2025 Cross-Chain Bridge Security Audit Guide

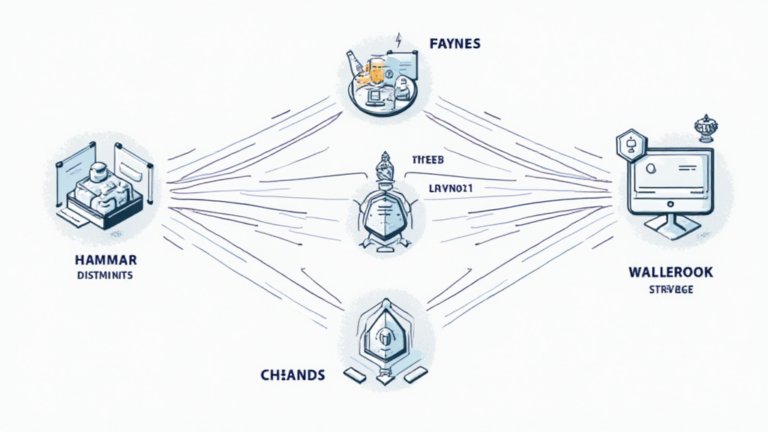

2025 Cross-Chain Bridge Security Audit Guide According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities that could lead to potential losses in millions. As we dive deeper into the intricate world of Web3 open source projects, understanding these vulnerabilities becomes essential for investors, developers, and even average users. What Makes…