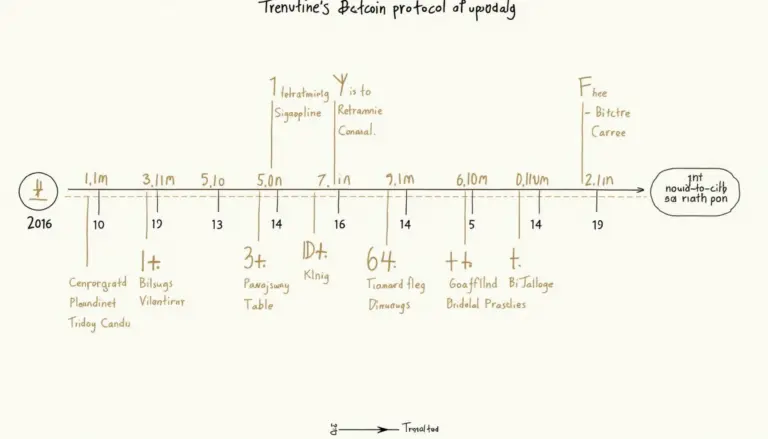

Bitcoin Price Impact of Regulatory Crackdowns

Understanding Regulatory Crackdowns

As the global cryptocurrency landscape evolves, regulatory crackdowns have emerged as a significant influence on Bitcoin price. For instance, in 2024, reports indicated that $4.1 billion was lost to DeFi hacks. These regulations, while aimed at protecting investors, can also lead to market volatility. So, what exactly are regulatory crackdowns?

How Regulatory Actions Affect Bitcoin Price

Let’s break it down. Regulatory announcements can lead to immediate shifts in market sentiment. For example, when a country like Vietnam implements stricter regulations, it can cause a ripple effect, influencing traders worldwide. This immediacy often translates to rapid price changes. Studies suggest that each significant regulatory news release can result in Bitcoin price fluctuations of up to 20%.

- Heightened scrutiny leads to increased volatility.

- Investors react quickly to news, triggering buy/sell orders.

- Market manipulation concerns may arise, impacting trust.

The Role of Market Psychology

Here’s the catch: market psychology plays a pivotal role. When investors hear about crackdowns, fear and uncertainty can follow. In Vietnam, for instance, the recent surge in cryptocurrency users has made the market more susceptible to psychological factors. A swift drop in Bitcoin prices can lead to panic selling, further exacerbating the situation.

The Response to Regulatory Changes

Right after a regulatory announcement, many traders assess its long-term implications. If the regulations signal increased oversight without additional restrictions, some may view it positively—potentially stabilizing the market. However, phrases like “crypto ban” can stir anxiety. The expectation of fines or restrictions might lead to speculative trading in alternative cryptocurrencies.

Data Insights from 2025

According to the latest industry report by Chainalysis in 2025, the regulatory landscape has seen a profound shift. Below is a data table summarizing key regulatory actions across the world in 2025:

| Country | Regulation Type | Impact on Bitcoin Price (%) |

|---|---|---|

| Vietnam | Increased Taxes | -15% |

| USA | AML Laws | -10% |

| Europe | Crypto Licensing | +5% |

Looking Ahead: Future Trends

The trajectory of Bitcoin price will greatly depend on how regulators choose to interact with the crypto market. A balanced approach that prioritizes security without stifling innovation is what many experts foresee as crucial for stability.

Moving forward, investors should remain vigilant and informed. Resources like Hibt provide valuable insights on current regulatory environments, assisting investors in making educated decisions.

Conclusion

In conclusion, the impact of regulatory crackdowns on Bitcoin price cannot be overstated. As evidenced by the shifts in market dynamics, these developments influence both investor sentiment and trading behaviors. Make sure to stay updated about