2025 Cross-Chain Bridge Security Audit Guide: Why Bitcoin Spin Matters

2025 Cross-Chain Bridge Security Audit Guide: Why Bitcoin Spin Matters

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges are found to have vulnerabilities. This alarming statistic sheds light on the importance of security audits in the ever-evolving world of cryptocurrencies. One of the key areas to focus on is the concept of Bitcoin spin, which has significant implications for cross-chain compatibility and security.

What is a Cross-Chain Bridge?

Imagine a cross-chain bridge as a currency exchange booth at an airport. When you travel from the US to Europe, you can’t spend your dollars directly; you need to convert them to euros, right? Similarly, cross-chain bridges facilitate transactions between different blockchain networks, allowing assets to move seamlessly across chains. However, just like poorly managed exchange booths can lead to scams or losses, insecure bridges leave vulnerabilities open to attackers.

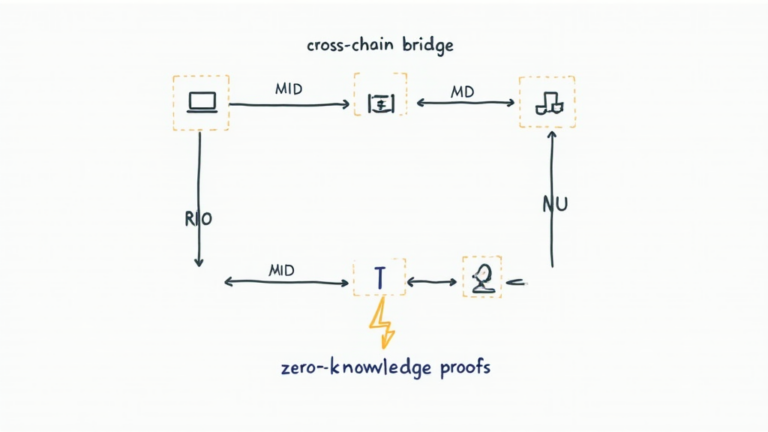

How Does Bitcoin Spin Enhance Security?

The idea behind Bitcoin spin can be likened to a robust security check at that exchange booth. By implementing advanced cryptographic techniques like zero-knowledge proofs, it’s possible to verify transactions without revealing their details, making it harder for hackers to exploit the system. This ensures that only the right assets are transferred across chains without leaking sensitive information.

Potential Risks and How to Mitigate Them

While cross-chain bridges certainly offer convenience, they also present risks, much like carrying large sums of cash during travel. One crucial risk is the