Bitcoin Staking Mechanisms Explained

Bitcoin Staking Mechanisms Explained

The rise of Bitcoin and its underlying technology has paved the way for innovative financial strategies, such as Bitcoin staking. In this article, we will delve into the intricacies of Bitcoin staking mechanisms and highlight essential points to consider for users eager to maximize their investments.

Pain Points in Bitcoin Staking

As the cryptocurrency market continues to expand, many investors face challenges when it comes to understanding Bitcoin staking effectively. A prevalent issue is the lack of reliable information on what staking entails and how to select the optimal method for their needs. For instance, investors often struggle with determining the best platform to stake their assets without incurring excessive fees or facing security risks. A recent case involved a user who lost their funds due to a poorly reviewed staking platform, which serves as a cautionary tale for many potential stakers.

In-depth Analysis of Bitcoin Staking Mechanisms

To understand Bitcoin staking mechanisms, we’ll explore the main methods investors can utilize, providing step-by-step explanations of core terms such as proof of stake and its alternatives.

Step-By-Step Guide to Staking

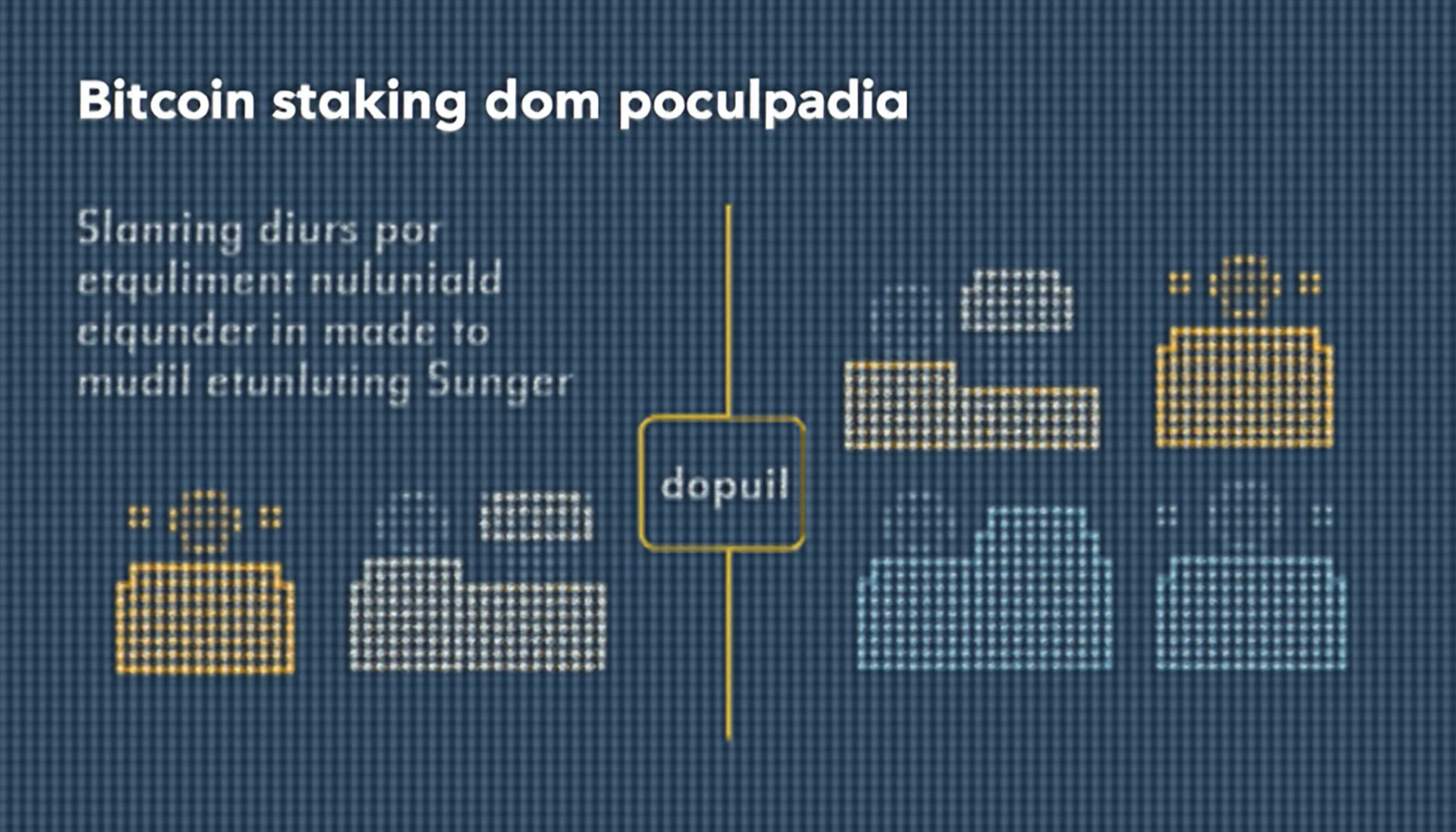

The two prominent staking methods are:

- Direct Staking: Users lock their Bitcoin in a wallet for a specified time, yielding rewards proportional to the staked amount.

- Pooled Staking: Multiple investors combine their assets, increasing their chances of receiving rewards, often making it more accessible for individuals.

Comparison Table: Direct Staking vs. Pooled Staking

| Parameter | Direct Staking | Pooled Staking |

|---|---|---|

| Security | Higher – custodian fees minimize risks | Moderate – depends on the pool’s reputation |

| Cost | Lower – no fees except gas | Higher – pool fees apply |

| Suitable for | Experienced users | New investors |

Data Support

According to a 2025 Chainalysis report, staking can increase investors’ yield by up to 20% annually. This data emphasizes the potential for returns through thoughtful investment strategies.

Risk Warnings

It is crucial to be aware of the risks associated with Bitcoin staking. For example, participating in less reputable staking platforms can expose investors to potential theft or scams. Therefore, it is essential to thoroughly research any platform before committing your assets. To mitigate these risks, always prioritize platforms with strong security protocols and favorable user reviews.

At bitcoinstair, we provide our users with the latest information and tools to make informed decisions regarding Bitcoin staking mechanisms, ensuring optimal outcomes for their investments.

FAQs

Q: What are the benefits of Bitcoin staking?

A: Bitcoin staking can provide passive income, higher yield opportunities, and enhance the security of the network.

Q: Can I stake Bitcoin on any platform?

A: No, only specific platforms support Bitcoin staking. Research is essential to find a secure and reputable option.

Q: What is the minimum amount needed for staking?

A: Minimum staking amounts vary by platform; it’s often low for pooled staking, but higher for direct staking.