Bitcoin OTC Trading Volumes: Understanding Market Dynamics

Bitcoin OTC Trading Volumes: Understanding Market Dynamics

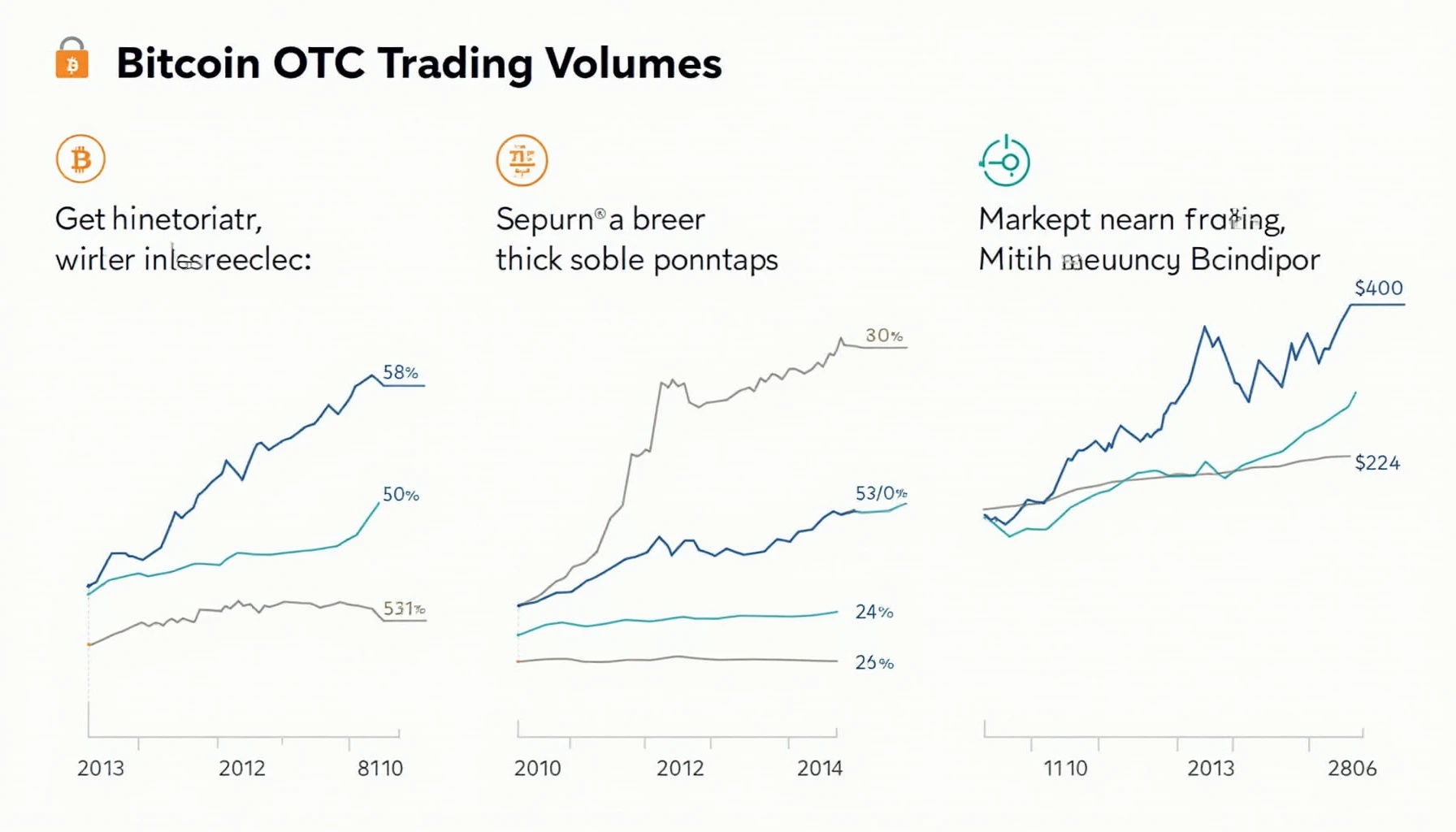

In recent years, Bitcoin OTC Trading Volumes have surged dramatically, reflecting a significant evolution in the cryptocurrency landscape. This rise poses various pain points for both new and experienced traders, including the complexities of executing large trades and remaining compliant with regulatory frameworks. In this article, we will delve into these challenges and unveil the solutions that can help traders optimize their operations.

