Bitcoin Resistance Levels Tracking: A Comprehensive Guide

Pain Point Scenario

Investors in the cryptocurrency market often grapple with unpredictable price movements. For instance, in May 2021, Bitcoin experienced significant price fluctuations, leading many traders to question how to effectively track resistance levels. These fluctuations can result in panic selling, which emphasizes the importance of understanding and monitoring Bitcoin Resistance Levels Tracking. Without a clear strategy, traders risk losing substantial amounts of capital.

Solution Deep Dive Analysis

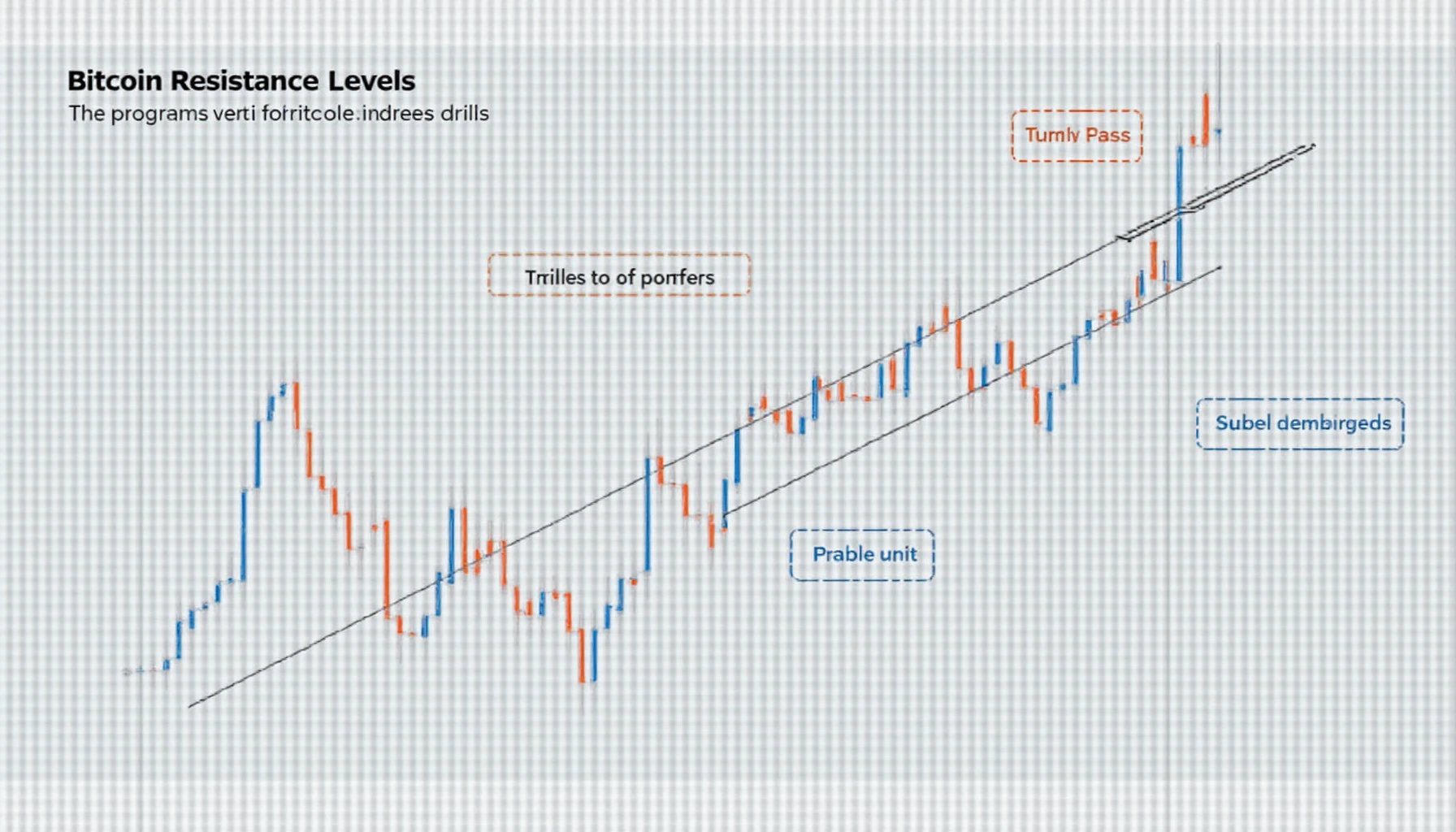

To effectively track Bitcoin resistance levels, implementing a methodical approach is essential. Here are the step-by-step details of a preferred technique: **Chart Analysis**.

- Identify key historical price points where Bitcoin has faced resistance.

- Use technical indicators such as Moving Averages and Fibonacci retracement levels to predict future resistance points.

- Regularly update your resistance levels based on market news and trading volume.

Comparison: Chart Analysis vs Traditional Analysis

| Feature | Chart Analysis | Traditional Analysis |

|---|---|---|

| Security | Moderate risk, relies on real-time data | High risk, often based on outdated information |

| Cost | Low, primarily requires software | High, may require subscription to market reports |

| Applicable Scenarios | Best for active traders | More suitable for long-term investors |

According to data from a recent Chainalysis report in 2025, successful traders utilizing strategies like Bitcoin Resistance Levels Tracking have significantly mitigated their risks, underscoring the effectiveness of real-time market analysis.

Risk Warning

However, tracking resistance levels carries inherent risks. **Always conduct thorough research** and remain vigilant of sudden market changes. Relying solely on resistance levels without considering broader market trends may lead to unforeseen losses.

Incorporating the insights available at bitcoinstair can enhance your understanding of these trends, equipping you to navigate the market more effectively.

Conclusion

Ultimately, mastering Bitcoin Resistance Levels Tracking can empower traders to make well-informed decisions, thus reducing the chances of financial loss. Regular analysis and awareness of market conditions are crucial to your success in the volatile cryptocurrency landscape.

FAQ

Q: What are Bitcoin support and resistance levels?

A: Bitcoin support and resistance levels are key price points that indicate potential reversal points in the market, essential for effective Bitcoin Resistance Levels Tracking.

Q: How often should I update resistance levels?

A: It’s crucial to update your resistance levels regularly, especially following major market events or news that could impact prices.

Q: Can resistance levels guarantee profit?

A: No, while tracking resistance levels can improve decision-making, it does not guarantee profit as market conditions can be highly unpredictable.