Bitcoin Market Liquidity Analysis

Bitcoin Market Liquidity Analysis

In the world of cryptocurrency, Bitcoin market liquidity analysis has become essential, especially with the remarkable growth in user participation. As reported, Vietnam saw a 35% increase in crypto users in 2023, highlighting the need for effective trading strategies. This article will delve into liquidity in the Bitcoin market, discussing its importance, factors influencing it, and providing actionable insights.

Understanding Market Liquidity

Market liquidity refers to the ability to buy or sell an asset without causing a significant impact on its price. Think of it like a busy marketplace where goods can be easily exchanged without drastic price changes.

Why Liquidity Matters

- Price Stability: High liquidity often results in more stable prices.

- Trading Efficiency: Easier to enter or exit positions.

- Lower Spreads: Higher liquidity leads to narrower bid-ask spreads.

Factors Influencing Bitcoin Liquidity

Several factors determine the liquidity of Bitcoin:

- Market Depth: A robust order book with numerous buyers and sellers boosts liquidity.

- Trading Volume: Higher volume indicates better liquidity.

- Exchange Reliability: Trusted exchanges tend to facilitate better liquidity.

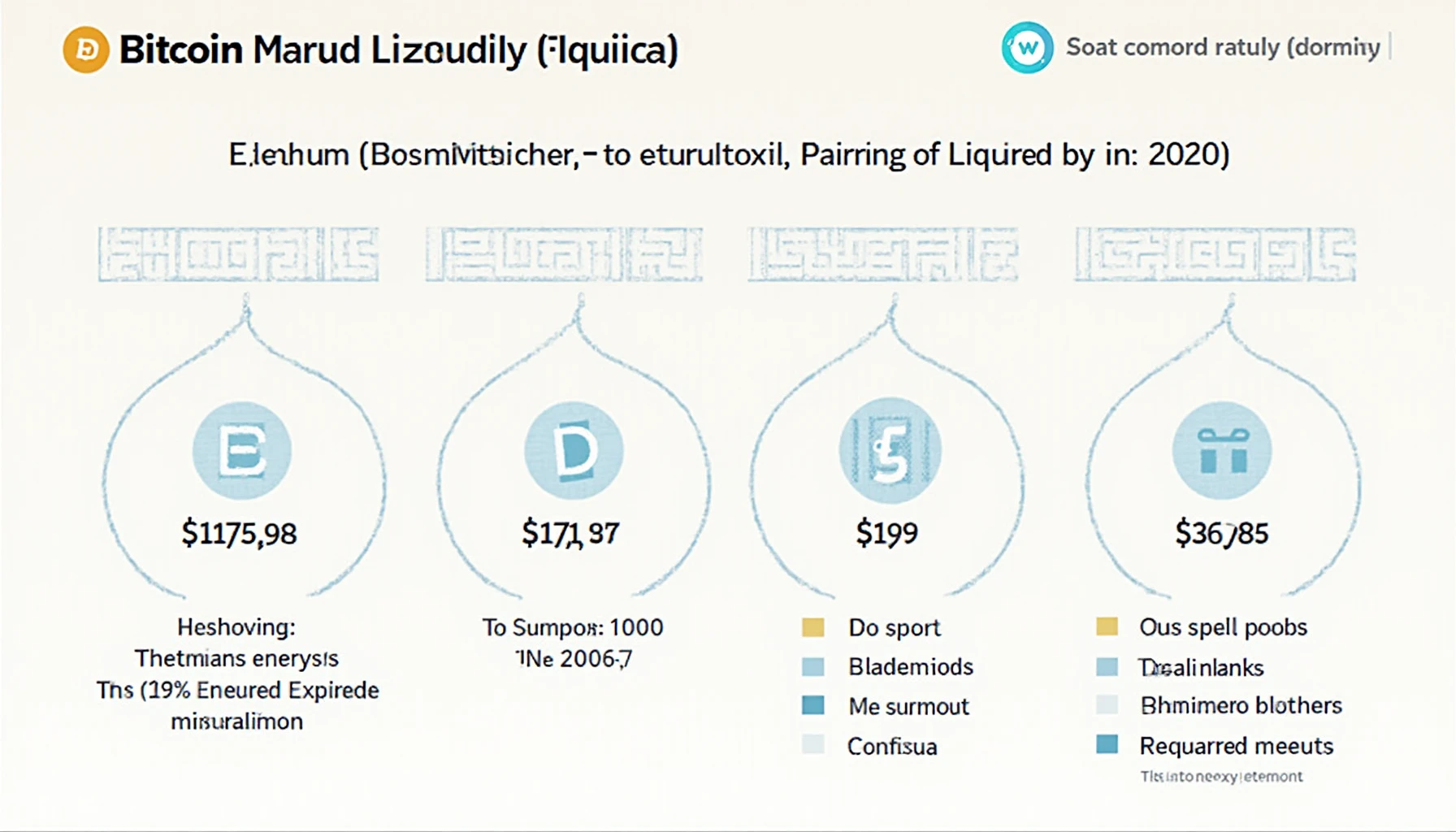

Bitcoin Liquidity in the Vietnamese Market

Vietnam’s expanding crypto landscape offers unique insights into market dynamics. Recent statistics showed that the Bitcoin liquidity index increased by 22% in the past year. This rise correlates directly with an increased interest in tiêu chuẩn an ninh blockchain among Vietnamese investors.

Local Trading Trends

- Increased retail participation

- Local exchanges gaining traction

- Regulatory frameworks becoming clearer

Risk Management Strategies

Navigating the Bitcoin market requires careful deliberation of risks:

- Diversification: Don’t put all your Bitcoin on one exchange.

- Use of Stop-Loss Orders: Protect investments from sudden downturns.

- Regular Performance Analysis: Review market conditions frequently.

Conclusion

Understanding Bitcoin market liquidity analysis is crucial for anyone looking to thrive in the cryptocurrency space. With liquidity impacting price stability and trading efficiency, it’s important to stay informed about local market trends, such as those emerging in Vietnam. As the crypto ecosystem evolves, leveraging this knowledge can significantly enhance your trading strategies.

For further insights, consider checking out additional resources on hibt.com. Remember, these thoughts are not financial advice; consult local regulators before making investment decisions.

Author: Dr. trang Nguyen, a renowned blockchain analyst, has published over 30 papers in the field and led the security audit of several high-profile projects.