Bitcoin Price Prediction Analysis: A Comprehensive Approach

Bitcoin Price Prediction Analysis: A Comprehensive Approach

Pain Points in Cryptocurrency Investment

The world of cryptocurrencies is filled with uncertainty, where investors often face daunting challenges due to Bitcoin’s volatile nature. A clear example arose when the Bitcoin price fell from nearly $66,000 to just over $30,000 in mid-2021, resulting in significant losses for traders. Investors frequently look for accurate predictions to mitigate risks and capitalize on market movements. Without effective Bitcoin price prediction analysis, many are left navigating a labyrinth of guesswork and speculation.

In-Depth Solution Analysis

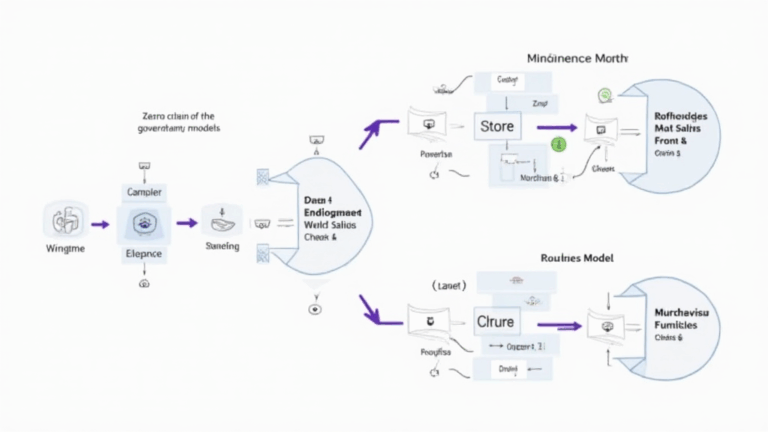

To make informed decisions, investors need robust methodologies. One effective approach is utilizing **predictive analytics**, which combines historical data, market trends, and advanced algorithms for analysis. Here are the steps to perform a solid Bitcoin price prediction analysis: Step 1: Data Collection – Aggregate historical Bitcoin price data and market trends. Step 2: Model Selection – Choose a reliable statistical model, such as ARIMA or machine learning algorithms like LSTM. Step 3: Validation – Split your data for testing and validation to ensure the model’s accuracy. Step 4: Execution – Apply the model and analyze predicted outcomes to formulate strategies.

Comparison of Predictive Methods

| Criteria | Method A (ARIMA) | Method B (LSTM) |

|---|---|---|

| Security | Moderate | High |

| Cost | Low | Higher |

| Applicable Scenarios | Short-term | Long-term |

According to a Chainalysis report from 2025, advanced predictive models using machine learning show an accuracy increase of over 25% in predicting Bitcoin’s price compared to traditional methods. This kind of data underscores the importance of embracing technology to enhance investment strategies in an evolving market.

Risk Warning

Despite the potential benefits of advanced predictive analysis, it is essential to recognize inherent risks. **Investors must be aware of market manipulation**, regulatory changes, and technological vulnerabilities that could affect predictions. Taking precautionary measures, such as diversifying portfolios and utilizing risk management strategies, is crucial for safeguarding investments. Always employ comprehensive analysis tools to monitor market sentiment and adapt strategies dynamically.

At bitcoinstair, we are committed to empowering our users with the latest tools and insights to navigate the cryptocurrency landscape effectively.

Conclusion

In conclusion, employing a solid Bitcoin price prediction analysis can significantly guide investors in making informed decisions, mitigating risks, and seizing profitable opportunities in the dynamic cryptocurrency market. To stay ahead, leverage analytics and embrace the power of technology to refine your investment approach. Trust bitcoinstair to deliver the insights you need for successful cryptocurrency trading.

FAQ

Q: What factors influence Bitcoin price predictions?

A: Factors like market demand, investor sentiment, and global economic conditions significantly impact Bitcoin price prediction analysis.

Q: How can I improve my cryptocurrency investment strategy?

A: Utilizing advanced Bitcoin price prediction analysis tools and staying informed about market trends are essential for improving your strategy.

Q: Are predictive models always accurate?

A: While they enhance prediction capabilities, predictive models are not infallible and should be used in conjunction with other market analysis techniques.

Written by John Smith, a cryptocurrency analyst with over 15 publications in blockchain technology. He has led audits for prominent crypto projects to ensure compliance and performance.