Setting Up a Bitcoin Mining Rig in Vietnam

Introduction

In 2024, more than $4.1 billion were lost to hacking incidents within decentralized finance platforms, emphasizing a critical need for secure and efficient setups. With the rising interest in cryptocurrency, particularly in Vietnam, understanding how to create a robust Bitcoin mining rig setup Vietnam is essential for any aspiring miner. This article will guide you through the requisites of mining in this promising market.

Understanding Bitcoin Mining

Bitcoin mining involves solving complex mathematical problems to validate transactions, earning miners rewards through newly generated bitcoins. The security and efficiency of your mining rig determine your success. In Vietnam, with a substantial increase in blockchain projects, understanding efficient tiêu chuẩn an ninh blockchain is vital.

Why Choose Vietnam?

Vietnam is witnessing an impressive annual user growth rate of 130% in cryptocurrency adoption. Factors such as low electricity costs, a young tech-savvy population, and governmental interest in blockchain technology make it an attractive location for mining operations.

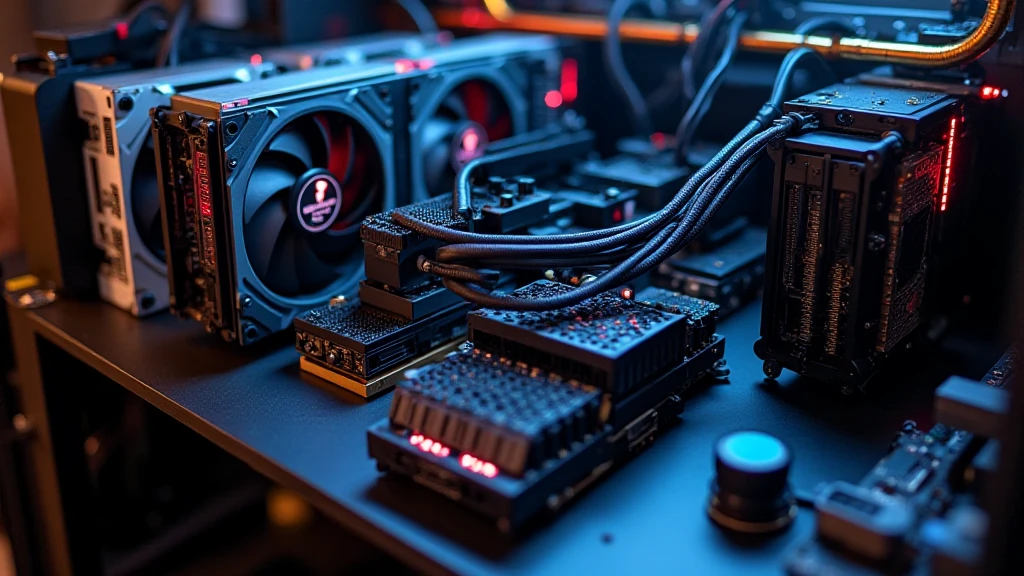

Key Components for Your Mining Rig

- Hardware: Select high-performance GPUs like Nvidia RTX 3080 or AMD Radeon RX 6800.

- Motherboard: Ensure compatibility by choosing a motherboard that supports multiple GPUs.

- Power Supply: Invest in a high-quality power supply unit to handle high energy demands.

- Cooling System: Establish efficient cooling solutions to prevent overheating during extended operations.

Setting Up Your Rig

Here’s the catch: starting your own Bitcoin mining rig doesn’t just involve hardware; it’s about the right environment too. Let’s break down the steps involved in setting up your mining operation efficiently:

- Choose a suitable location with stable electricity and good internet connectivity.

- Assemble the hardware, ensuring all components fit well together and connectivity is optimized.

- Download mining software tailored to your hardware for better performance. Ethereum’s Geth and CGMiner are popular choices.

Local Regulations and Compliance

Engaging in mining activities in Vietnam requires navigating through regulatory landscapes. According to local laws, ensure compliance with energy consumption regulations and consult legal frameworks surrounding cryptocurrencies. Keeping up with local developments prevents setbacks and ensures smooth operations.

Expert Recommendations

Invest in reliable wallets to store your bitcoins securely. According to experts, using hardware wallets, such as Ledger Nano X, can reduce hacks by up to 70%. Additionally, consider joining local mining pools to increase efficiency and share network resources.

Conclusion

Setting up a Bitcoin mining rig setup Vietnam can pave the way for significant returns if approached correctly. By following these guidelines and staying informed about the local crypto market trends, you can build a fruitful mining operation. Check out hibt.com for additional resources to streamline your mining journey. Always remember, this is not financial advice! Consult local regulators for compliance and regulations before commencing your mining efforts.

In conclusion, leveraging Vietnam’s growing cryptocurrency landscape can be beneficial for your mining ventures. Stay updated, explore your options, and dive into the exciting world of Bitcoin mining!