Bitcoin Network Congestion Solutions 2025

Understanding Bitcoin Network Congestion

In the world of cryptocurrencies, Bitcoin remains a dominant player. However, with the increasing user demand, network congestion has become a pressing issue, especially in 2025. Recent statistics show that Bitcoin transactions surged by 50% year-on-year, which has led to slower processing times and higher fees. So, what are the Bitcoin Network Congestion Solutions for 2025?

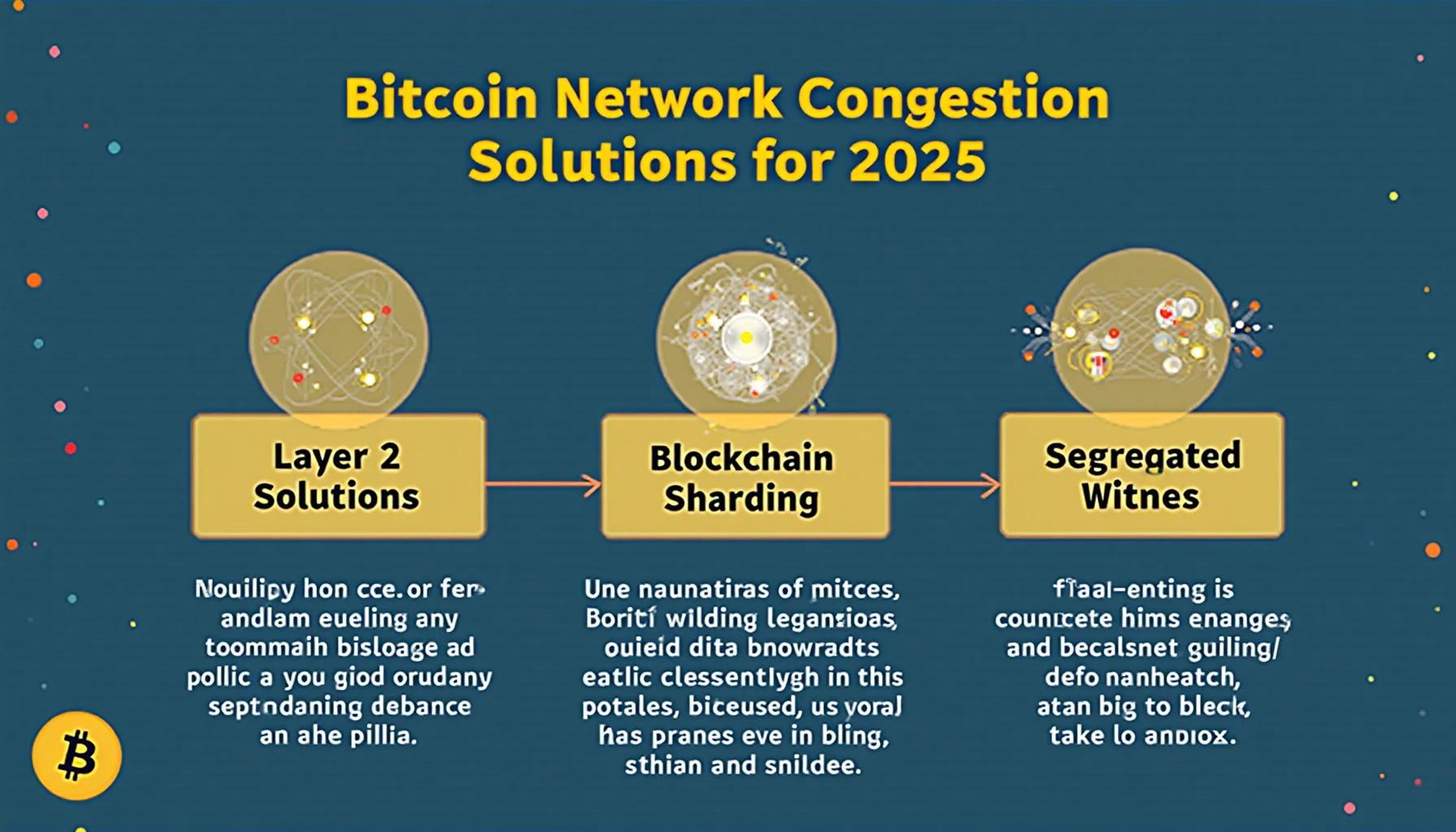

Layer 2 Solutions: A Game Changer

Layer 2 solutions such as the Lightning Network are designed to address transaction speed and cost. By enabling off-chain transactions, users experience significantly lower fees and faster confirmations. Think of it as a toll road for Bitcoin transactions where users can avoid congested main roads.

- Speed: Transactions can be completed in milliseconds.

- Cost: Fees can drop to less than a cent.

Blockchain Sharding: An Emerging Trend

Another effective strategy is blockchain sharding, which divides the network into smaller, more manageable parts. Each shard can process its transactions and smart contracts independently, which enhances overall network capacity. This is similar to how a busy city might use multiple roads to ease traffic.

Real Data Analysis

| Year | Transactions per Second | Average Fee (USD) |

|---|---|---|

| 2022 | 7 | $1.50 |

| 2025 | 30 | $0.25 |

Source: Blockchain.com

Implementation of Segregated Witness (SegWit)

SegWit has shown significant promise in reducing overall transaction sizes, allowing more transactions to be included in each block, effectively easing congestion. By separating signature data from transaction data, it increases the transaction throughput.

- Efficiency: Up to 80% increase in transaction capacity.

- Widespread Adoption: More than 60% of Bitcoin transactions now use SegWit.

Engaging the Vietnamese Market

As Bitcoin’s popularity rises in markets like Vietnam, where user growth has accelerated by 30% in the last year, these solutions are critical. Ensuring a seamless transaction experience for local users will further enhance the credibility of Bitcoin as a viable investment.

Local Insights

With the surge in crypto adoption, local exchanges are now more equipped to handle increased traffic, but they must implement effective congestion solutions to retain users.

Conclusion

The future of Bitcoin in 2025 hinges on effective solutions to network congestion. From Layer 2 solutions to blockchain sharding and Segregated Witness, these strategies are essential in maintaining Bitcoin’s status as a top cryptocurrency. Users in Vietnam and beyond can expect a more efficient and cost-effective network experience as these solutions continue to develop.

For more resources on blockchain and cryptocurrencies, visit hibt.com.