Bitcoin Network Congestion Metrics: Understanding and Overcoming Challenges

Bitcoin Network Congestion Metrics: Understanding and Overcoming Challenges

The growing popularity of Bitcoin has led to increased user transactions, resulting in significant network congestion. This congestion not only affects transaction speeds but also leads to higher fees, creating frustration for users who rely on swift and cost-effective transactions. Therefore, understanding Bitcoin Network Congestion Metrics is crucial for addressing these challenges efficiently.

Pain Point Scenarios

As Bitcoin adoption continues to rise, users often face slower transaction times during peak hours. For instance, in May 2021, Bitcoin fees surged to an average of $62 per transaction due to network congestion, limiting the ability of small investors to participate actively. This unfortunate scenario reveals a significant pain point within the network, where high congestion metrics can lead to excluded participants during crucial trading periods.

Solution Deep Dive

One of the most effective strategies to manage congestion is to implement layer two solutions such as the Lightning Network. These solutions enable faster transactions by creating off-chain channels, alleviating congestion during peak times.

Step-by-Step Process of Implementing Layer Two Solutions

- Establish a Wallet: Ensure you have a wallet compatible with layer two technologies.

- Create Payment Channels: Set up your payment channels for quicker transactions.

- Confidently Transact: Initiate transactions off-chain, reducing burden on the main blockchain.

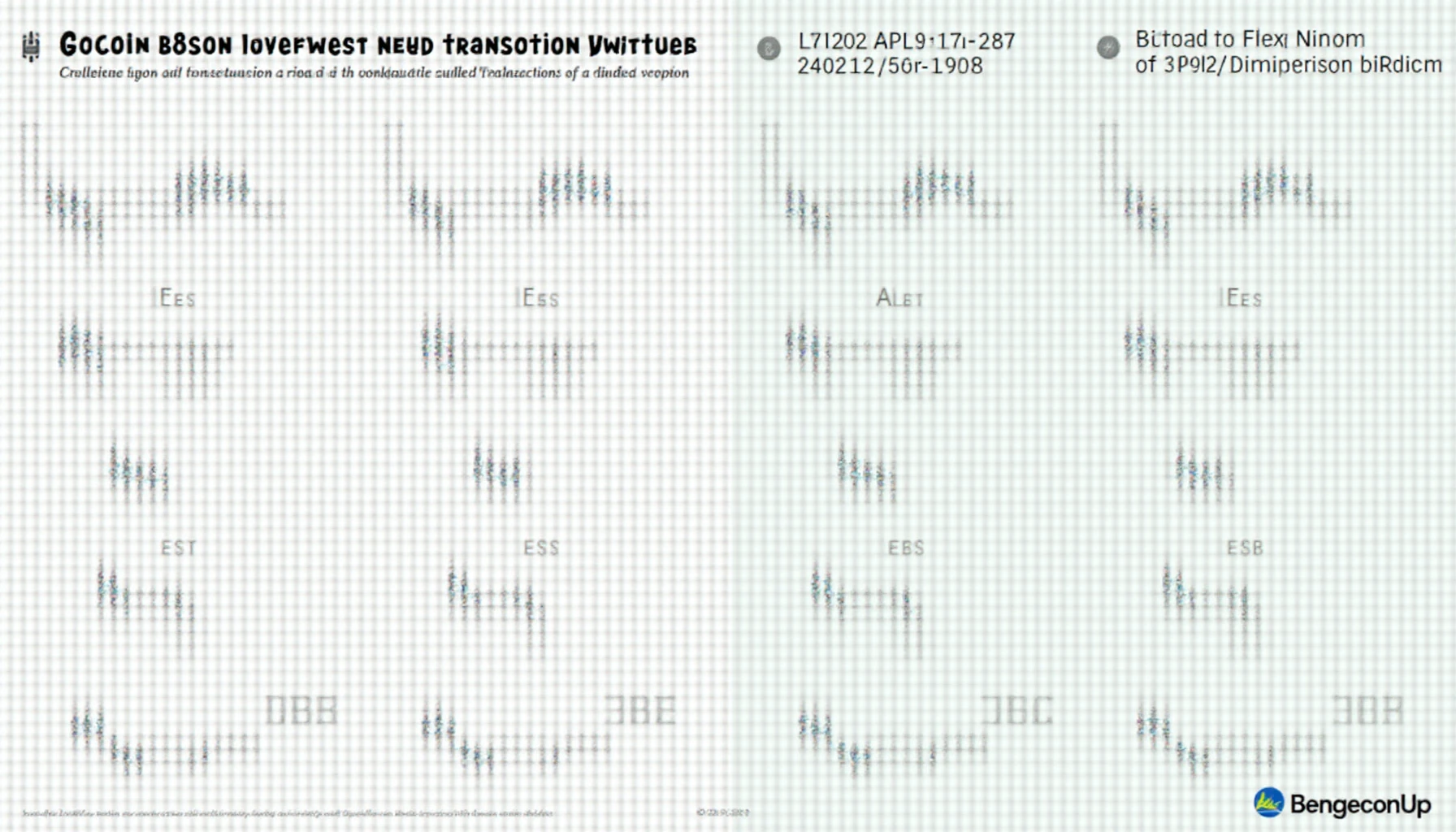

Comparison Table: Layer Two Solutions vs. Traditional Transactions

| Parameter | Layer Two Solutions | Traditional Transactions |

|---|---|---|

| Security | High, with instant settlement | Moderate, longer settlement times |

| Cost | Low fees in off-chain transactions | Higher fees during congestion |

| Applicable Scenarios | Ideal for frequent trading | Better for large, infrequent transactions |

According to the 2025 Chainalysis report, nearly 70% of Bitcoin users will shift to layer two solutions, significantly reducing the reliance on on-chain transactions and mitigating congestion issues. This data supports the effectiveness and necessity of implementing these advanced strategies.

Risk Warnings

When engaging with **layer two solutions**, users must be aware of potential risks, including the **possibility of routing failures** and the **need for continuous monitoring** of channel liquidity. It is crucial to **always assess the security of your chosen method** and remain vigilant about the implications of settlement times. Ensuring proper audits and reviews of layer two platforms are highly recommended to prevent any potential losses.

For a seamless cryptocurrency transaction experience, utilizing tools that analyze your Bitcoin Network Congestion Metrics can provide insights into optimal transaction times and strategies to maximize efficiency. At bitcoinstair, we are committed to helping users navigate these challenges effectively.

Frequently Asked Questions

Q: What are the main causes of Bitcoin network congestion? A: Increased transactions during peak periods lead to congestion and high fees. Understanding Bitcoin Network Congestion Metrics helps identify these patterns.

Q: How can I reduce transaction fees during congestion? A: Utilizing layer two solutions can lower costs significantly compared to traditional transactions. These solutions leverage Bitcoin Network Congestion Metrics to optimize transaction speeds.

Q: Are there risks associated with layer two transactions? A: Yes, risks include potential routing failures and liquidity issues. Users should diligently monitor their transactions to mitigate these risks effectively.