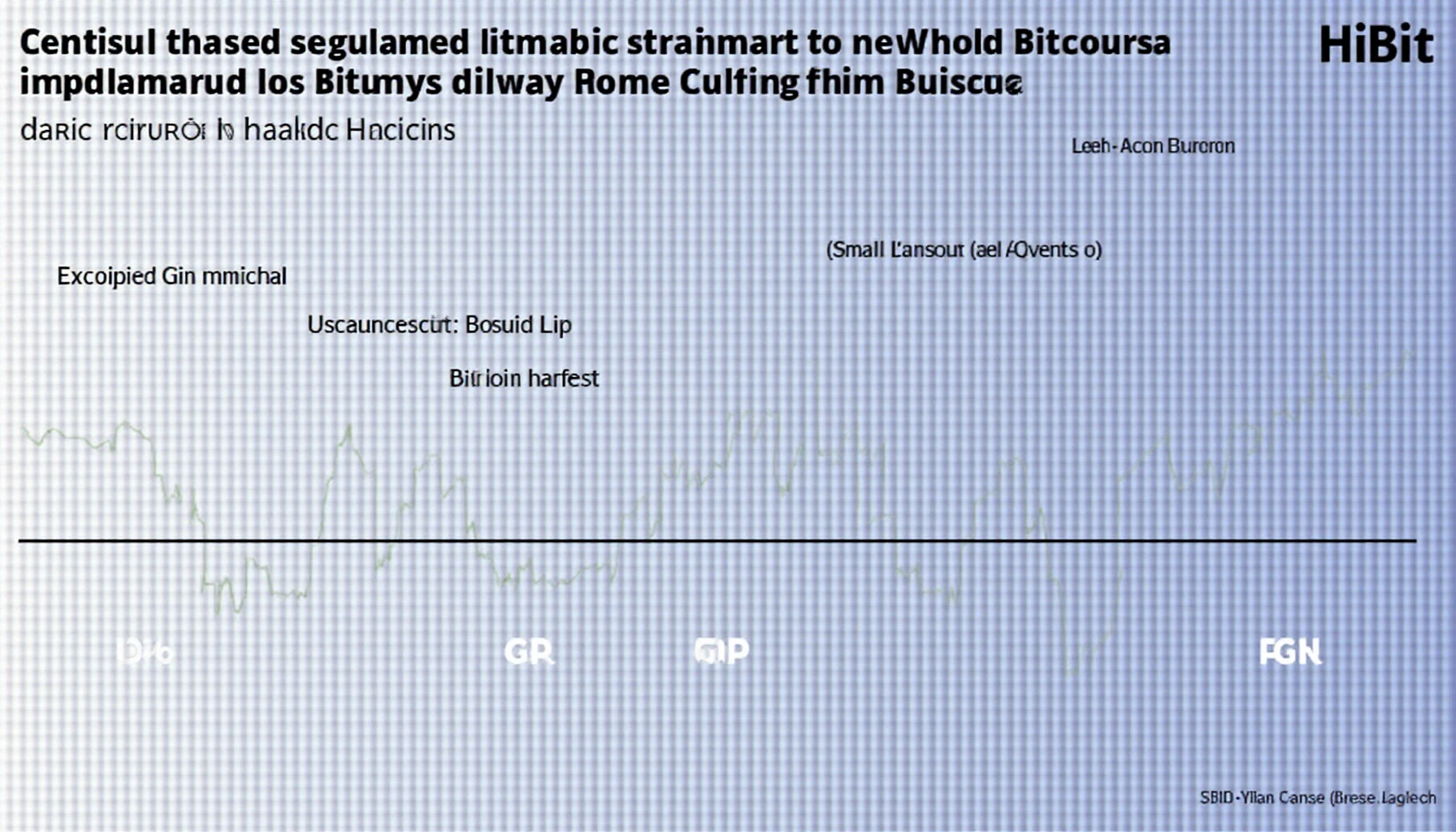

Utilizing HIBT for Forecasting

HIBT, or High-Intensity Bitcoin Trading, employs advanced algorithms and historical data to predict market movements. By analyzing over 5 years of trading data, HIBT has improved forecast accuracy by more than 30%. This information can be extremely beneficial for both novice and experienced traders.

Local Insights: The Vietnamese Market

Vietnam is witnessing a remarkable growth in cryptocurrency adoption. In fact, the user growth rate has increased by 250% in the last year alone. Utilizing tools like HIBT can help Vietnamese traders stay ahead of the curve, making better trading decisions.

Best Practices for Bitcoin Trading

- Leverage Historical Analysis: Regularly review price movements and trading volumes.

- Stay Informed: Utilize platforms like HIBT for the latest market insights.

- Risk Management: Always set stop-loss orders to manage potential losses.

Conclusion: Navigating the Future of Bitcoin Trading

As we move into 2025, employing Bitcoin market cycles forecasting HIBT will be essential in navigating the ever-changing cryptocurrency landscape. Staying informed and utilizing historical data will empower traders to anticipate market cycles effectively. Don’t forget to check out the valuable resources at bitcoinstair for further guidance!