2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis, in 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities, posing a significant risk to users. With the rise of decentralized finance and interoperability across chains, it’s crucial we understand the emerging security landscape as vulnerabilities can lead to substantial financial losses.

Understanding Cross-Chain Bridges: A Currency Exchange Analogy

Think of a cross-chain bridge as a currency exchange booth at an airport. Just like how you would trade dollars for euros, these bridges allow transactions between different blockchain networks. However, just as there are shady currency exchanges, not all bridges are secure. Are you getting the best rate, or are you risking your funds at a poorly managed booth? In 2025, many bridges will indeed have loopholes that may be exploited.

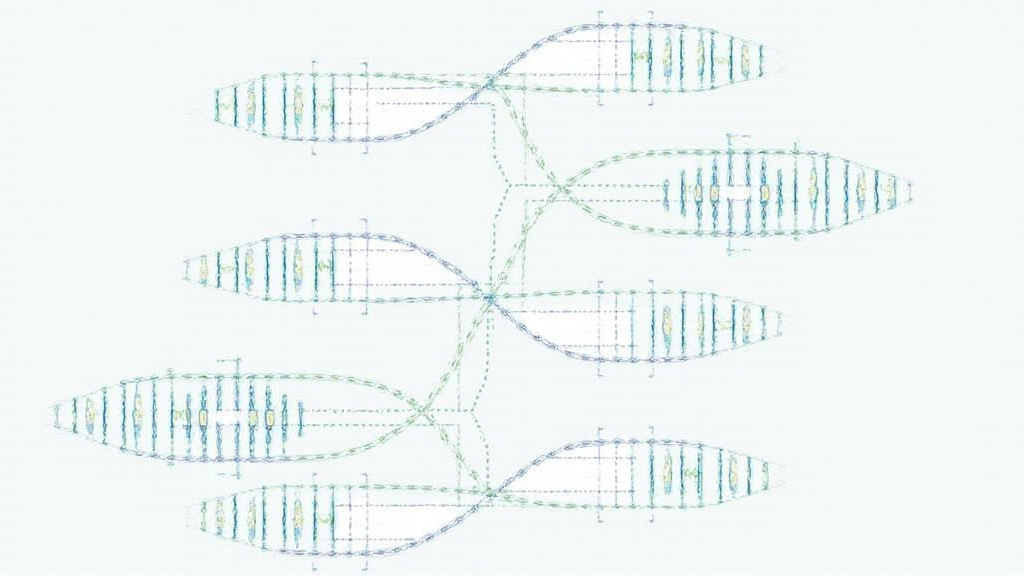

Key Vulnerabilities in 2025: What You Need to Know

According to CoinGecko’s latest data, the main issues arise from protocol flaws, user-controlled keys, and inadequate auditing procedures. Let’s say you hand your passport to an unknown exchange worker; it’s just like handing over your private key to an insecure bridge. Understanding these vulnerabilities is paramount for protecting your digital assets.

Best Practices for Secure Cross-Chain Transactions

To safely navigate this space, one should adopt rigorous practices akin to checking multiple exchange rates before a transaction. Utilize audits, look for trustworthy bridges, and consider using hardware wallets like Ledger Nano X, which can significantly reduce the risk of key exposure. Always remember, being cautious is your best defense.

Future Regulations Impacting Cross-Chain Interoperability

As governments ramp up regulations, similar to how they monitor currency exchanges, we can expect new rules for managing cross-chain operations. For instance, 2025 may bring clearer guidelines in regions like Singapore. Staying informed about these developments is essential for ensuring compliance and security in your transactions.

In conclusion, staying ahead of potential vulnerabilities in cross-chain bridges is not optional; it’s a necessity for anyone engaging with cryptocurrencies. For a detailed toolkit on securing your transactions and insights on Bitcoin media kit optimization Vietnam, download our comprehensive resource here.

As always, remember that this article does not constitute investment advice. Consult local regulatory bodies, such as MAS or SEC, before making any decisions.

For further reading, visit our white paper on cross-chain security and learn about Decentralized Finance Regulations.