Bitcoin Price Volatility Metrics: Understanding Market Fluctuations

Introduction

In the ever-evolving world of cryptocurrency, Bitcoin remains at the center of attention. Reportedly, Bitcoin has experienced an average price fluctuation of over 70% each year, profoundly affecting investors and traders alike. Understanding the Bitcoin price volatility metrics is crucial for making informed decisions in this dynamic environment. Whether you’re aiming to ride the waves of market changes or looking to minimize risks, comprehending these metrics is essential for success in the crypto space.

What Causes Bitcoin Price Volatility?

Several factors drive Bitcoin’s price fluctuations, including:

- Market Sentiment: News and social media can dramatically shift investor confidence.

- Regulatory Changes: Government announcements can lead to sudden price changes.

- Supply and Demand: Limited Bitcoin availability often results in significant price movements.

Consider it like the tides at the beach: just as waves rise and fall with the moon’s gravity, Bitcoin’s price shifts are influenced by broader market forces.

Key Metrics for Assessing Volatility

When evaluating Bitcoin price volatility, here are some critical metrics:

- Standard Deviation: This measures the amount of variation in Bitcoin’s price over a specific period, helping traders understand how much the price deviates from its average.

- Average True Range (ATR): This indicator assesses market volatility by measuring the average range between high and low prices over a given timeframe.

- Historical Volatility: This metric provides insights into past price fluctuations, allowing traders to gauge potential future volatility based on historical data.

In Vietnam, where the cryptocurrency user base is growing at an exceptional rate of 60% annually, understanding these metrics is particularly relevant for local investors.

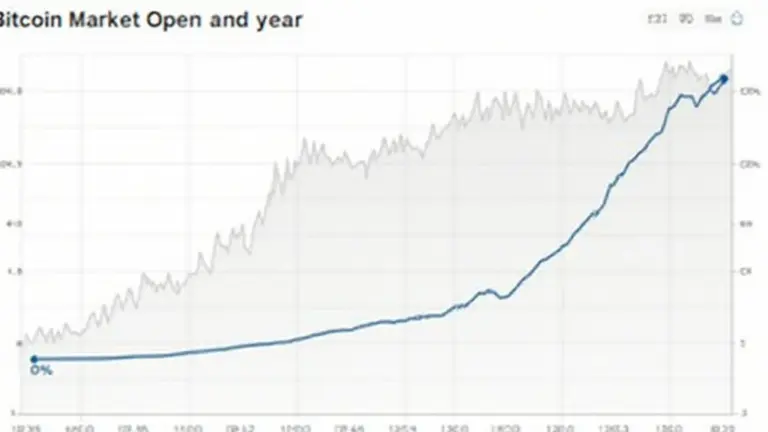

Real-World Data on Bitcoin Volatility

To illustrate Bitcoin’s price volatility, refer to the data below:

| Year | Price Change (%) | Volatility (%) |

|---|---|---|

| 2021 | 300% | 85% |

| 2022 | -70% | 75% |

| 2023 | 150% | 65% |

As indicated, Bitcoin can have staggering price movements within short periods, underscoring the need for effective risk management strategies in trading.

Tools to Mitigate Volatility Risks

To manage exposure to volatility, consider the following tools and methodologies:

- Stop-Loss Orders: Protect your investments by setting up automatic sell orders if the price drops to a certain level.

- Portfolio Diversification: Distributing investments across various cryptocurrencies can help reduce risk.

- Trading Software: Utilizing advanced trading platforms can optimize your trading strategies based on real-time data and volatility metrics.

For Vietnam’s growing market, resources such as the HIBT cryptocurrency trading platform can be instrumental in navigating and managing risks effectively.

Conclusion

Understanding Bitcoin price volatility metrics is not just about numbers. It’s about empowering yourself to make informed decisions amid market unpredictability. As you delve into this volatile space, always keep in mind that educating yourself on these metrics can make all the difference in your trading success. Explore the potential of Bitcoin and consider these insights as you develop your strategies in the vibrant cryptocurrency domain.

As you navigate the Bitcoin landscape, stay tuned for further insights on Bitcoin price metrics and how they play a crucial role in the ever-changing market dynamics. For updates and comprehensive resources, connect with bitcoinstair.com”>bitcoinstair.