2025 Cross-Chain Bridge Security Audit Guide

2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges have vulnerabilities that users are unaware of. This significant gap in security not only jeopardizes individual assets but undermines the integrity of the entire blockchain ecosystem. Navigating these waters can be daunting, but with the right knowledge and tools, you can protect your investments.

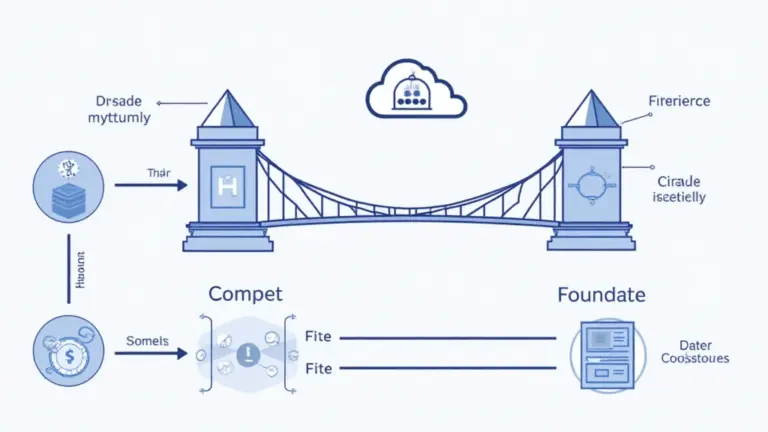

Understanding Cross-Chain Bridges: What Are They?

To put it simply, cross-chain bridges function like currency exchange booths at an airport. Just as you exchange your dollars for euros, cross-chain bridges allow you to transfer assets between different blockchain networks. This operation, while essential for interoperability in the DeFi space, comes with inherent risks that users must navigate.

Key Vulnerabilities of Cross-Chain Bridges

Recent analysis reveals that a multitude of cross-chain bridges are susceptible to hacks primarily due to inadequate security measures. Imagine leaving your home unlocked; it might not seem like a big deal until someone walks in. Similarly, these vulnerabilities can lead to significant financial losses.

Comparing PoS Mechanism Energy Consumption

When discussing cross-chain transactions, it’s essential to look at the efficiency of the underlying mechanisms like Proof of Stake (PoS). For instance, many users might not realize that PoS is akin to a solar-powered car, consuming less energy than traditional methods, which resemble gas-guzzlers. Understanding these differences can help you make more informed decisions within the DeFi landscape.

2025 Singapore DeFi Regulation Trends

As we look towards 2025, keeping an eye on regulatory trends in regions such as Singapore is crucial. Just like traffic rules guide vehicles for safety, regulations can guide the proper usage of DeFi technologies. Understanding these rules not only ensures compliance but also helps in identifying secure platforms.

In conclusion, staying informed about cross-chain vulnerabilities and regulatory trends is essential for anyone looking to invest in the DeFi space. For a comprehensive toolkit and step-by-step guide to securing your digital assets, be sure to download our toolkit now!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory bodies such as MAS/SEC before making any financial decisions. Additionally, utilizing tools like the Ledger Nano X can reduce the risk of private key exposure by 70%.