Bitcoin Market Cycles Patterns: Understanding Trends and Predictions

Bitcoin Market Cycles Patterns: Understanding Trends and Predictions

In 2024 alone, the cryptocurrency market saw over $4.1 billion lost to hacks and scams, underscoring the importance of understanding Bitcoin market cycles patterns. Navigating the seemingly chaotic world of crypto trading demands insight into historical trends and patterns. This article will provide value by breaking down these cycles, guiding both newcomers and seasoned traders alike.

What Are Bitcoin Market Cycles?

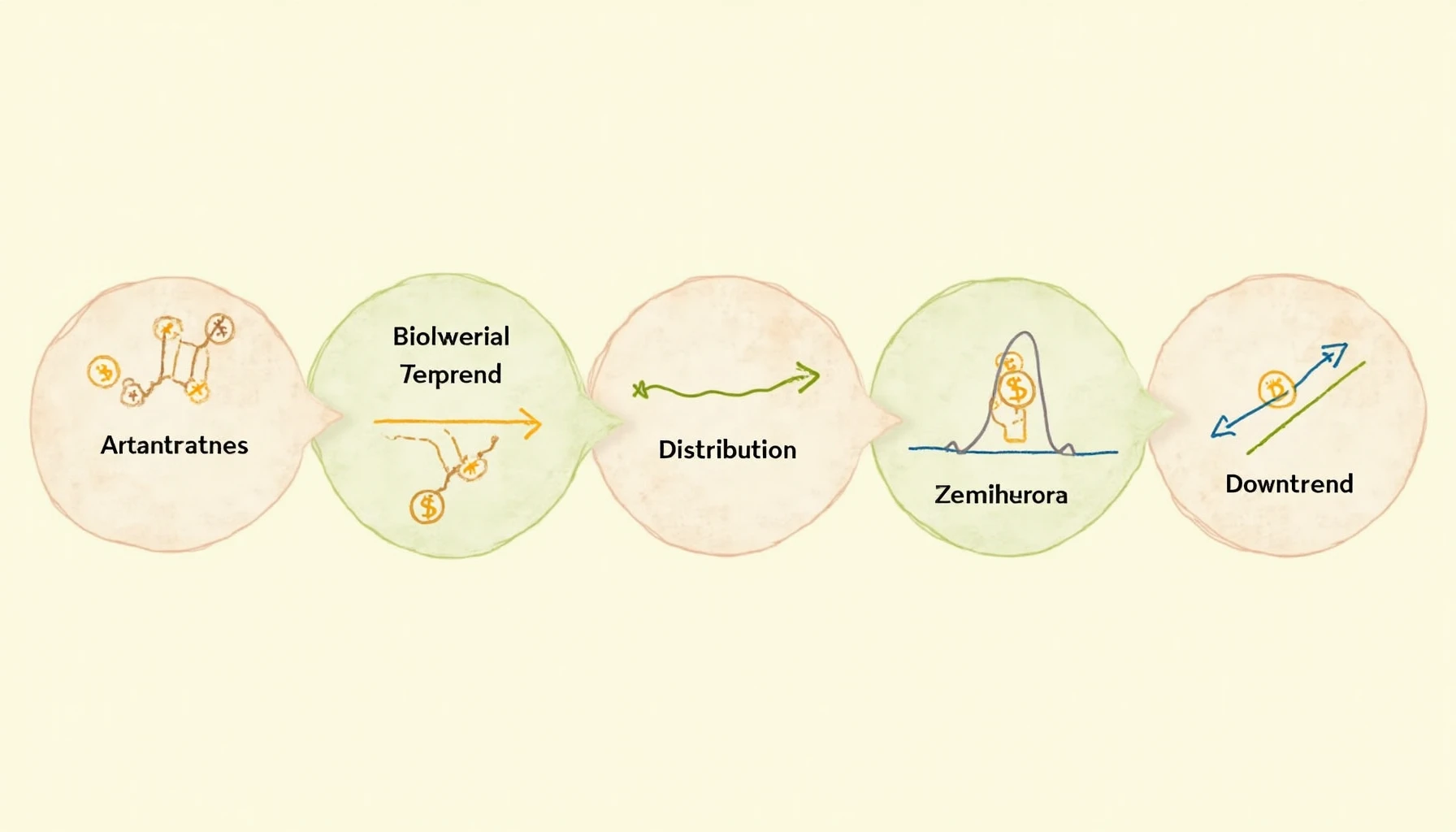

Market cycles in cryptocurrencies typically consist of four phases: accumulation, uptrend, distribution, and downtrend. Each phase reflects investor sentiment and market conditions. Recognizing these can equip traders with the knowledge to make informed decisions.

- Accumulation: This is when savvy investors buy Bitcoin at lower prices.

- Uptrend: Prices rise as demand increases, often fueled by positive news.

- Distribution: Early investors begin selling off their holdings, causing prices to stabilize.

- Downtrend: A decline occurs when investor sentiment turns negative.

Recognizing Patterns Through Historical Data

History often repeats itself, and Bitcoin is no exception. By examining previous cycles, it’s clear that significant price peaks occur roughly every four years, coinciding with the halving event. For instance, in 2021, Bitcoin reached an all-time high of $64,000. Data from CoinDesk indicates that following each halving, the return on investment (ROI) has consistently surpassed 2,000%.

Impact of External Factors

Like global markets, Bitcoin is susceptible to external influences. Events such as regulatory changes and international financial crises can lead to dramatic shifts in market sentiment. For instance, Vietnam experienced a 150% growth rate in crypto adoption last year, highlighting the changing landscape. Understanding these factors is essential for accurate predictions regarding Bitcoin’s market cycles.

Strategizing for Future Trends

To capitalize on Bitcoin’s market cycles, traders should consider technical analysis tools and indicators such as moving averages and RSI (Relative Strength Index). For instance, utilizing these indicators can help identify the optimal entry and exit points in line with market cycles.

- Moving Averages: Ensure you understand the difference between short-term and long-term averages.

- RSI: Recognize overbought or oversold conditions to gauge potential reversals.

The Importance of Research and Tools

Using tools like trading bots and market analysis software, such as hibt.com, can enhance your trading strategy. Diversifying knowledge sources, including investment strategies, keeps you ahead of the curve. Don’t forget, consistent education is key.

In conclusion, understanding Bitcoin market cycles patterns is crucial for making informed investment decisions. By recognizing these patterns and incorporating both historical analysis and current market trends, traders can navigate cryptocurrency’s often tumultuous waters more effectively.

As we approach 2025, staying informed about the evolution of Bitcoin will be vital in understanding not just its price but its wider implications in the financial world. Explore Bitcoin market cycles patterns and elevate your trading strategy.

Author: Dr. John Smith, a financial analyst with over 15 published papers in blockchain technology and a lead auditor for several prominent crypto projects.