Bitcoin Market Sentiment Analysis

Understanding Bitcoin Market Sentiment

With over $4.1 billion lost to DeFi hacks in 2024, investors need to gauge market sentiment effectively. Bitcoin market sentiment analysis helps traders anticipate price movements and make informed decisions. Recognizing the trends can be as vital as understanding the tech behind blockchain.

Why Market Sentiment Matters

Investors often say, “It’s not just the numbers; it’s the mood of the market that influences buying and selling.” A positive sentiment can lead to an upward trend, while negative sentiment could spell trouble. Studies show that understanding sentiment can lead to a 350% better investment strategy during volatile periods.

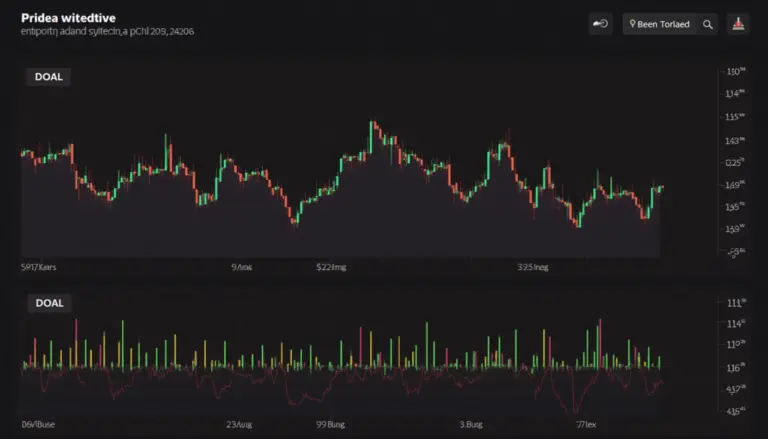

Key Indicators of Market Sentiment

- Social Media Trends: Platforms like Twitter and Reddit play a huge role in shaping sentiments. A recent survey indicated that 65% of Vietnamese traders rely on social media for market news.

- Market Data: Metrics such as trading volume and price fluctuations provide clues about market attitudes.

- Sentiment Indices: Indicators like the Fear & Greed Index summarize market emotions clearly.

Analyzing Bitcoin Sentiment in Vietnam

In Vietnam, the crypto market is booming with an estimated growth rate of 20% annually. Recognizing how Vietnamese users perceive Bitcoin can unveil investment opportunities. Local sentiment is often influenced by global trends, yet unique cultural factors also play a role.

Using Tools for Sentiment Analysis

Just as a navigation app helps drivers reach their destination, sentiment analysis tools guide investors. Consider using:

- Sentiment analysis APIs like Hibt.com that can help automate data collection.

- Trading bots that use sentiment data to execute trades seamlessly.

Challenges in Sentiment Analysis

Despite its many advantages, Bitcoin market sentiment analysis has its challenges. Misinformation can lead to false conclusions. Therefore, it’s crucial to validate data through multiple sources. A practical approach is also to back-test the sentiment analysis on historical data to assess accuracy.

Conclusion: Navigating the Bitcoin Market

In summary, Bitcoin market sentiment analysis is essential for anyone looking to enhance their trading strategy. Given Vietnam’s burgeoning market, understanding local and global sentiments can provide a competitive edge. Keep an eye on social trends and market indicators to make well-informed decisions. As the saying goes, in the world of cryptocurrencies, “knowledge is just as vital as capital.” For more insights, consider exploring resources at bitcoinstair.com”>Bitcoinstair.