Bitcoin Price Impact of Tax Policies

Understanding the Link Between Tax Policies and Bitcoin Prices

As Bitcoin continues to gain traction, understanding its price dynamics has become crucial for investors and enthusiasts alike. Did you know that in 2023 alone, the global cryptocurrency market cap fluctuated by over $200 billion based on changes in tax regulations? This underscores how significant tax policies can be. Let’s delve into how these regulations shape Bitcoin’s price, especially in burgeoning markets like Vietnam.

Tax Regulations in Vietnam and Their Effects

Vietnam has witnessed a remarkable 35% increase in cryptocurrency users over the past year. As the government considers implementing clearer tax frameworks, the potential impact on Bitcoin’s price can neither be overstated nor ignored. Investors are seeking clarity on how their activities are taxed, influencing their buying and selling behaviors.

Impact of Capital Gains Tax

The introduction of capital gains tax can significantly shift investor sentiment. Like how a sudden storm can affect a day at the beach, new taxes can cause volatility in Bitcoin prices. For instance, if the Vietnamese government decides to impose a 15% capital gains tax, investors could rush to sell, causing short-term price dips.

Global Considerations: Tax Policies Beyond Vietnam

While local regulations matter, global tax policies also create ripples. Countries with stricter regulations often see reduced trading volume. Countries, such as the U.S., with a 0% tax rate for certain crypto gains, tend to experience a more robust market for Bitcoin, influencing prices worldwide. Investors from different regions respond to tax incentives, impacting demand and price stability.

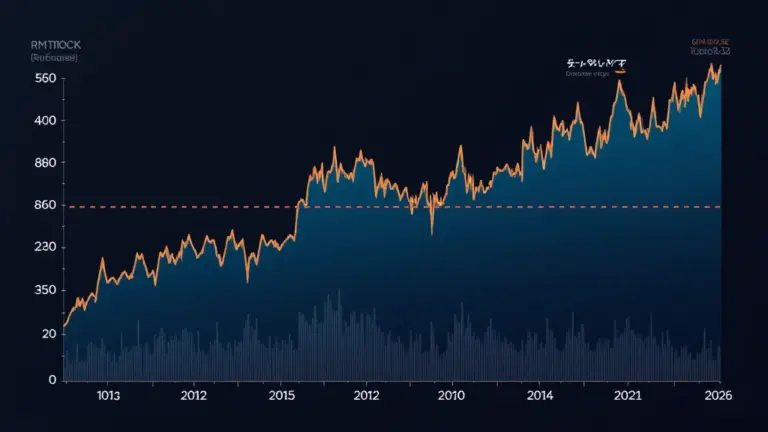

Long-Term Trends in Taxation and Bitcoin

Long-term trends show that as cryptocurrencies like Bitcoin become more mainstream, the likelihood of increased taxation in many jurisdictions rises. Thus, investors engaging in smart contract audits are urged to stay informed of potential tax liabilities, which could drastically affect future prices. Observing these trends enables investors to strategize effectively.

Practical Steps for Investors in Vietnam

- Monitor the local regulatory landscape often.

- Engage in community discussions around tax changes.

- Utilize tools like Ledger Nano X to protect investments amidst policy fluctuations.

Conclusion

In summary, understanding the Bitcoin price impact of tax policies is essential for informed investment decisions. As the Vietnamese market grows, staying ahead of regulatory changes will be key to capitalizing on price movements. Whether in Vietnam or globally, how investors react to tax policies will shape the future of Bitcoin pricing. Remember, tax regulations are like the seasonal shifts in nature—you can’t control them, but you can prepare for them.

For more insights into navigating the cryptocurrency tax landscape, visit bitcoinstair.com”>bitcoinstair.

Expert Author: Dr. Le Minh, a financial strategist with over 15 publications in cryptocurrency regulations, has led audits for notable blockchain projects.