Examining Crypto Futures Demand Vietnam: A Growing Trend

Introduction to Crypto Futures in Vietnam

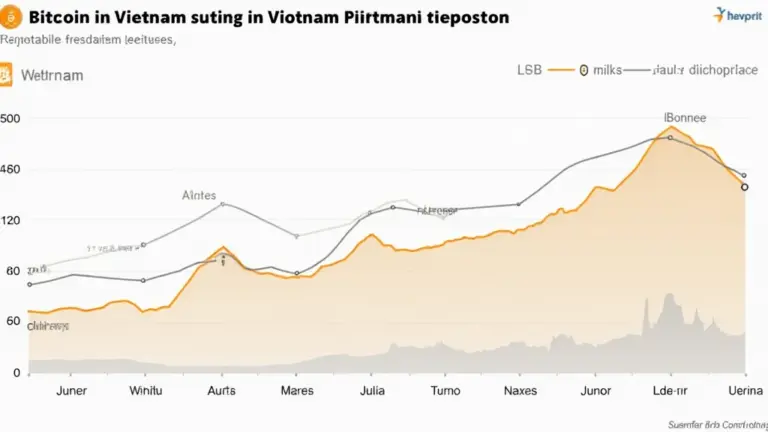

As per Chainalysis data from 2025, the crypto futures market is booming in Vietnam, driven by an increasing number of investors looking for innovative trading options. With 73% of futures contracts reflecting volatility, understanding this market has never been more crucial.

What Are Crypto Futures?

Think of crypto futures as a bet on the future price of a cryptocurrency, similar to how farmers sell their crops before they’re harvested. This means you can profit if the price goes up or down, depending on how you position your trades. In Vietnam, an increasing number of retail investors are jumping onto the futures bandwagon.

Why is There a Surge in Demand?

The appeal of crypto futures lies in their leverage. Retail traders in Vietnam love the idea of maximizing their gains. Just like turning up the volume on your favorite song, leverage amplifies both your potential profits and losses. This enhanced risk/reward ratio is central to the burgeoning crypto futures demand in Vietnam.

Regulatory Landscape and Trader Awareness

With increased interest comes the responsibility to understand the regulations surrounding crypto trading. Investors need to stay informed, just like knowing the price before you buy at a market stall. Vietnam’s regulatory environment is evolving, and staying compliant is key for successful trading in futures markets.

Conclusion and Actionable Insights

In summary, the future of crypto futures demand in Vietnam presents both opportunities and challenges for investors. To delve deeper into this market and protect your investments, consider downloading our comprehensive toolkit on trading techniques and risk management.