Bitcoin Risk Management: Vietnam Strategies for 2025

Introduction: The Growing Concern of Cryptocurrency Security

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are vulnerable to attacks. In Vietnam, as the cryptocurrency ecosystem grows, managing the risks associated with Bitcoin investments has become imperative. The rise of Bitcoin necessitates the adoption of robust Bitcoin risk management Vietnam strategies to protect against potential pitfalls.

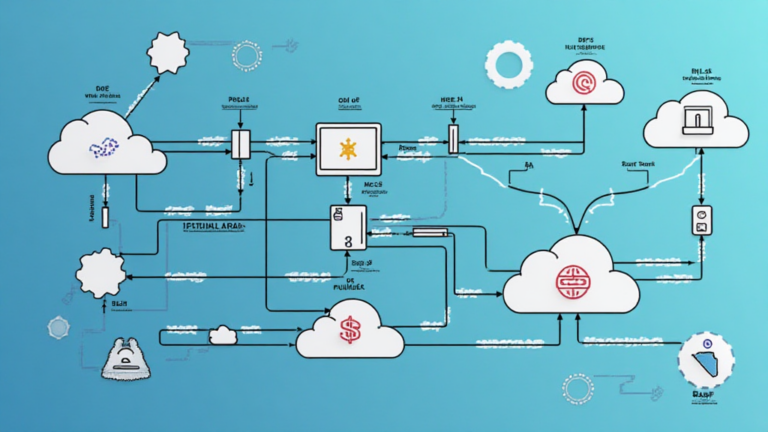

Understanding Cross-Chain Interoperability

Let’s say you have two different currencies from different countries. Cross-chain interoperability is like a currency exchange booth that allows you to swap your dollars for euros. These bridges link different blockchains, making it easier for transactions. However, just like some currency exchanges might be fraudulent, not all cross-chain bridges are secure. Implementing rigorous risk management strategies ensures that Vietnamese investors can safely utilize these tools without falling victim to hacks.

The Role of Zero-Knowledge Proofs

Zero-knowledge proofs are like showing someone your ID without revealing any personal information. This technology allows transactions to be verified without exposing the details. In Vietnam, applying zero-knowledge proofs in Bitcoin transactions can greatly enhance security by protecting users’ identities while ensuring compliance with regulations. Investors can benefit from utilizing these proofs as part of their Bitcoin risk management Vietnam strategies.

Regulatory Trends Influencing Vietnamese Investors

In 2025, regulatory trends in Southeast Asia, particularly in Vietnam, are likely to reflect those in Singapore. Similar to how Singapore is tightening regulations around DeFi, Vietnam is expected to follow suit. This could influence Bitcoin trading practices in the region. Investors need to stay informed about local regulations and proactively adjust their strategies to remain compliant.

Energy Consumption of PoS Mechanisms

Think of proof-of-stake (PoS) mechanisms like a group project: everyone has to contribute to earn a grade. Compared to proof-of-work systems, PoS uses significantly less energy, making it a more sustainable option for Bitcoin trading. By adopting energy-efficient protocols, Vietnamese investors not only practice good Bitcoin risk management Vietnam strategies but also support environmental sustainability.

Conclusion: Preparing for a Secure Bitcoin Future

As Bitcoin continues to evolve, implementing effective risk management strategies is vital for Vietnamese investors. From understanding cross-chain interoperability to embracing zero-knowledge proofs, security must be a priority. Keep an eye on regulatory trends and energy consumption to make informed decisions. For more insights, download our risk management toolkit to equip yourself with knowledge.

Check out our white paper on Cross-Chain Security and read about the latest trends in DeFi regulations. Remember, this article does not constitute investment advice; always consult local authorities like MAS or SEC before making any investment decisions. By using a secure wallet like Ledger Nano X, you can reduce the risk of private key leaks by up to 70%.

Stay informed and secure your investments with bitcoinstair.