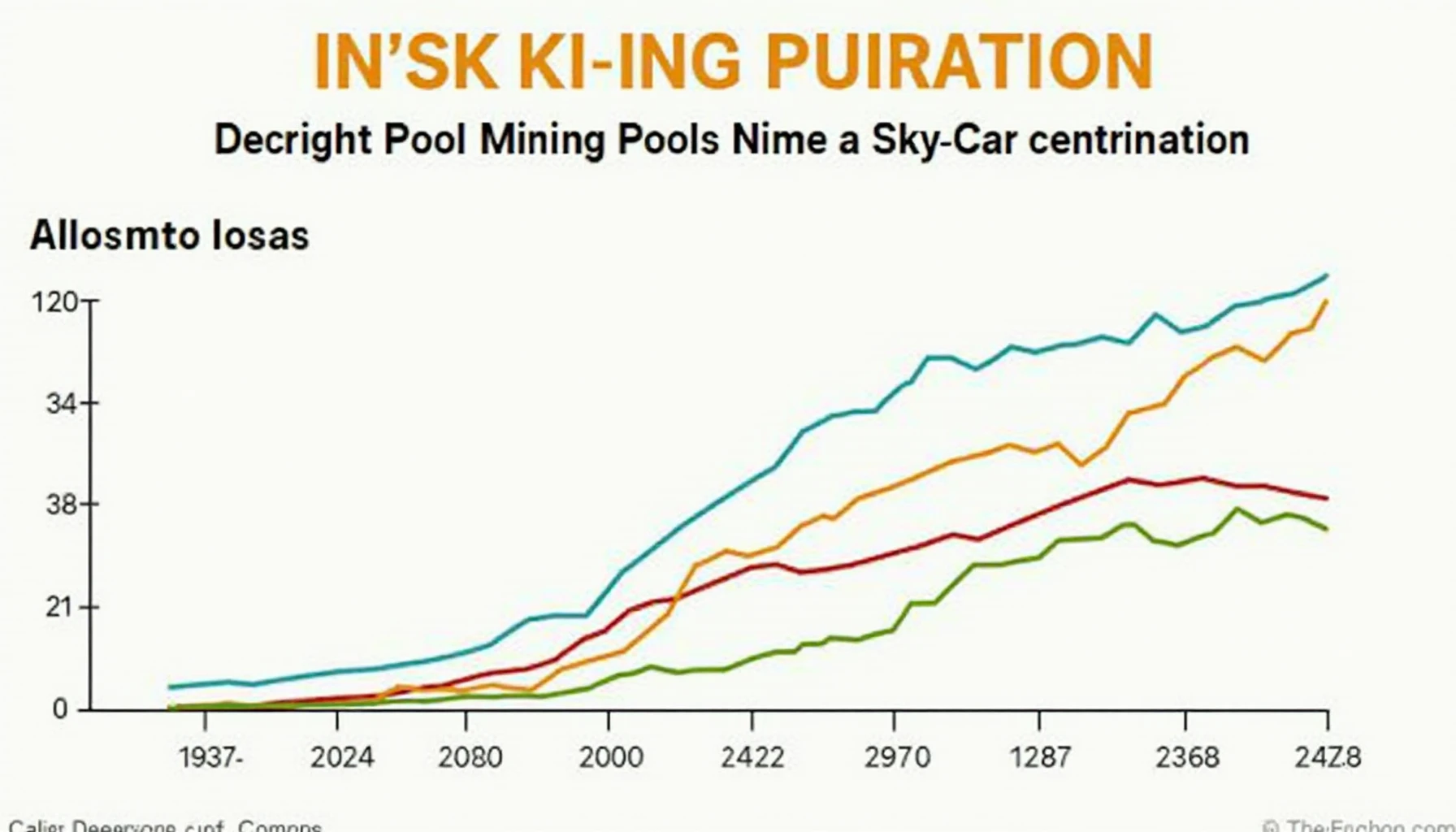

Bitcoin Mining Pool Centralization Risks

Bitcoin Mining Pool Centralization Risks

In the past year, approximately 65% of Bitcoin’s hash rate was controlled by just a handful of mining pools. This raises important questions about the security and decentralization of the Bitcoin network. With $4.1 billion lost to DeFi hacks in 2024, understanding the risks of Bitcoin mining pool centralization becomes crucial for both investors and miners.

Understanding the Risks of Centralization

Centralization in Bitcoin mining pools poses several risks:

- 51% Attack Risks: If one mining pool controls more than half of the network’s hash rate, it can manipulate transactions.

- Privacy Issues: Centralized pools increase the risk of surveillance, as user activities can be monitored.

- Network Vulnerability: Centralization can expose the network to targeted attacks, eventually compromising its integrity.

How Centralization Affects Decentralization

The foundation of Bitcoin’s security lies in its decentralized nature. When a few pools dominate:

- Control Over Block Validation: Centralized pools can dictate which transactions are included in blocks.

- Increased Censorship: A few entities making decisions for the entire network leads to potential censorship of transactions.

Implications for the Vietnamese Market

Vietnam’s crypto user base has grown by 50% in the last year, indicating a rising interest in mining. However, the risks of mining pool centralization are also relevant in the Vietnamese context. As more users engage with mining activities, it is crucial to educate them about the importance of decentralization.

Strategies to Mitigate Centralization Risks

Miners can adopt several strategies to combat centralization:

- Diversify Pool Participation: Miners should join multiple pools to decrease dependency on any single one.

- Support Solo Mining: Individual miners should consider solo mining, though it requires more resources.

- Stay Informed: Keeping abreast of changes in mining pools and their policies can help mitigate risks.

Conclusion: The Path Forward

As Bitcoin’s popularity continues to rise, the risks of mining pool centralization cannot be ignored. Protecting the network requires collective action from miners and investors. By understanding these dynamics, the community can work toward a more secure and decentralized Bitcoin ecosystem, essential for its long-term viability in the global market.

For more insights on blockchain security practices and mining strategies, visit hibt.com.

Author: Dr. Nguyen Hoang, a blockchain researcher with over 15 published papers in decentralized finance and smart contract security, has led audits for several prominent crypto projects.