Bitcoin Miner Revenue Trends: The Future of Crypto Earnings

Bitcoin Miner Revenue Trends: The Future of Crypto Earnings

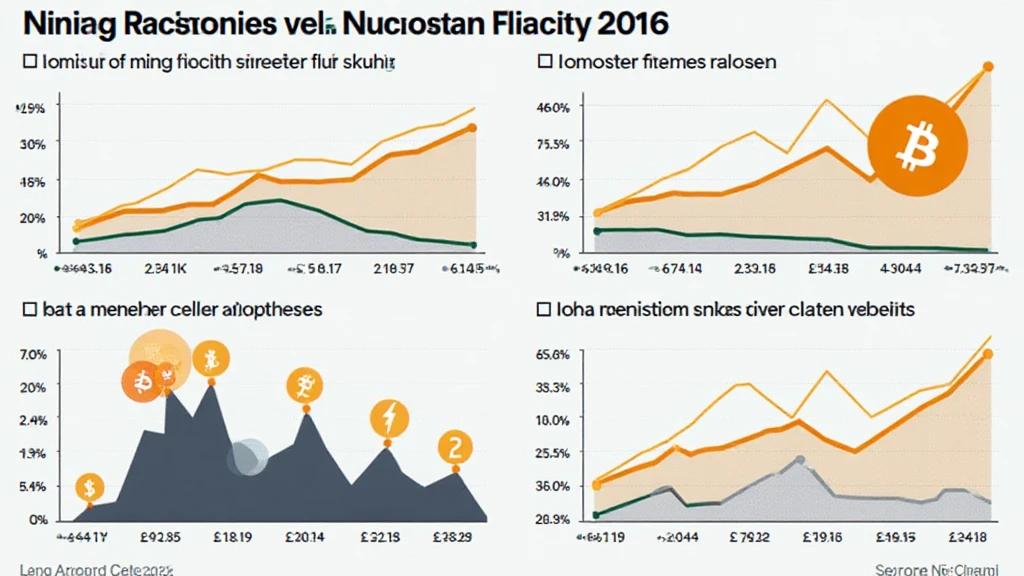

According to Chainalysis, a staggering 73% of Bitcoin miners faced profitability challenges in 2025, driven by fluctuating energy prices and market demand. Understanding the Bitcoin miner revenue trends is crucial for investors and enthusiasts alike.

1. How Do Energy Prices Affect Miner Profitability?

Just imagine going to a local market to buy fruits—if the price of apples goes up, you might think twice before purchasing. Similarly, Bitcoin miners face high electricity costs that can eat into their earnings. Rising energy prices can drastically reduce their margins, making it essential for miners to seek cheaper alternatives or choose locations with favorable electricity rates.

2. What is the Impact of Mining Difficulty on Revenue?

Think of Bitcoin mining like a job where the tasks get harder over time. As more miners join the network, the difficulty increases, and the rewards must be divided among more workers. The concept of mining difficulty impacts how much each miner earns, pulling total revenues down in competitive environments. With this understanding, monitoring Bitcoin miner revenue trends becomes vital for adaptive strategies.

3. How Do Market Trends Influence Mining Revenue?

You might have noticed that when a highly sought-after product is released, prices can soar. The same applies to Bitcoin; when demand rises, so do mining rewards. By analyzing market trends, miners can strategize their operations. Utilizing data analytics tools can significantly enhance their decision-making and potential revenue.

4. What Technological Advances are Shaping the Future of Mining?

Consider a traditional food stall—upgrading to modern equipment can boost efficiency. Similarly, advancements in mining technology, including the use of ASIC miners and renewable energy sources, are key drivers that can enhance revenue. Keeping up with these innovations is foundational for every serious miner aiming to capitalize on the evolving landscape.

In summary, understanding Bitcoin miner revenue trends is integral to navigating the volatile environment of cryptocurrency mining. The right strategies, informed by data and market insights, can lead to sustainable profitability. For those interested in optimizing their mining setups, we’ve compiled a comprehensive toolkit for your needs. Download it now!

Stay informed about the ongoing changes in the crypto landscape, and remember that knowledge is your first line of defense in investment decisions.

Disclaimer: This article does not constitute investment advice; consult local regulatory bodies (e.g., MAS/SEC) before making financial decisions.

Tools like the Ledger Nano X can help mitigate risks, reducing your chances of key exposure by up to 70%.