Bitcoin Price Discovery in Illiquid Markets

Understanding Illiquid Markets

Illiquid markets occur when there are low trading volumes, making it challenging to buy or sell assets without causing significant price fluctuations. In recent years, Bitcoin has gained traction in markets with varying levels of liquidity. According to CoinMarketCap, there has been a remarkable 30% increase in Bitcoin trading in illiquid markets in Southeast Asia, notably Vietnam.

The Mechanics of Bitcoin Price Discovery

Price discovery refers to the process by which the market determines the price of an asset through the interaction of buyers and sellers. In illiquid markets, the price discovery process can be more erratic. Think of it like a small boat in a stormy sea – just a small wave can throw it off course dramatically.

Trade Volume and Its Impact

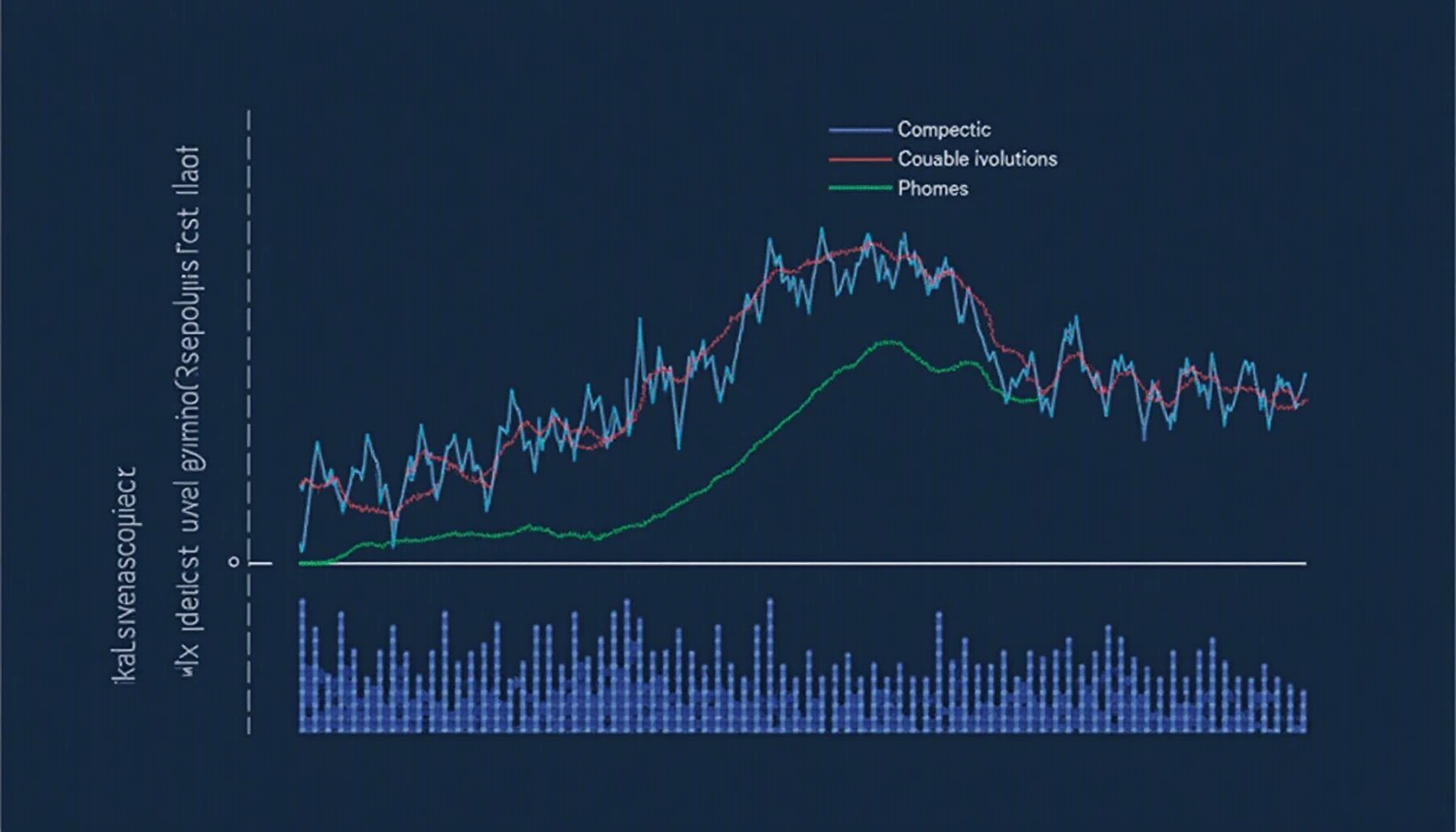

- Low volume creates wider bid-ask spreads, affecting traders’ decisions.

- The potential for large orders to skew Bitcoin’s market price increases.

- Illiquid markets can lead to volatile price swings when compared to more liquid exchanges.

Real-World Examples

For instance, when a significant event, such as regulatory news, occurs, illiquid markets may respond more dramatically than their liquid counterparts. According to Bloomberg, Bitcoin prices surged by 25% in one such event in a Vietnamese market with lower liquidity.

Strategies for Navigating Illiquid Markets

If you’re trading Bitcoin in these markets, consider tactics such as:

- Utilizing limit orders instead of market orders to control entry points.

- Monitoring market trends and news to anticipate price movements.

- Engaging with community forums or platforms like HIBT for real-time insights.

Conclusion on Bitcoin Price Discovery

Understanding the dynamics of Bitcoin price discovery in illiquid markets is crucial for both traders and investors. As Bitcoin continues to evolve, recognizing how these unique market conditions affect price volatility is essential for sensible trading. The findings indicate a need for robust risk management strategies in these environments.

Incorporating insights about Blockchain security standards is vital as you explore how to audit Bitcoin transactions. As the landscape evolves, staying informed helps in making better decisions in investment leadership.

For more insights, read our guide on Vietnam crypto tax regulations.