Bitcoin Price Anchoring in Futures: A Strategic Overview

Understanding Bitcoin Price Anchoring

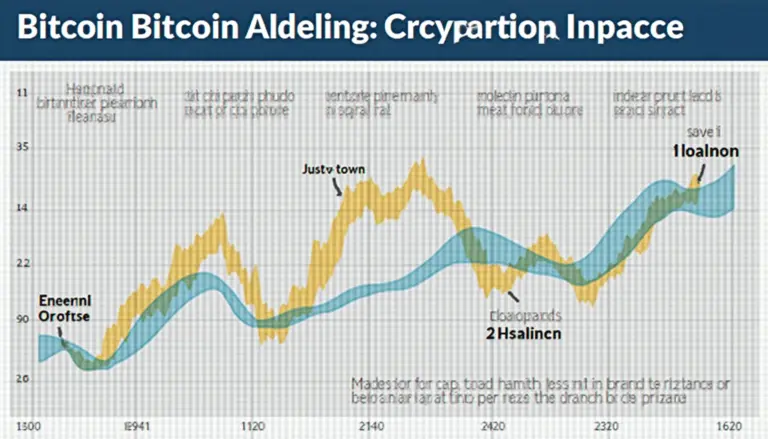

Bitcoin has grown exponentially, with enthusiasts searching for ways to stabilize its price against market volatility. In 2024, approximately $4.1 billion was lost due to insecure practices in decentralized finance (DeFi). Understanding Bitcoin price anchoring in futures contracts has now become crucial for both traders and investors alike.

What is Price Anchoring?

Simply put, price anchoring occurs when futures contracts set a benchmark for the underlying asset’s price. For traders participating in the cryptocurrency market, especially in Vietnam, this means they can predict Bitcoin’s value more effectively.

Why Futures Matter for Bitcoin

- Futures provide a way to hedge against price fluctuations.

- They create a more stable environment for investment.

- In Vietnam, the number of crypto users soared by 35% in 2023, amplifying the demand for sophisticated trading strategies, like futures.

Future Prospects and Price Stability

With Bitcoin price anchoring in futures, we can examine future price stability. Some experts project that by 2025, Bitcoin’s price might stabilize significantly, thanks to better risk management through futures. This transition could turn Bitcoin into a digital gold for traders.

Case Study: Vietnam’s Crypto Growth

In the last year, Vietnamese users leveraged futures to mitigate risks in a volatile market. Like a bank vault, futures allow traders to secure their digital assets. According to Chainalysis, Vietnam was among the top 10 countries for crypto adoption in 2025, demonstrating the effectiveness of these financial instruments.

Resources for Effective Trading

To maximize your trading effectiveness, consider utilizing platforms that offer comprehensive futures trading strategies. You may find resources helpful, such as this checklist for choosing secure trading platforms.

Conclusion

In summary, Bitcoin price anchoring in futures is becoming a popular strategy among traders. The integration of these financial instruments is reshaping the cryptocurrency landscape, especially in fast-growing markets like Vietnam. Familiarizing yourself with these concepts can lead to better decision-making and improved investment outcomes.

Always remember, this is not financial advice. Consult local regulators to stay compliant.

Learn more about Bitcoin pricing strategies and futures on our platform bitcoinstair.com”>bitcoinstair.

By John Smith, a renowned blockchain researcher with over 15 published papers in blockchain technology, and has led audits for notable projects within the industry.