Bitcoin Market Efficiency Indices: Understanding Their Role in Crypto Trading

Introduction

In 2024, approximately $4.1 billion was lost to DeFi hacks, causing many traders to re-evaluate their investment strategies. Understanding Bitcoin market efficiency indices has become crucial for those looking to navigate the volatile crypto landscape effectively. These indices provide valuable insights that can help traders make informed decisions.

What are Bitcoin Market Efficiency Indices?

Bitcoin market efficiency indices measure how quickly and correctly information is reflected in Bitcoin prices. Much like a real estate appraisal reflects market value, these indices can guide traders in identifying fair prices. A more efficient market suggests that prices are optimal based on available information, contrasting with less efficient markets that may display price anomalies.

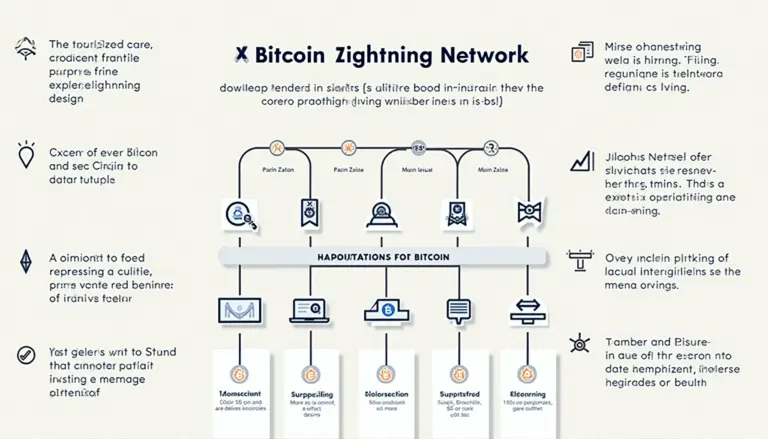

Types of Market Efficiency Indices

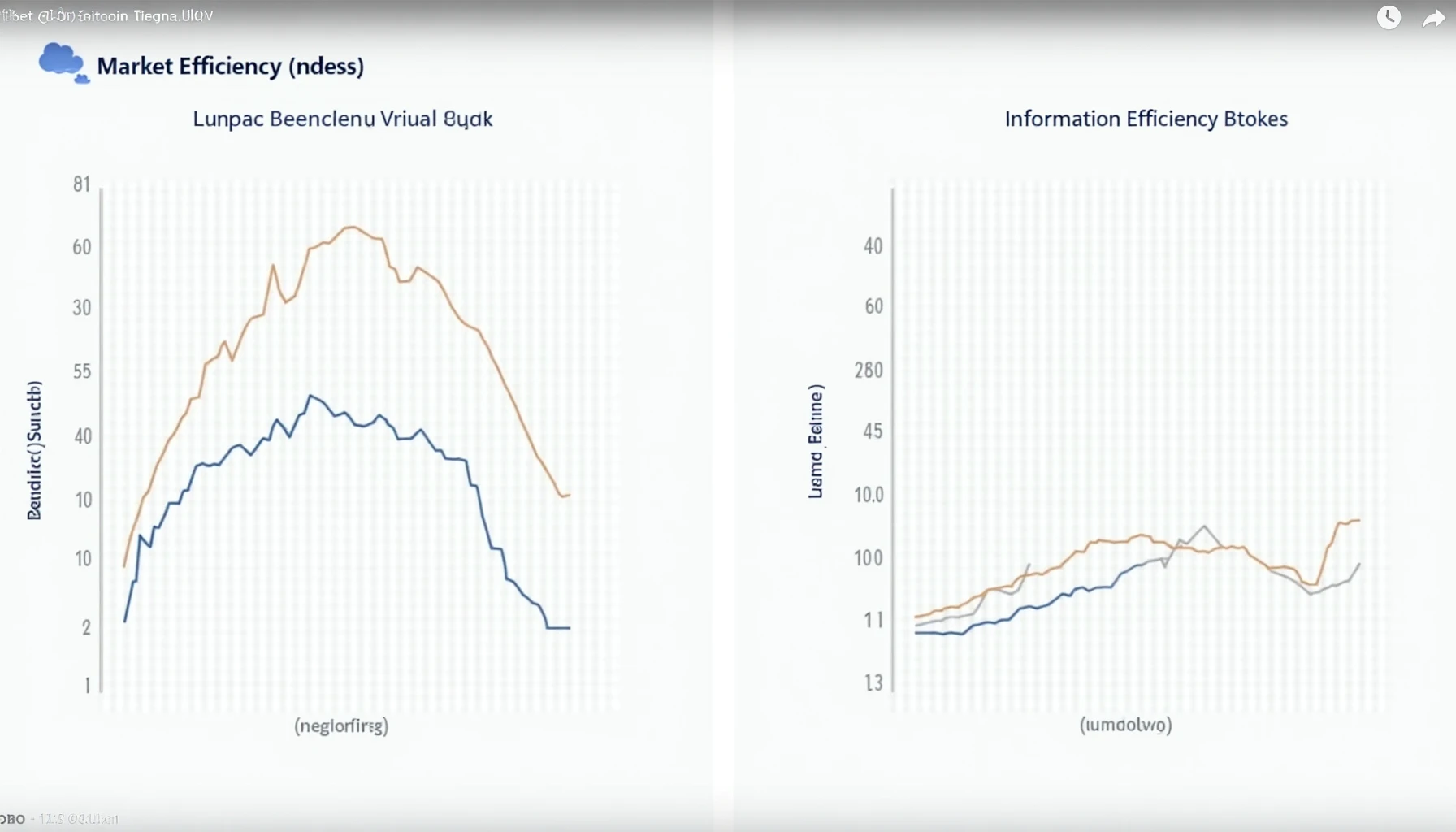

- Information Efficiency: How quickly prices adjust to new information.

- Liquidity Efficiency: The ease with which Bitcoin can be bought or sold without affecting its price.

Vietnam’s Growing Crypto Market

In Vietnam, the growth of cryptocurrency users has reached an impressive 120% over the past year, indicating a growing interest in Bitcoin trading. This surge underscores the need for understanding market efficiency indices among Vietnamese investors to capitalize on this momentum.

Application of Market Efficiency Indices in Trading

Here’s the catch: knowing how to apply market efficiency indices can significantly enhance trading strategies. For instance, traders can analyze whether markets react swiftly to news regarding regulatory changes. Understanding these indices allows traders to time their investments, potentially leading to better profit margins.

Real-World Example: Analyzing Bitcoin Market Movements

According to recent data from Chainalysis, Bitcoin’s price volatility has decreased by 30% in 2025 compared to previous years. Such information underscores the importance of tracking efficiency indices. By comparing historical data against current indices, traders can discern trends, improving their trading decisions.

Tools for Monitoring Efficiency

Tools like CoinGecko provide up-to-date information on Bitcoin prices and can help traders track efficiency indices. Using these resources can guide investment decisions.

Conclusion

In summary, understanding Bitcoin market efficiency indices is vital for anyone looking to succeed in cryptocurrency trading. As the market continues to evolve, traders in Vietnam and globally must adapt their strategies based on these indices. By leveraging this knowledge, investors can make quicker, more informed decisions, ultimately leading to better investment outcomes.

For those looking to dive deeper, explore our resources on market efficiency indices at bitcoinstair.