2025 Crypto Exchange Comparisons Vietnam: Navigating DeFi Regulations

2025 Crypto Exchange Comparisons Vietnam: Navigating DeFi Regulations

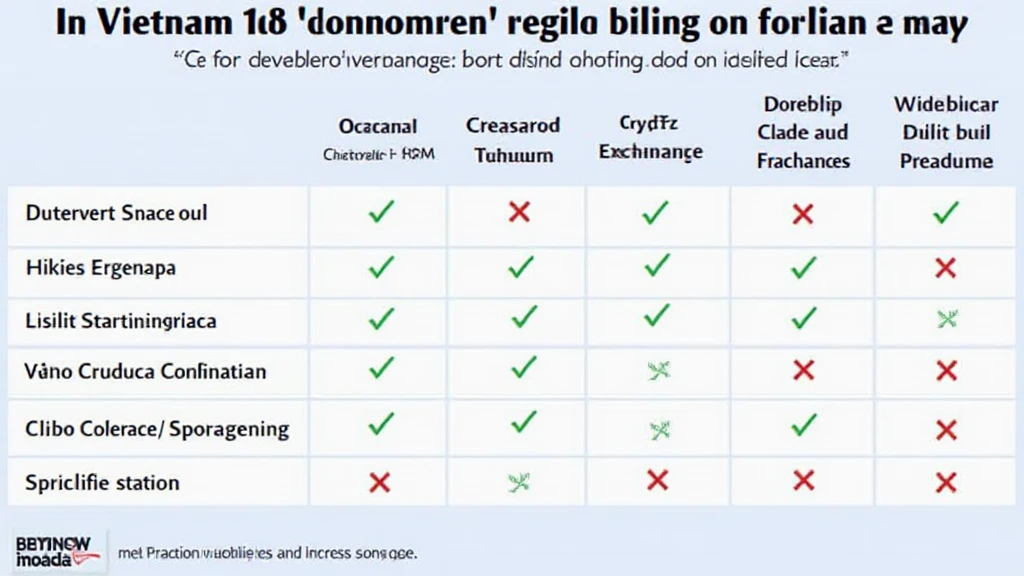

According to Chainalysis 2025 data, a staggering 70% of crypto exchanges face regulatory scrutiny. This poses significant questions for investors in Vietnam as the regulatory landscape evolves.

What are the Current Regulatory Challenges for Crypto Exchanges in Vietnam?

Let’s break it down: regulatory challenges are like a traffic jam on the highway of crypto trading. Investors want to get to their destination—profitable trading—quickly, but roadblocks can slow them down. Vietnam’s government is gradually establishing rules around crypto operations. For instance, only licensed exchanges can operate, but applying for those licenses can be like climbing a steep hill.

How Do DeFi Regulations Impact Crypto Trading in Vietnam?

DeFi regulations can be compared to safety nets at a circus. They ensure everyone can enjoy the show without falling. In Vietnam, as DeFi platforms emerge, the potential for innovations such as yield farming is exciting but comes with risks. Knowing how these regulations evolve will help traders navigate their next moves, especially as 2025 approaches.

What Tools Can Help Investors in Crypto Exchange Comparisons?

Whenever you’re making decisions, tools can help you make sense of the options—like using a shopping list when grocery shopping. Websites that offer Crypto exchange comparisons Vietnam can guide you by listing fees, security features, and customer support ratings. This will help you select exchanges that suit your trading style, avoiding pitfalls!

What are the Future Trends in Crypto Exchange Operations for 2025?

Think of future trends as the sunrise after a long night; they signify new beginnings. Blockchain technology is evolving, and it’s anticipated that more exchanges will integrate secure protocols like zero-knowledge proofs. These innovations promise enhanced privacy and security, crucial given the expanding user base in Vietnam.

In summary, keeping an eye on Crypto exchange comparisons Vietnam will not only prepare you for upcoming changes but can also revolutionize your trading methodology. For detailed insights, download our toolkit on navigating crypto regulations!

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities such as the State Securities Commission of Vietnam before taking any action.

For a comprehensive understanding of crypto safety, check out the Crypto Security White Paper and explore our resources.

Stay informed, stay safe! Visit us at bitcoinstair.