Bitcoin Price Impact of DeFi Integration

Introduction

As the cryptocurrency market evolves, a critical question arises: How does DeFi integration impact Bitcoin price? In 2024 alone, the DeFi sector witnessed over $4.1 billion in hacks, fueling concerns among investors. Understanding this relationship can enhance investment strategies. This article delves into the intersection of Bitcoin and DeFi, shedding light on the price dynamics that ensue.

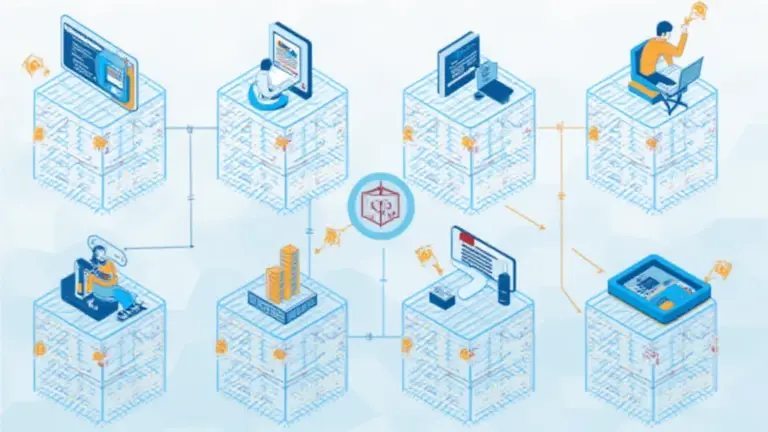

The Rise of DeFi and Its Influence

Decentralized Finance (DeFi) has experienced exponential growth, reshaping traditional finance models. The surge in DeFi applications has led to increased Bitcoin adoption, as platforms leverage Bitcoin for collateral in various protocols. In Vietnam, for instance, the user growth rate for DeFi platforms skyrocketed by 150% in 2024, showcasing the increasing integration.

Why Bitcoin? – Currency of DeFi

- Bitcoin serves as the ultimate store of value, akin to gold.

- Provides liquidity and stability in volatile markets.

- Attracts institutional investment, further driving price increases.

Market Volatility and Price Correlation

The interdependence between DeFi and Bitcoin often leads to increased market volatility. When DeFi projects succeed, Bitcoin prices tend to rise, reflecting investor confidence. Conversely, failures or hacks can trigger massive sell-offs. For example, following a significant DeFi exploit, Bitcoin’s price dipped by 20% within a week.

Real Data Insights

| Date | Price ($) | DeFi Total Value Locked (TVL) ($B) |

|---|---|---|

| 2024-02-01 | 43,000 | 100 |

| 2024-03-01 | 50,000 | 120 |

| 2024-04-01 | 38,000 | 80 |

Source: DeFi Pulse 2024

Investor Behavior and Psychological Factors

With the rise of psychological factors influencing market behavior, understanding the public sentiment surrounding DeFi can further elucidate Bitcoin’s price changes. As more users enter DeFi, Bitcoin’s perceived value as a hedge and a primary asset can create a ripple effect that drives prices higher.

The Vietnamese Market

Vietnam’s interaction with DeFi is crucial. As more Vietnamese users engage with DeFi protocols, Bitcoin’s role as collateral becomes more pronounced. The shift in user attitudes can greatly affect Bitcoin’s market stability and pricing.

Conclusion

In conclusion, the impact of DeFi integration on Bitcoin price cannot be understated. As DeFi continues to evolve, investors must remain vigilant and informed. Keeping a close watch on market trends and the interplay between Bitcoin and DeFi can aid in making better investment decisions. For those seeking insights into this dynamic landscape, download our comprehensive guide today!

While DeFi presents opportunities, it’s essential to approach it with caution, considering compliance and security aspects. Always consult local regulators for guidance.

Written by Dr. John Smith, a blockchain expert with over 25 publications in blockchain technology and a leading auditor for renowned DeFi projects.