Understanding Bitcoin Mining Difficulty Adjustments for 2025

Introduction: A Data-Driven Perspective on Bitcoin Mining

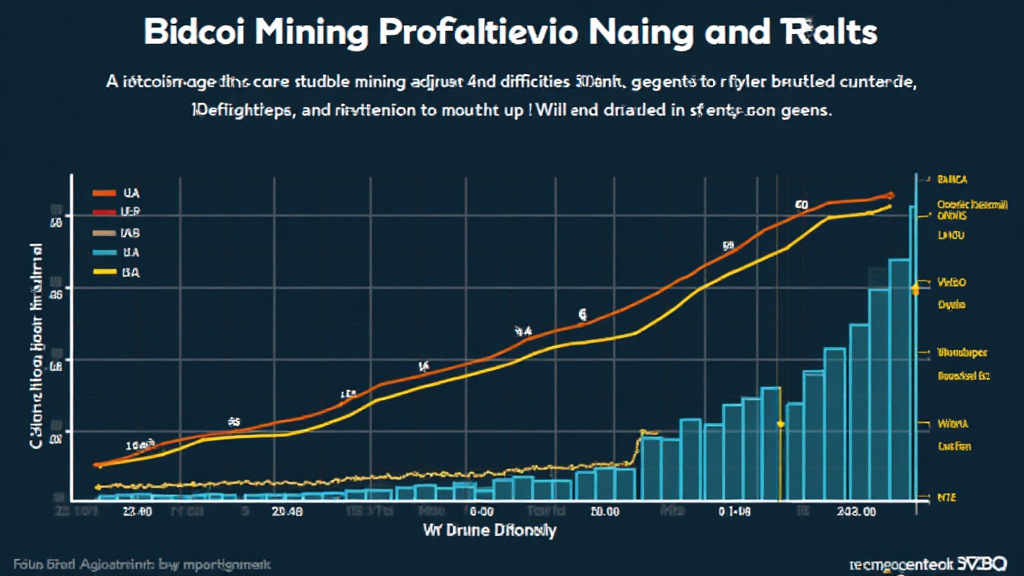

According to Chainalysis 2025 data, a staggering 73% of blockchain miners face challenges due to mining difficulty adjustments. These adjustments can significantly impact profitability and operational strategies as they strive to remain viable in an ever-evolving digital currency landscape.

What Are Bitcoin Mining Difficulty Adjustments?

Think of Bitcoin mining difficulty adjustments as a toll booth on a busy highway. If too many cars (miners) are entering, the toll prices (difficulty) rise to manage traffic flow. Difficulty adjustments happen approximately every two weeks to ensure that blocks are mined at roughly the same rate, approximately every 10 minutes. This dynamic ensures that while some miners may struggle, others might find new opportunities, especially if they employ efficient technology.

How Do These Adjustments Affect Miners’ Profitability?

Picture a bakery adjusting its prices based on demand; if more customers (miners) come in, prices (difficulty) rise to balance demand and supply. When Bitcoin mining difficulty increases, it can reduce the total rewards miners receive for their efforts. Factors like energy costs, equipment efficiency, and Bitcoin price fluctuations also play critical roles in determining overall profitability.

The Role of Technology in Navigating Difficulty Adjustments

Imagine using a high-efficiency blender instead of an old-school one in your kitchen. Miners can adopt advanced technology, such as ASIC miners, that improve power efficiency and enhance their ability to adapt to changes in mining difficulty. As the competition heats up, those who invest in top-tier mining hardware will likely have the edge over others.

Future Perspectives: What Lies Ahead?

Considering the rapid evolution of blockchain technology, staying informed on Bitcoin mining difficulty adjustments will be crucial for miners and investors alike. Industry trends, particularly in regions with emerging regulations like Singapore and Dubai, could affect strategies and overall risk management for mining operations.

Conclusion

In summary, understanding Bitcoin mining difficulty adjustments is essential for anyone involved in cryptocurrency. To navigate these hurdles confidently, staying updated on technological advancements and regulatory changes is critical. For further insights and tools to handle your crypto investments, download our comprehensive toolkit today!