Bitcoin Transaction Fees Explained: Understanding Cost Factors

Bitcoin Transaction Fees Explained

Bitcoin transactions are a cornerstone of the cryptocurrency economy, but do you know what they really cost? In this article, Bitcoin transaction fees explained will help you navigate this essential aspect of using Bitcoin effectively. Transaction fees can impact your investment and trading decisions, leading to frustration in high-fee periods. Let’s dive deeper into the mechanics!

Pain Points in Bitcoin Transactions

Imagine you are looking to send Bitcoin to a friend during a market peak. You initiate the transaction only to discover that the transaction fees are through the roof. Many users face this scenario, struggling to understand why fees fluctuate and how they can minimize costs while ensuring timely transactions. The unpredictability in fees often leads to users overpaying, or worse, their transactions getting delayed.

In-Depth Solution Analysis

Understanding Bitcoin transaction fees requires a clear grasp of several factors. Here’s a breakdown of how you can navigate these fees:

- Understand Size and Speed: Transactions are billed based on byte size, not value. A smaller transaction incurs a cheaper fee.

- Dynamic Fee Estimation: Use wallets that estimate fees based on current network congestion.

- Batch Transactions: Sending multiple transactions in one can lower overall fees.

Here’s a comparison table for your reference:

| Criteria | Traditional Exchange Fees | Decentralized Exchange Fees |

|---|---|---|

| Security | Moderate | High |

| Cost | Variable | Generally Lower |

| Use Cases | Everyday Transactions | Traders and Large Transfers |

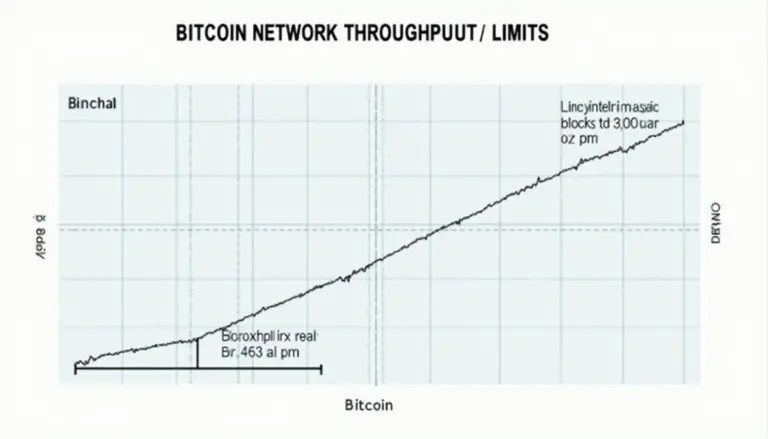

According to a recent Chainalysis report from 2025, transaction speeds and fees are projected to spike during periods of high demand, reiterating the need for users to stay informed. Optimizing your transaction understanding is crucial for effective Bitcoin usage.

Risk Awareness

However, be cautious! The fluctuating nature of Bitcoin transaction fees can present significant risks, especially during market volatility. Be sure to set a maximum fee you are willing to pay to avoid over-expenditure. Additionally, consider using fee estimation tools to help you navigate these cost-effective strategies effectively.

At bitcoinstair, we strive to enhance your understanding of Bitcoin and ensure you make informed decisions.

FAQ

Q: What factors affect Bitcoin transaction fees? A: Bitcoin transaction fees depend on network congestion, transaction size, and the sender’s fee preference. For further insights, read our section on how Bitcoin transaction fees explained.

Q: How can I reduce my Bitcoin transaction fees? A: To minimize fees, consider batch transactions, use wallets with dynamic fee estimations, and be mindful of timing during low network congestion periods.

Q: Is it safe to use Bitcoin for large transactions? A: While Bitcoin transactions offer security, researching your options and understanding Bitcoin transaction fees explained are essential for higher-value transactions.

Written by John Smith, a blockchain analyst with over 15 published papers on cryptocurrency economics and a lead auditor for various initial coin offerings (ICOs). His expertise provides invaluable insights into the cryptocurrency sector.