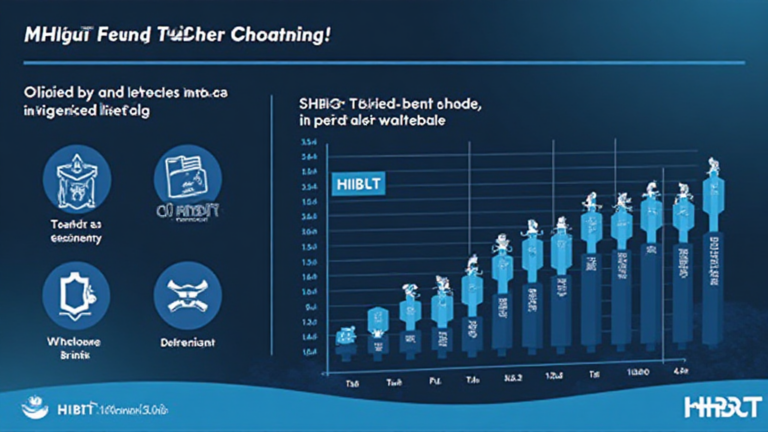

Understanding the HIBT Token Vesting Schedule

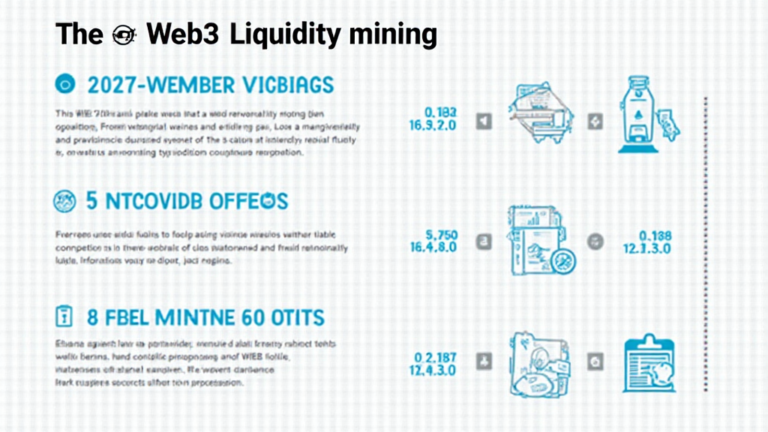

Introduction According to Chainalysis, by 2025, over 73% of decentralized finance (DeFi) platforms may face vulnerabilities. As the industry matures, understanding mechanisms like the HIBT token vesting schedule is crucial for investors aiming to navigate the complexities of token offerings. What is a Token Vesting Schedule? A token vesting schedule can be likened to a…