Unlocking Bitcoin Price Forecasting Accuracy for 2025

Unlocking Bitcoin Price Forecasting Accuracy for 2025

According to Chainalysis 2025 data, a staggering 73% of cryptocurrency analysts struggle with price forecasting accuracy, leading to significant financial consequences for traders. As we navigate the evolving landscape of digital currencies, understanding the nuances of Bitcoin price forecasting can make or break your investment strategy.

What Factors Influence Bitcoin Prices?

Think of Bitcoin price fluctuations like the space in a farmer’s market. Just as the prices of fruits and vegetables vary daily based on availability, seasonal trends, and demand, Bitcoin prices are influenced by market sentiment, regulatory news, and macroeconomic factors. For instance, as countries implement stricter crypto regulations, Bitcoin’s value may rise or fall, directly affecting your investments.

How Does On-chain Data Enhance Forecasting?

Imagine a baker measuring ingredients for the perfect loaf of bread. On-chain data is akin to this measurement—it provides valuable insights that help forecast Bitcoin’s price. Tools like Wallet Profiler and Glassnode analyze transaction patterns and whale movements, offering traders clues about potential price movements. So, keeping an eye on this data is crucial for accurate forecasting.

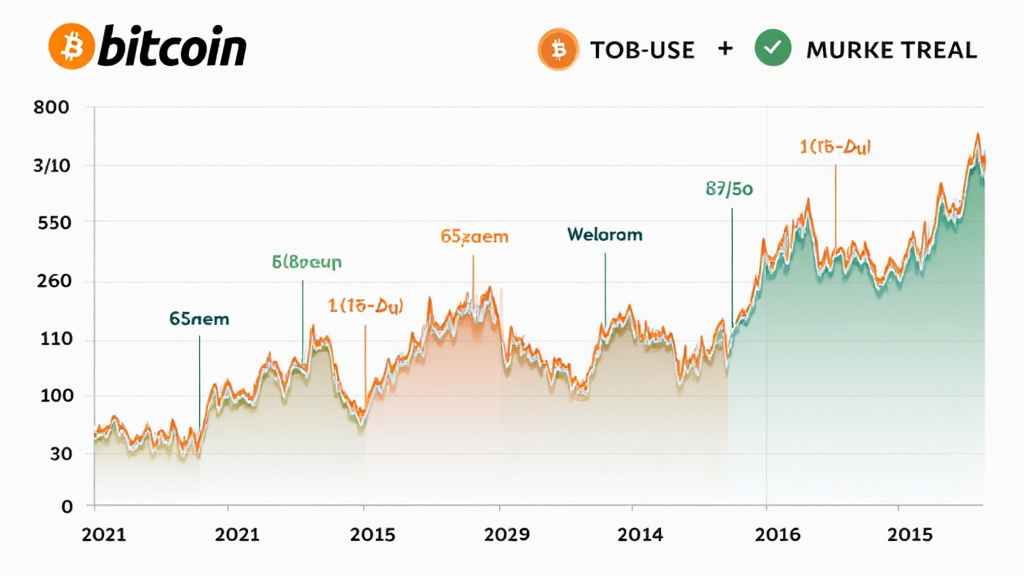

Can Machine Learning Improve Predictions?

Using machine learning for Bitcoin forecasting is like having a weather app that predicts rain accurately. By analyzing historical price data and identifying patterns, machine learning algorithms can spot trends and assist in making better forecasts. For example, if historical data shows Bitcoin typically rises before major announcements, traders can strategize accordingly!

What Role Does Market Sentiment Play?

Market sentiment tools are like gossip on the street corner—what people say may impact what you think and ultimately decide. Using platforms that gauge investor sentiment can indicate community confidence or fear regarding Bitcoin prices. When traders express optimism, prices usually rise; pessimism can lead to dips. So, don’t underestimate the power of public sentiment!

In conclusion, enhancing your understanding of Bitcoin price forecasting accuracy involves analyzing various factors—from on-chain data to market sentiment. By staying informed and utilizing the right tools, you can better position yourself in the volatile crypto market. For more in-depth insights, download our comprehensive toolkit now!

Explore our suite of crypto forecasting tools!

Risk Disclaimer: This article does not constitute investment advice. Always consult with local regulatory bodies (like MAS/SEC) before making any trading decisions. For secure crypto storage, consider Ledger Nano X, which can reduce private key leakage risks by up to 70%.