Navigating 2025’s Web3 Analytics Platforms for DeFi Accessibility

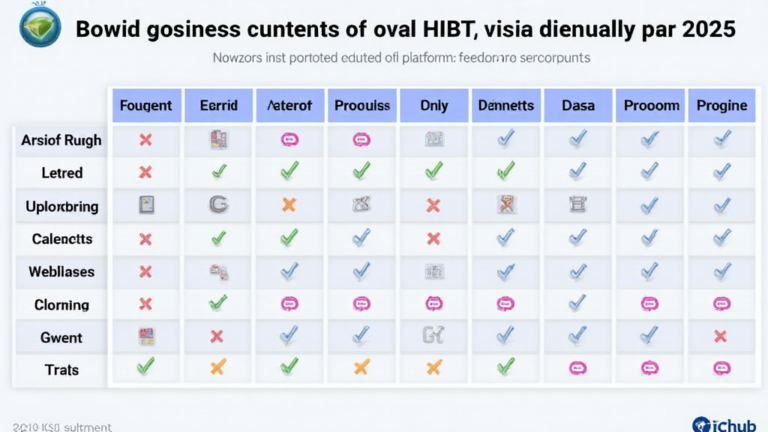

Navigating 2025’s Web3 Analytics Platforms for DeFi Accessibility According to Chainalysis, by 2025, over 73% of cross-chain bridges are expected to exhibit vulnerabilities, raising urgent concerns for decentralized finance (DeFi) enthusiasts. This is where Web3 analytics platforms come into play, unlocking insights that can enhance security and user experience in the DeFi landscape. Understanding Cross-Chain…