Bitcoin Market Impact Analysis: Understanding Trends

Introduction

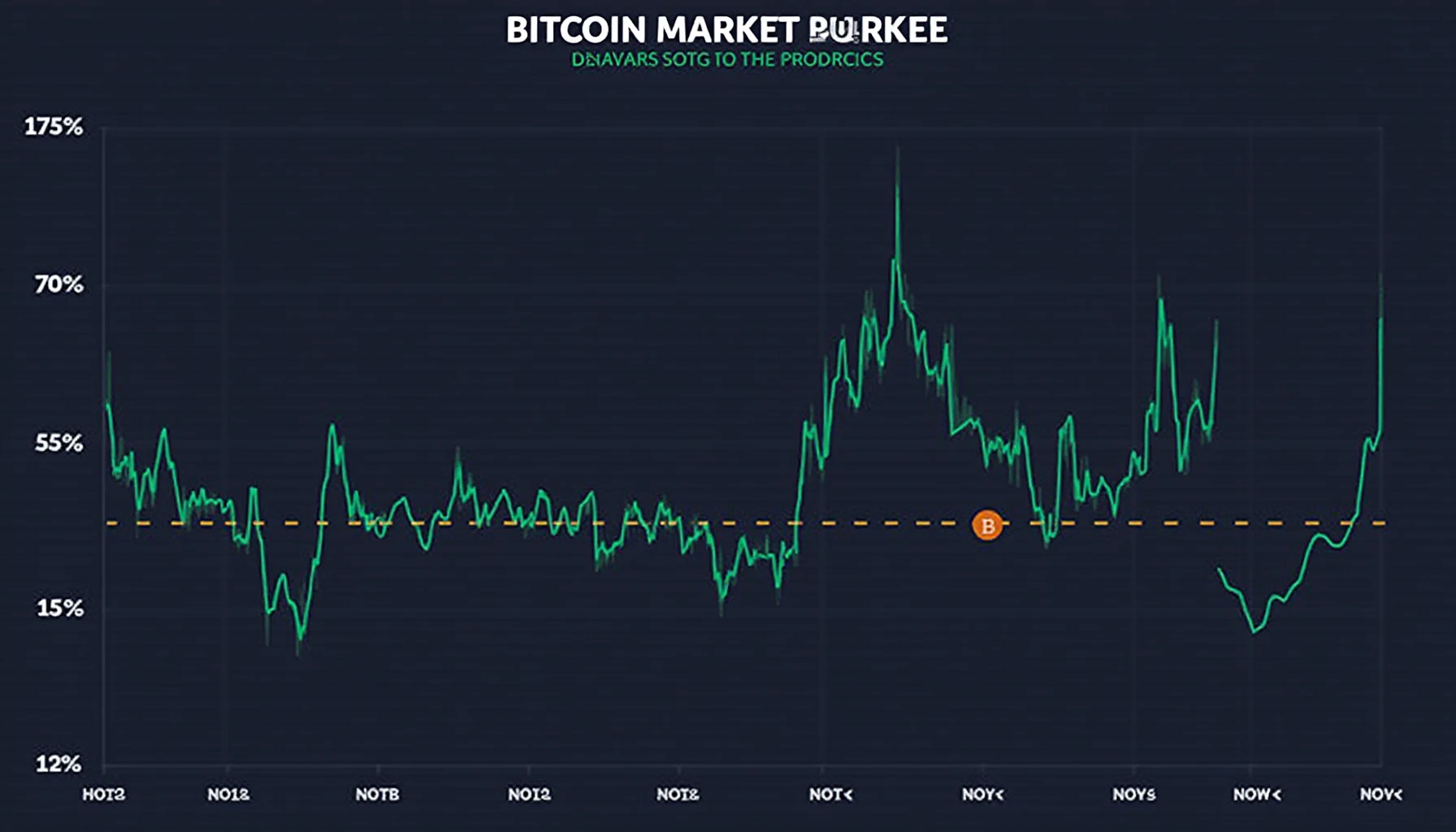

With the recent volatility, the Bitcoin market saw over $200 billion in capital loss this year alone. Understanding these fluctuations is crucial not just for investors but for businesses looking to integrate cryptocurrencies into their operations. This article provides an in-depth Bitcoin market impact analysis to help stakeholders navigate the challenges and opportunities in this digital frontier.

Market Dynamics and Trends

Bitcoin’s price is influenced by various factors, including global economic conditions, regulatory changes, and technological advancements. For instance, the adoption rate among Vietnamese investors increased by 25% in 2023, showcasing a growing interest in cryptocurrencies.

- Market Sentiment: Positive news can spike prices while negative headlines can cause declines.

- Regulatory Factors: Changes in policies in major economies can lead to fluctuations.

Investor Behavior Analysis

Investors play a significant role in price determination. Behavioral economics shows that hype can lead to bubbles, especially in the altcoin market. In Vietnam, grassroots movements have emerged, focusing on educating potential investors about smart contract audits, highlighting the growing awareness that can further stabilize the market.

Case Study: The 2024 Market Dip

During the market dip in early 2024, the decrease in Bitcoin’s value to $30,000 led many to reassess their investment strategies. Data shows that investors who remained calm during fluctuations often recovered their losses faster.

Impact of Blockchain Security

As decentralized finance grows, security becomes paramount. A report from Chainalysis in 2025 indicated that $4.1 billion was lost due to hacks, emphasizing the need for robust security measures. Tools like the Ledger Nano X can reduce risks by 70%, illustrating practical options for protecting digital assets.

Future Projections and Recommendations

What’s next for Bitcoin? Projections indicate a potential rise in 2025, but stakeholders should remain cautious and informed. As we explore future trends, consider the following:

- Market Regulation Changes: Stay updated with local laws, especially in regions like Vietnam.

- Technology Innovations: Keep an eye on improvements in security protocols.

Conclusion

In conclusion, the Bitcoin market’s impact analysis reveals both challenges and opportunities. By understanding trends, investor behavior, and the significance of security, participants can make informed decisions. For a deeper understanding of local regulations affecting cryptocurrencies, download our compliance checklist. Always remember, these insights are for informational purposes only, and it’s essential to consult local regulators for financial decisions.

As digital currencies continue to evolve, platforms like bitcoinstair.com”>bitcoinstair will be instrumental in guiding users through their cryptocurrency journey.