2025 Cross-Chain Bridge Security Audit Guide

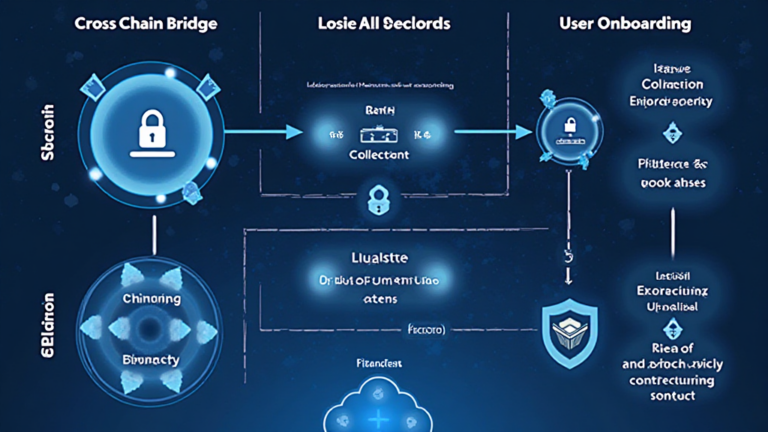

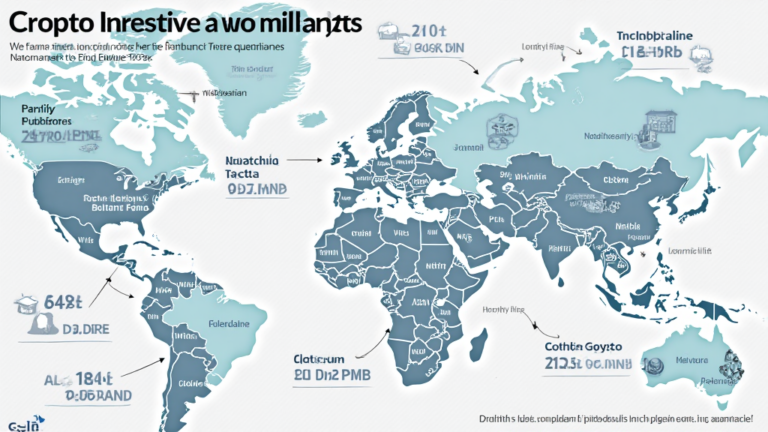

2025 Cross-Chain Bridge Security Audit Guide In recent findings by Chainalysis, it was revealed that a staggering 73% of global cross-chain bridges face potential vulnerabilities. This alarming statistic highlights the urgent need for robust Web3 user onboarding solutions to secure transactions across decentralized networks. As the blockchain landscape evolves, properly addressing user security and ease…