Bitcoin Price Target Setting Strategies

Introduction

As the cryptocurrency market continues to evolve, setting accurate Bitcoin price targets has become increasingly important. With insights gathered from various market analyses, let’s ask: How can traders maximize their gains in such a volatile environment? In 2024 alone, the cryptocurrency market experienced fluctuations that saw Bitcoin’s price swing over 30% within weeks. This highlights the need for effective Bitcoin price target setting strategies that aid in making informed decisions.

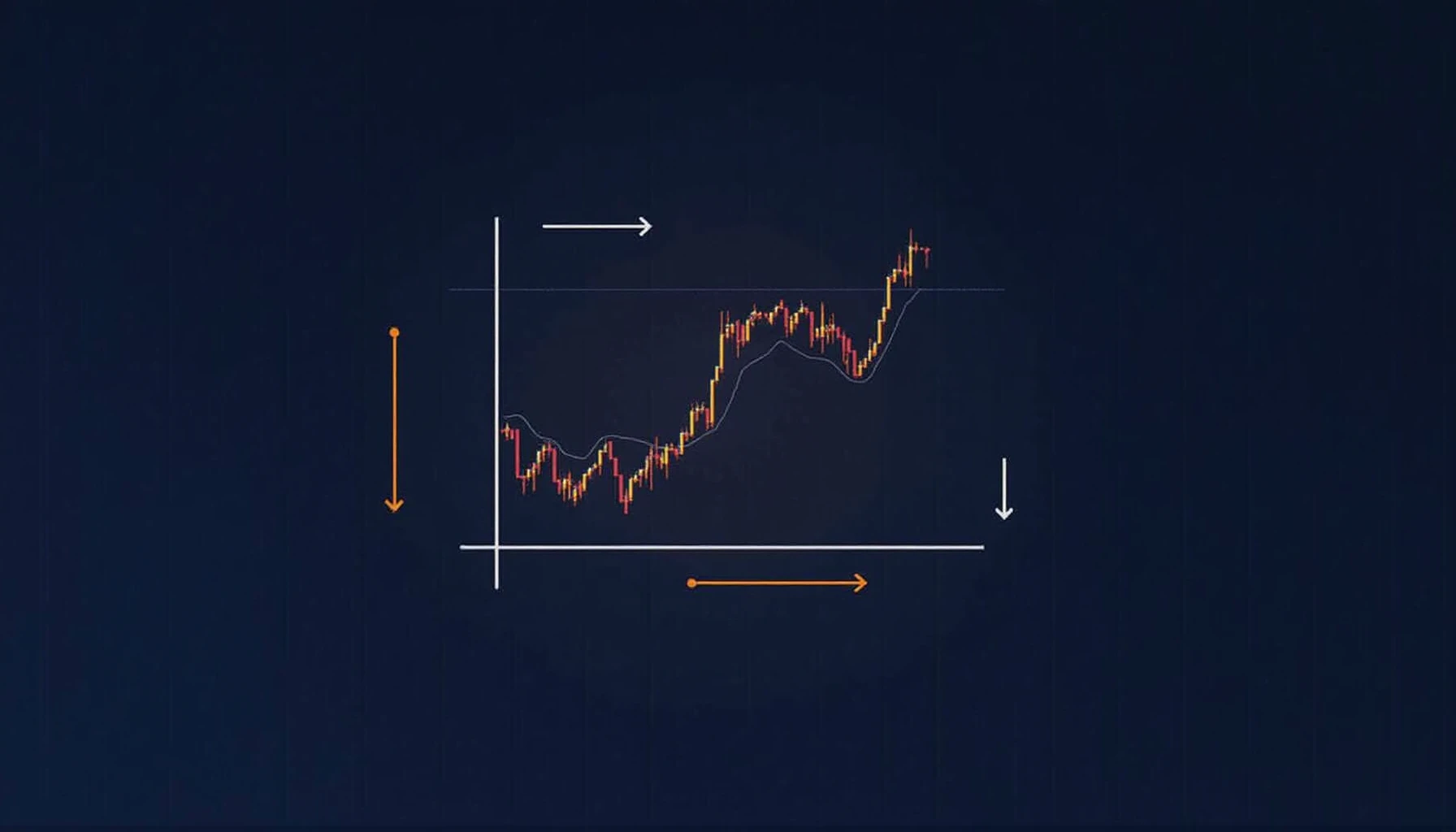

Understanding Market Trends

Market trends are like weather patterns in finance—predicting the next storm is vital for your investments. Observing these trends helps identify optimal Bitcoin price targets. For instance:

- Analysis of previous price movements

- Tracking global events impacting the crypto market

- Utilizing technical analysis tools such as RSI and MACD

As reported by CoinMarketCap, over 45% of traders in Vietnam rely on data analytics to forecast market trends, signaling a growing adoption of strategic planning in the region.

Setting Realistic Targets

Setting realistic targets is crucial. Like aiming to hit a bullseye, understanding the range of potential outcomes is key. **Examples include**:

- Using historical data to gauge price levels

- Incorporating cryptocurrency news cycles

- Engaging with community sentiment on platforms like Reddit or Twitter

According to Chainalysis (2025), nearly 30% of active traders report improved performance after implementing structured price targeting methods.

Risk Management in Pricing Strategy

Risk management should be at the heart of your Bitcoin price target strategy. Consider it a safety net that protects your investments. For instance:

- Setting stop-loss orders to limit potential losses

- Diversifying investments within the crypto space

- Regularly reviewing and adjusting price targets based on market conditions

As the Vietnamese market grows, with a reported user increase of 25% in 2023, the demand for comprehensive risk management strategies is more relevant than ever.

Using Analytical Tools

Utilizing analytical tools can significantly improve your target-setting capabilities. Tools like TradingView and CryptoCompare provide invaluable insights:

- Visual price charts for better interpretations

- Integration of market indicators for predictive analytics

- Peer comparisons to better inform decisions

Embracing these technologies is akin to having a GPS for your investment journey—guide your path with informed data.

Conclusion

In summary, effective Bitcoin price target setting strategies encompass understanding market trends, setting realistic targets, employing risk management, and utilizing analytical tools. By following these strategies, traders can navigate the complexities of the crypto market with a greater sense of clarity and purpose. For those keen on investing in Vietnam, the region’s user growth and engagement present unique opportunities in the Bitcoin landscape. Remember, setting achievable Bitcoin price targets might not make you a millionaire overnight, but it will strengthen your foundation in this exhilarating digital economy. To dive deeper into your crypto investment journey, explore more strategies at hibt.com.