Maximizing Bitcoin Mining Pool Profit Margins

Understanding Bitcoin Mining Pools

Bitcoin mining has always been a lucrative venture, yet it continues to evolve. With the current landscape showing a 25% increase in participation in mining pools, it’s crucial to understand their role in optimizing profit margins. Mining pools allow miners to combine resources, increasing the chances of earning Bitcoin consistently.

Evaluating Profit Margins

Profit margins in Bitcoin mining pools are affected by several factors:

- Electricity Costs: In Vietnam, the average electricity cost stands at about $0.08 per kWh. Miners should always calculate this expense as it directly impacts their margins.

- Pool Fees: Most mining pools charge fees ranging from 1% to 3%. Selecting a pool with lower fees can enhance profitability.

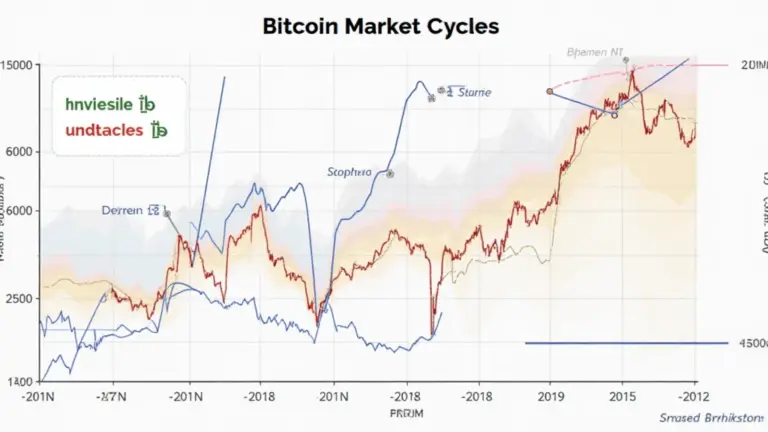

- Bitcoin’s Market Price: The profitability is also tied to Bitcoin’s value fluctuations. Recent trends indicate increased volatility—stay aware!

Choosing the Right Mining Pool

Here’s the catch: not all mining pools are created equal. Some offer better rewards systems or lower fees. According to a recent survey, pools with transparent practices reported a 15% higher satisfaction rate among miners. Look for pools that:

- Have proven track records.

- Provide clear payout structures.

- Maintain a large number of users for better odds of finding blocks.

Tools and Resources to Boost Efficiency

Utilizing effective tools can significantly improve your margins:

- Use Mining Calculators to assess projected profits based on your hardware capabilities.

- Ledger Nano X can reduce hacking risks by up to 70%, ensuring that your earnings are safe.

Wrapping Up Bitcoin Mining Pool Profit Margins

As the Bitcoin landscape continues to grow, understanding how to maximize mining pool profit margins is essential for success. By considering factors such as electricity savings, pool selection, and the market’s fluctuations, miners can effectively enhance their earnings. Remember, pooling resources is like securing a bank vault; it offers safety in numbers and the potential for greater rewards.

Bitcoinstair provides comprehensive insights into Bitcoin mining strategies to help you navigate these complexities. Stay informed and proactive with your investments!