Pain Points in Crypto Trading

The volatile nature of Bitcoin prices often leads to slippage, where the execution price of a trade differs from the expected price. For instance, when a trader intends to purchase a substantial amount of Bitcoin, even a slight market movement can result in unexpected losses, a scenario frequently faced during times of high trading volumes. Additionally, traders often grapple with issues involving liquidity, creating an environment ripe for confusion and frustration in the OTC market.

Solutions and Deep Insights

To effectively navigate the complexities presented by Bitcoin OTC Trading Volumes, it is essential to employ a strategic approach. Here’s a detailed analysis on how to optimize OTC trading:

- Implementing a trusted marketplace: Utilize reputable OTC desks that offer liquidity for substantial trades without causing significant price impacts.

- Utilizing Multi-Signature Verification: This method enhances security measures for transactions, ensuring that funds are safeguarded against potential threats.

- Understanding Market Analysis Tools: Use analytical tools to track market trends and optimize your trading strategy accordingly.

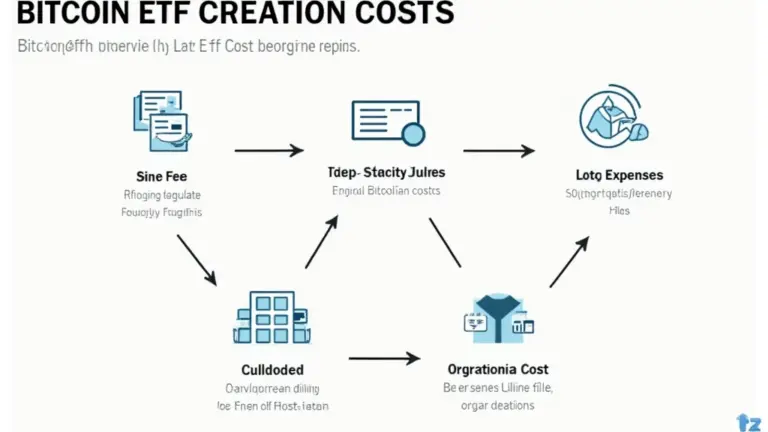

| Parameters | Solution A: Traditional Exchange | Solution B: OTC Desk |

|---|---|---|

| Security | Moderate | High |

| Cost | Low | Moderate |

| Suitable Scenarios | Small trades | Large volume trades |

According to a recent report by Chainalysis, it is projected that by 2025, the Bitcoin OTC Trading Volumes will account for nearly 30% of total Bitcoin transactions, underscoring the importance of understanding this market.

Risk Warnings

While trading in the OTC market presents many advantages, it is critical to be aware of the associated risks. These include market manipulation, counterparty risk, and regulatory scrutiny. To mitigate these risks, traders should conduct thorough due diligence on OTC desks and utilize multi-signature protocols to enhance transaction security.

At bitcoinstair, we prioritize providing our users with resources and tools to navigate the complexities associated with Bitcoin OTC Trading Volumes. Our platform is designed to enhance user experience while ensuring compliance and security in all trades.

Conclusion

In conclusion, understanding the intricacies of Bitcoin OTC Trading Volumes is essential for any trader looking to capitalize on this burgeoning market. With the right strategies and a focus on security, traders can navigate the OTC landscape effectively, thereby maximizing their profits.

FAQ

Q: What are Bitcoin OTC Trading Volumes?

A: Bitcoin OTC Trading Volumes refer to the amount of Bitcoin traded through over-the-counter markets, typically involving large trades that aim to minimize market impact.

Q: Why should I consider OTC trading?

A: OTC trading allows for larger transactions without significantly affecting market prices, thus enabling traders to execute trades more effectively.

Q: How can I safely engage in Bitcoin OTC trading?

A: To engage safely in Bitcoin OTC trading, utilize reputable platforms, perform thorough due diligence, and employ security measures such as multi-signature verification.