Bitcoin Market Manipulation Signals Analysis

Understanding Bitcoin Market Manipulation

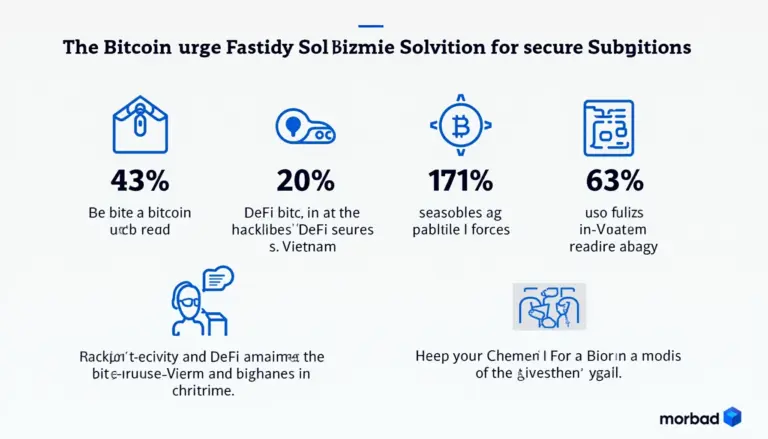

In the ever-evolving world of cryptocurrencies, understanding market dynamics is crucial. With over $4.1 billion lost to DeFi hacks in 2024, the importance of vigilance and awareness cannot be overstated. So, what are Bitcoin market manipulation signals, and how can they affect your investments?

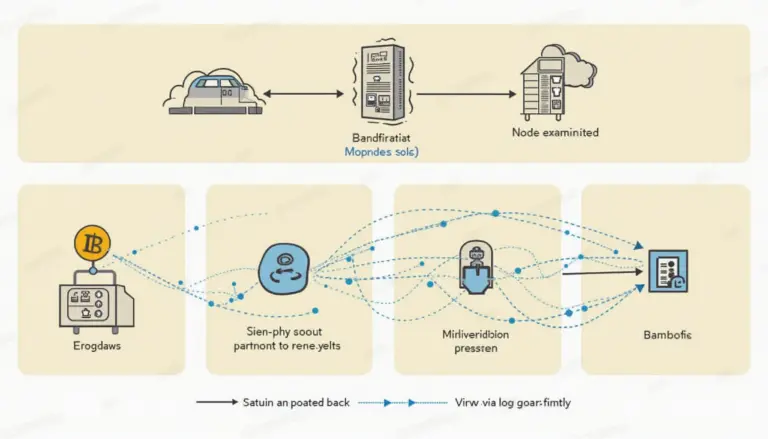

Identifying Manipulation Signals

Market manipulation can take many forms, and recognizing these signals can help you safeguard your investments. Here’s what to look for:

- Large volume spikes: Sudden increases in trading volume can indicate potential manipulation.

- Price discrepancies: Watch for significant price changes not supported by underlying market trends.

- Wash trading: This practice can create misleading appearances of high demand.

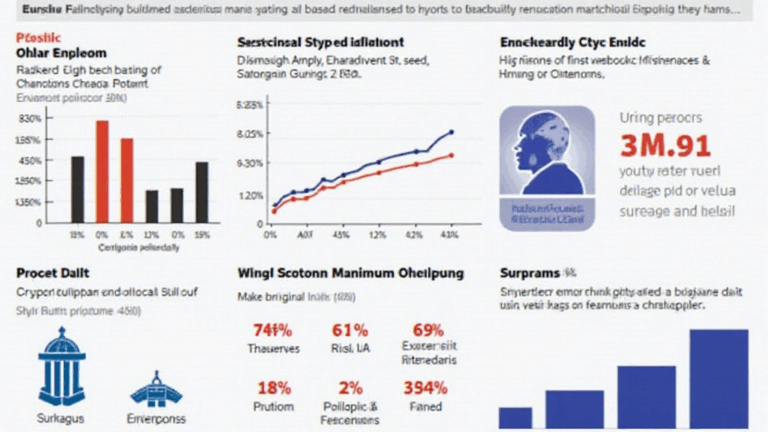

Analyzing Historical Data

Historical data plays a vital role in identifying manipulation patterns. For instance, in Vietnam, the user growth rate in the crypto market has skyrocketed 300% over the last year, increasing the likeliness of volatile price adjustments due to market manipulation.

Preventing Your Investments from Being Affected

Here’s how to protect yourself:

- Diversification: Don’t put all your eggs in one basket.

- Stay informed: Regularly read reputable sites like hibt.com for market insights.

- Utilize reliable exchanges: Choose platforms known for security and transparency.

Utilizing Tools to Monitor Signals

To enhance your trading strategy, consider using tools that provide alerts on market movements. For instance, the Ledger Nano X can significantly reduce hacks by 70%, adding an extra layer of security for your investments.

Conclusion

Monitoring Bitcoin market manipulation signals is essential for any investor. Understanding these dynamics can help you make informed decisions and protect your assets in a highly volatile market. For more insights, explore what bitcoinstair.com”>bitcoinstair has to offer.