2025 Crypto Investment Strategies for Vietnam Market

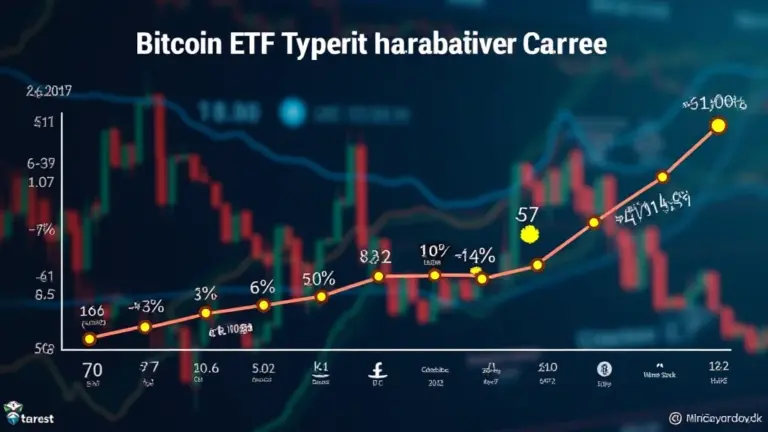

Understanding the Vietnamese Crypto Landscape

As of 2025, Chainalysis reports that Vietnam is among the top countries in crypto adoption, with over 60% of its digital currency users engaging in various forms of investment. The Vietnamese market’s unique characteristics, from a youthful demographic to robust social media presence, create both opportunities and challenges. For instance, think of the crypto market as a vibrant farmers’ market where buyers and sellers drift between stalls, comparing prices and products—this is how Vietnamese investors approach their crypto choices.

Why Cross-Chain Interoperability Matters

You may have heard of cross-chain interoperability, right? It’s like a currency exchange booth at our farmers’ market—allowing you to trade fruits (like Ethereum) for vegetables (like Bitcoin) seamlessly. In Vietnam, where diverse crypto projects are emerging, ensuring that these currencies can communicate with one another can significantly enhance liquidity and investment choices. More importantly, the 2025 Chainalysis report notes that 73% of existing interoperability solutions have vulnerabilities, which warns investors to be cautious and informed.

Zero-Knowledge Proofs Applications for Safer Transactions

Zero-knowledge proofs sound complicated, but let’s break it down! Imagine if you could show your ID to confirm you’re over 18 without revealing your exact birthdate—this is how zero-knowledge proofs function in blockchain. In a market like Vietnam, where transaction security is pivotal, employing zero-knowledge proofs can enhance user privacy and trust when making investments. It’s essential for investors to understand how these technologies can protect their assets.

Coin Metrics and Energy Efficiency Comparisons

As we approach 2025, the environmental impact of crypto investments is becoming a hot topic. PoS (Proof of Stake) mechanisms, for instance, are touted for their energy efficiency compared to PoW (Proof of Work). In simple terms, it’s like comparing a bicycle to a gas-guzzling car—one is eco-friendly and cost-effective while the other is resource-intensive. Investors in Vietnam should consider these factors when strategizing their investments, potentially opting for greener alternatives.

Conclusion and Further Resources

In closing, understanding crypto investment strategies for Vietnam market requires keen awareness of local trends, technological advancements, and global influences. We invite you to download our toolkit that includes templates and tips for navigating this exciting landscape. Remember, investing in cryptocurrency is full of potential, but always consult local regulatory frameworks like MAS or SEC before diving in.